No products in the cart.

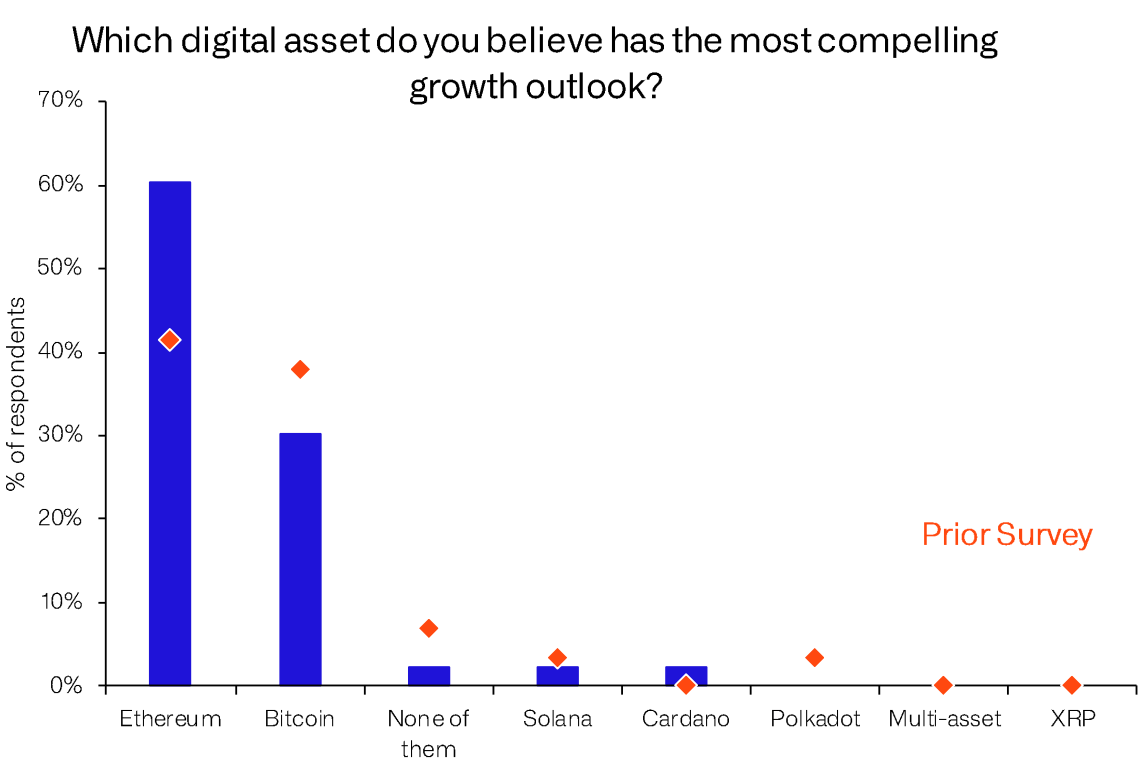

According to a CoinShares survey, about 60% of investors think Ethereum’s (ETH) growth prospects are more compelling.

According to CoinShares, only 30% of respondents said Bitcoin (BTC)’s growth prospects were the most attractive, while 60% favored ETH. Research.

The survey included 43 investors with assets under management totaling $390 billion. Of the participants, those identified as Wealth Managers (25%) and Family Offices (25%) made up half of the group. Another 22% and 17% were identified as hedge funds and institutional investors respectively.

Aging

Comparing the latest results with those for 2022, we can see that the majority of investors have shifted from BTC to ETH.

The blue columns in the chart below represent the most recent results, while the red marks indicate last year’s findings.

Just under 40% of respondents chose BTC in the 2022 survey, while only 40% of respondents said ETH had more attractive growth potential. In a year, 60% of investors chose ETH, while 30% voted for BTC.

Investors have stayed away from BTC, but this year’s results show that the number of investors who invested in it has increased. According to CoinShares, 30% of participants own his BTC, up from 24% in 2022.

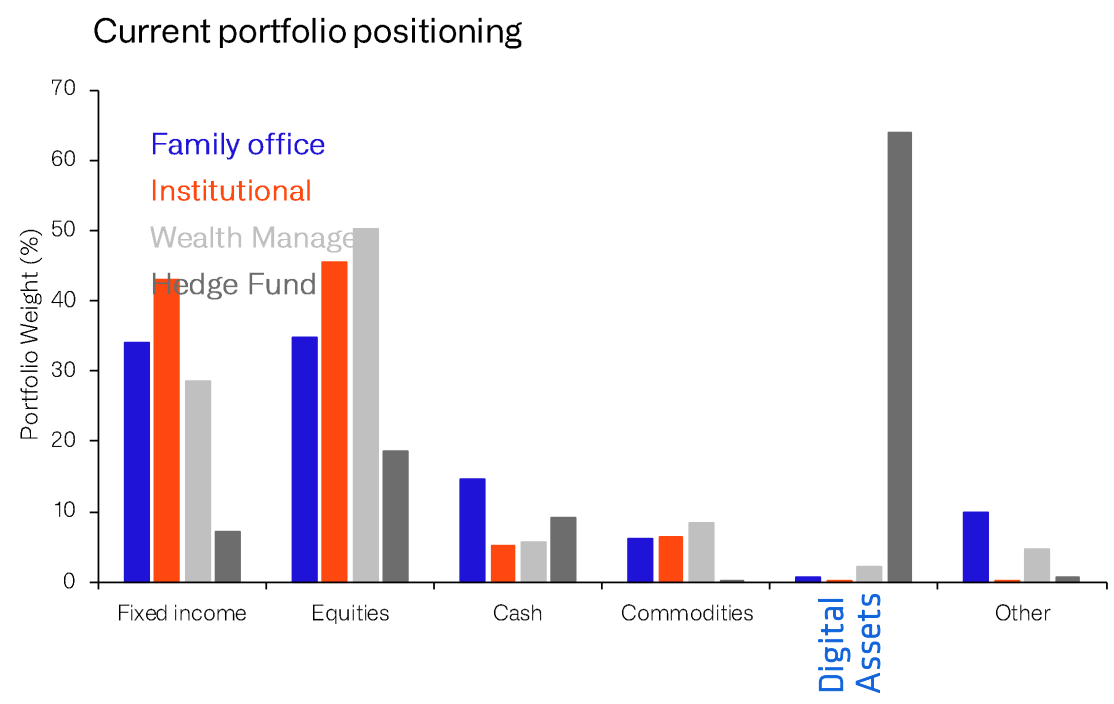

Digital Assets in Portfolio

According to the latest figures, digital assets account for 1.1% of the portfolio, up from 0.7% last year.

Hedge funds, in particular, have significantly increased their investment in digital assets, CoinShares data reveals. In the meantime, institutional investors have reduced their digital assets to less than 1% of his.