No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Algorithms with a reputation to outperform the cryptocurrency market show their preference for Ethereum (ETH) and three other big digital assets amid uncertain trading conditions.

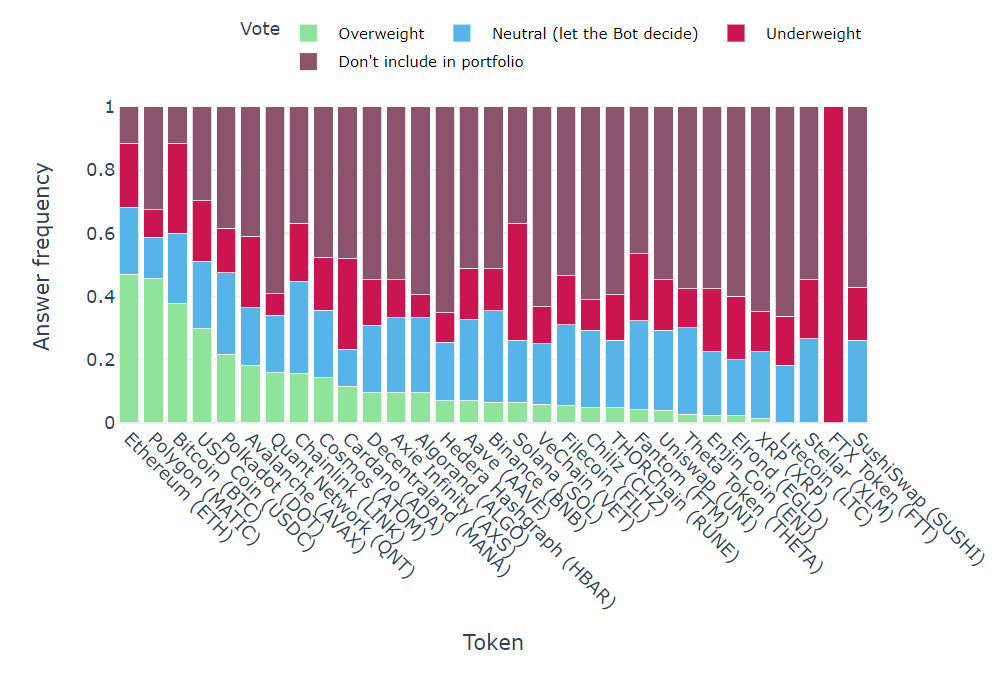

Each week, the Real Vision Bot conducts a survey to compile an algorithmic portfolio evaluation and create a hive mind consensus.

The latest bot data reveals a strong trader preference for Ethereum, with a majority of market participants voting to overvalue their portfolios in ETH.

At the time of writing, MATIC is trading at $0.86, down 70% from its all-time high. Meanwhile, Ethereum has fallen further, devaluing 75% from its record high.

Bot’s altcoin portfolio is rounded out by Ethereum rivals Polkadot (DOT) and Avalanche (AVAX), followed by blockchain interoperability system Quant (QNT) and decentralized oracle network Chainlink (LINK). increase.

According to those running Real Vision Bot, a large allocation to USDC is sign Traders want to avoid risks as the impact of the collapse of cryptocurrency exchange FTX spreads.

Real Vision Bot was co-developed by quantitative analyst Moritz Seibert and statistician Moritz Heiden.

According to Real Vision, crypto trader opinion-aggregating bot quotas have historically outperformed the top 20 crypto assets in the market by more than 20%.

Don’t miss a beat subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Zaleman

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024