No products in the cart.

- Latest

- Trending

ADVERTISEMENT

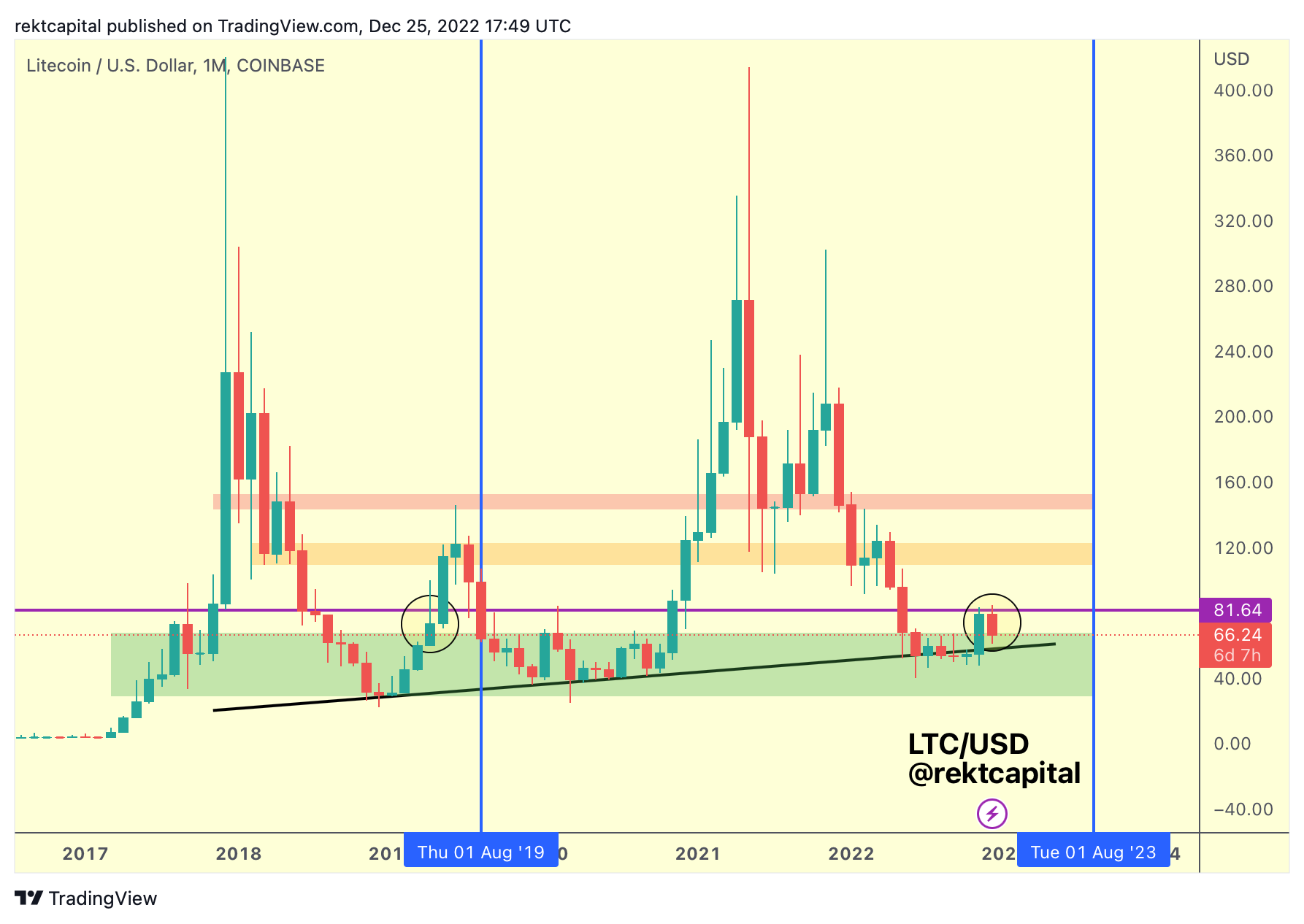

A popular crypto strategist says Litecoin (LTC) could see an epic surge ahead of next year’s peer-to-peer payment network halving event.

Pseudonymous analyst Rekt tells his 329,900 Twitter followers that Litecoin is showing signs of strength on higher timeframes after rising above long-term accumulation levels.

According to crypto strategists, LTC may reflect the price action of 2019, rising from around $70 to $146 in just a few months.

“[The] The last time LTC performed a monthly close above the historical accumulation area in green before Litecoin’s halving in August 2019 (blue)

LTC climbed towards the orange resistance and reached the top just before the Litecoin halving event. ”

Based on analyst charts, he appears to be predicting a rally towards $120, suggesting Litecoin could rise by more than 70%.

As of this writing, LTC has changed ownership at $70.31. Litecoin is set to undergo its next halving in July 2023.

