No products in the cart.

- Latest

- Trending

ADVERTISEMENT

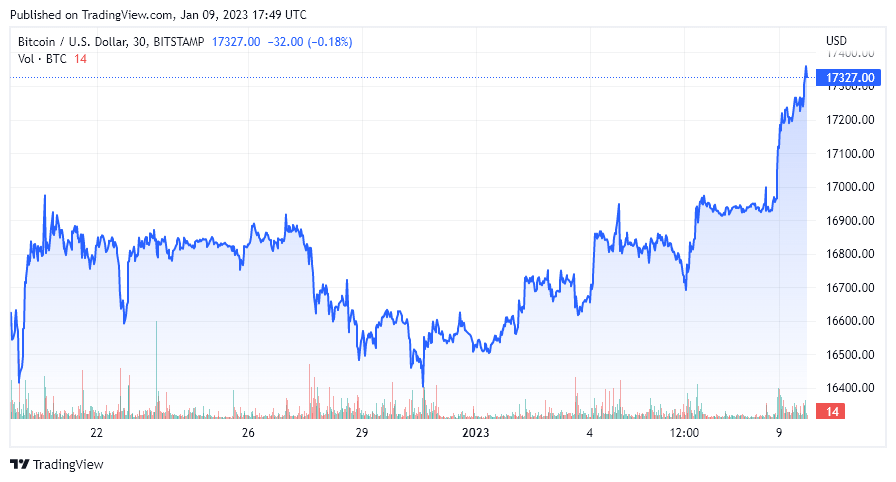

Crypto’s benchmark cryptocurrency, Bitcoin, has crossed $17,000 for the first time in 2023 after range-bounding between $16,380 and $16,975 for several weeks.

Bitcoin has been on a positive trend since beginning the year at $16,482 in early January. Bitcoin has gained 3.72% over the past 7 days and 2.33% over the past 24 hours, according to the report. crypto slate data.

With no significant on-chain development taking place within the Bitcoin ecosystem, this rise appears irrelevant to news related to the network. Furthermore, there have been few notable developments across the crypto space that Bitcoin could react to.

But as the dust starts to settle in the FTX news cycle, Bitcoin’s use case in self-management will be stronger than ever. A global financial crisis is looming, inflation continues to skyrocket, the war in Ukraine has no end in sight, and tensions between China and the West are rising. Additionally, concerns over which asset class will serve as the best store of value in 2023 may be reinforcing investor resolve towards Bitcoin.

Bitcoin has acted as a risk-on asset through much of 2022, but as we move further into 2023, all eyes are on whether Bitcoin will repeat its strong performance when the Ukraine war began. .

The next Bitcoin halving event is about 18 months away, so historical indicators show that a bull market is not yet around the corner. However, after the turbulent events of 2022, many investors fled cryptocurrencies. The collapse of major exchanges, projects, hedge funds, and lending platforms has shaken many investors and eliminated the bad guys from the space.

recent forbes Discussed Altana Digital Currency Fund founder Alistair Milne’s 2023 potential Bitcoin price prediction suggests it could reach $300,000 by 2024. Others, like a professor of finance at the University of Sussex, had more conservative estimates predicting prices between $30,000 and he $50,000. Carroll Alexander.

Eric Wall, CIO of Arcane Assets, also said Bitcoin has bottomed out and will race toward a $30,000 price target in 2023.

But the biggest elephant in this room is the fate of digital currency groups: Genesis and Grayscale Trust.Recent crypto slate A market report showed the predicament DCG is facing and the havoc it could wreak on the crypto industry if forced to liquidate its assets to avoid bankruptcy.

Following Winklevoss Twin’s ultimatum regarding Genesis Earn funding, CryptoSlate is keeping an eye on DCG. The Winklevoss brothers set a January 8 deadline for the DCG to respond to the open letter, a date that has now passed without any communication.

The Forbes article above also highlighted several traditional financial firms that predicted Bitcoin will fall below $10,000 this year.Most notably Eric Robert, Global Head of Research at Standard Chartered Cryptocurrency companies and exchanges find themselves lacking liquidity, leading to further bankruptcies and the collapse of investor confidence in digital assets, Sen said, demanding $5,000.