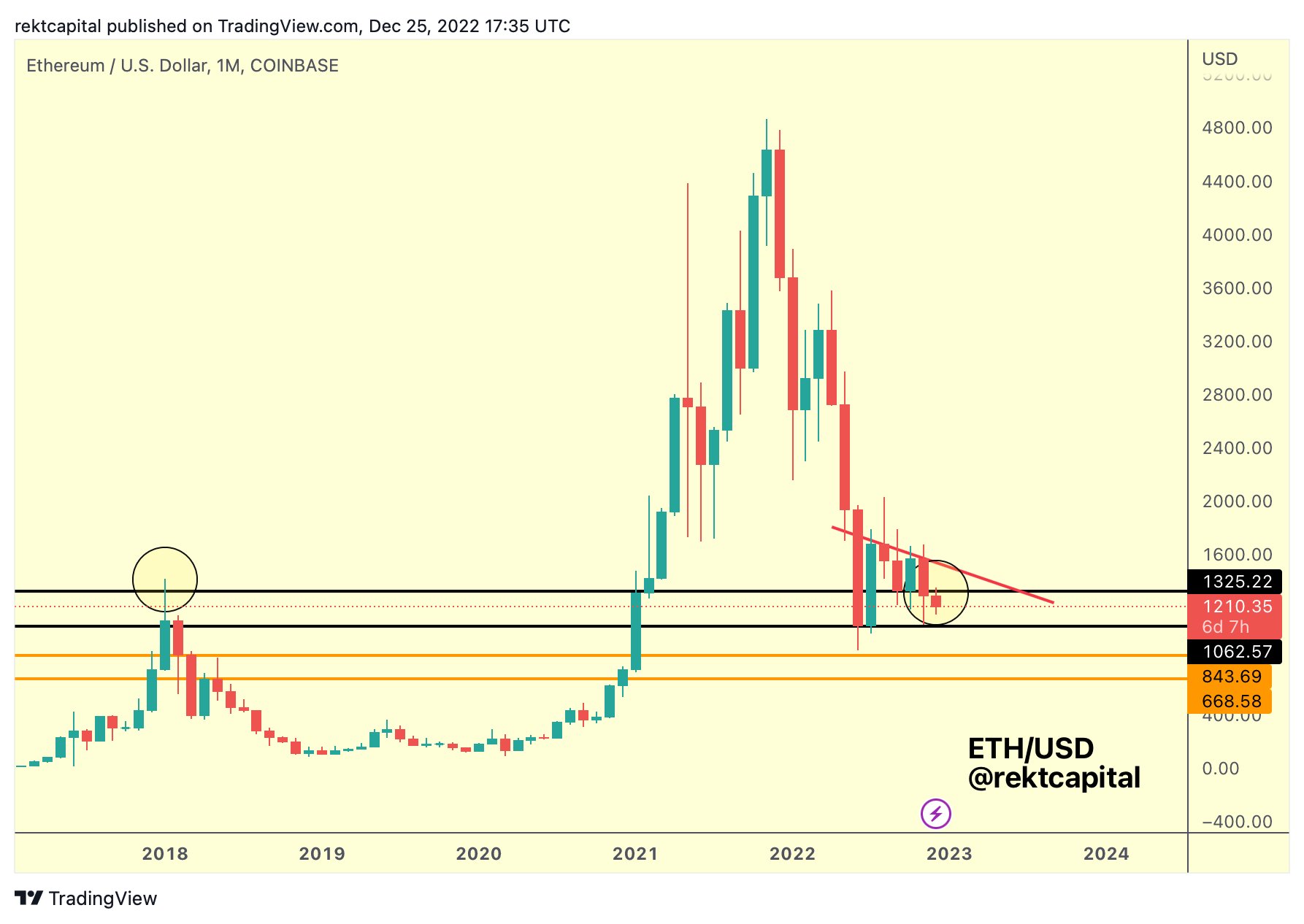

Looking at Ethereum (ETH), Rekt says the leading smart contract platform is trading within a wide range on monthly charts and should maintain critical support levels to avoid another selling event. I’m here.

ETH has seen a visibly downward trend since the summer rally (red).

In fact, red has pushed ETH below the $1,325 support (black).

Just like in 2017, black appears to be acting as resistance once again.

It also loses support at $1,062 -> falls to the orange area below ($843). ”

At the time of writing, ETH is trading at $1,226, a slight gain for the day.

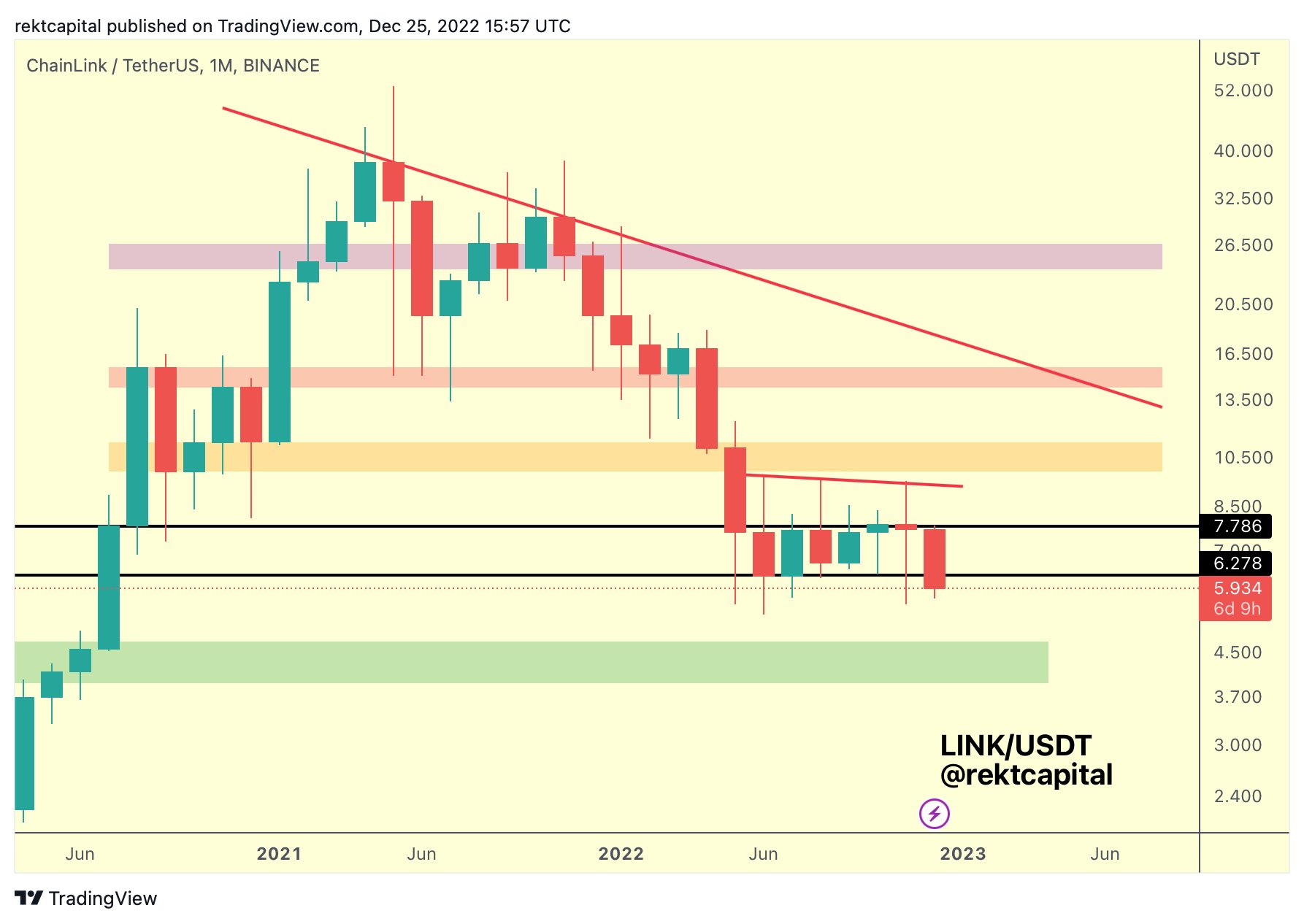

Another altcoin on traders radar is the decentralized oracle network Chainlink (LINK). According to Rekt, the next few days will be critical for Chainlink as it needs to regain support levels for its high timeframes to avoid witnessing any new corrective actions.

“LINK is still strengthening within this range, but it threatens to lose range as a support.

If the monthly close falls below the black range low ($6.27), LINK could drop to the sub-$5 territory (green box). “

As of this writing, LINK is valued at $6.01, well below Rekt’s monthly support.

Next is Aave (AAVE), a decentralized lending and borrowing protocol.

The macro downtrend remains strong (red diagonal line). Also, the multi-month downtrend weighs on AAVE (blue), which acts as a confluent resistance with the red box (old support). Reject here -> back to list price (black).

As of this writing, Aave is trading at $55.68.

The last coin on the trader’s list is Ethereum Hard Fork Ethereum Classic (ETC). According to Rekt, ETC is likely to head towards the historical support levels of around $13.

“etc -58% down since refusing from the macro downtrend. in fact, etc You may soon reach the green box. Green is where ETC has formed an accumulation range that will enable his 2021 bull market. ETC is likely to drop green to find a bear market bottom. “

As of this writing, ETC is trading at $16.20.

Don’t Miss a Beat Subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Dmitriy Rybin/WindAwake/Sensvector

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024