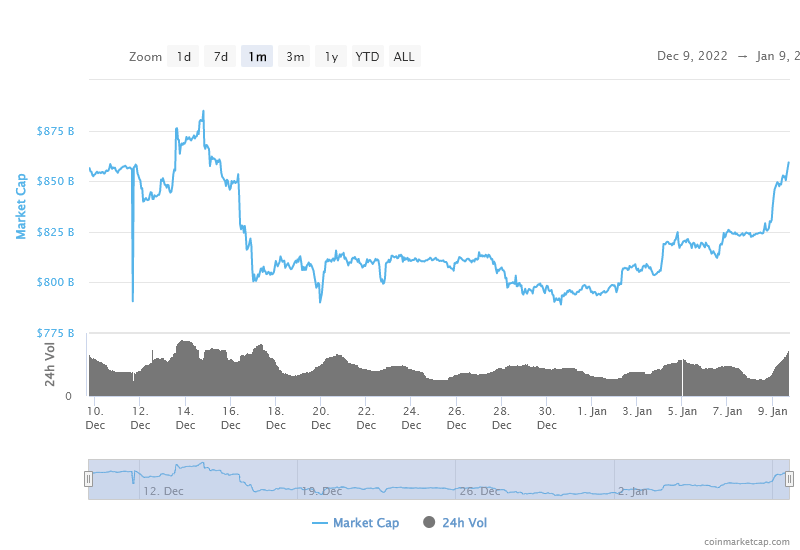

Still, as the graph below shows, the overall cryptocurrency market capitalization has been on the rise since 2023. Over the past nine days, over $50 billion has been injected into the cryptocurrency market. It had a market capitalization of $795 billion at the start of the new year, according to CoinMarketCap, and has since reached $859 billion.

With Bitcoin removed, the global cryptocurrency market cap was $477 billion on January 1st. It grew steadily to $525 billion, an increase of $58 billion. So while Bitcoin is doing well in 2023, the broader crypto market is outpacing the flagship crypto networks. Bitcoin has only $18 billion put in, compared to the rest of the market, which was up 10% ( excluding Bitcoin), the market capitalization increased by only 4.7%.

Nothing has changed when it comes to Bitcoin fundamentals and 2023 will either be the year the FIAT system solves the inflation problem or the events of 2008 hurt central banks more than ever.

A world where the FIAT system has taken its final steps is a world where Bitcoin has the potential to reign. Time will tell if we can.

Bitcoin was flat before it started to rise in value, but the dollar has been falling since late September. The chart below shows the peak strength of the dollar reached on September 22, 2022. Since then, the dollar has fallen more than 10%, about the same drop seen in the Bitcoin chart over the same period.

Bitcoin’s volatility was at an all-time low from November to January, fluctuating around 12% in both directions during that time.

Bitcoin’s price action today reflects the poor performance of the dollar over the last 24 hours. Since January 6th, DXY is down his 2.49% and Bitcoin is up his 2.9%. Of course, these moves are not unprecedented. However, if DXY continues to fall throughout his 2023, it could give Bitcoin the strength it needs to return to levels last seen before bad actors trigger a market-wide selloff in 2022. There is a nature.

Bitcoin clearly positions itself as a fiat currency escape in a world where the global currency is potentially in serious danger. Of course, there are multiple moving parts, some historically correlated, some uncorrelated, but 2023 will give us a glimpse of how Bitcoin will perform in the midst of even greater uncertainty in the global economy. There is no doubt that it will be an interesting experiment to see if it works.

At the time of press, Bitcoin ranks first in terms of market capitalization, and the price of BTC is Up 2.39% Within the last 24 hours. The market capitalization of BTC is $333.95 billion 24 hours trading volume $18.01 billion. Learn more >

At the time of press, the global cryptocurrency market is valued at $855.35 billion at the 24-hour volume of $46.14 billionBitcoin dominance is now 39.05%. Learn more >

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024