No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Failed crypto exchange FTX has revealed the names of various shareholders and investors in its recent bankruptcy court filings. January 9.

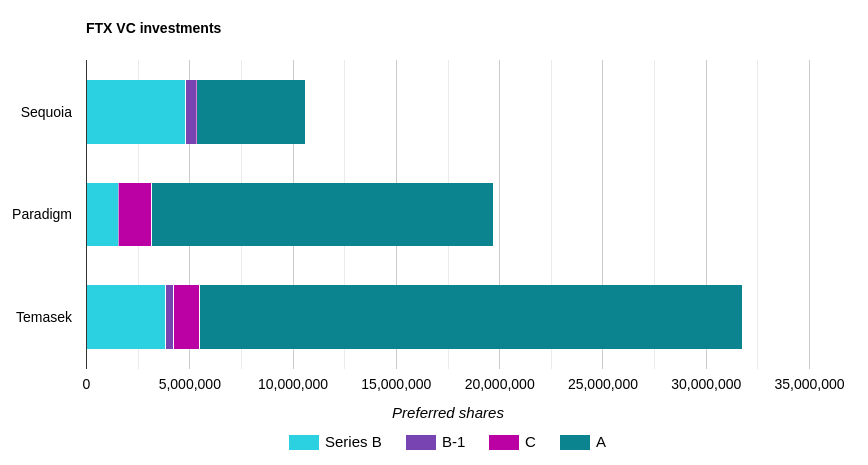

FTX has raised four rounds of funding called Series B, Series B-1, Series C, and Series A between July 2021 and January 2022.

These funding rounds were reportedly led primarily by VC firms known for their involvement in the cryptocurrency industry, including Sequoia and Paradigm. analysis By CNBC.

Sequoia Capital has made two major investments in Series B and Series A, acquiring 4.8 million preferred shares and 5.3 million shares respectively. It also won just over 572,000 shares in Series B-1. Despite acquiring a relatively small number of shares overall, it was the largest investor in the Series B, with his 16% stake in that round.

Paradigm made its largest Series A investment, acquiring 16.5 million shares. However, he was responsible for his 20% of all funding, although he only led a Series C and only acquired 1.6 million shares. Also in Series B he acquired 1.5 million shares.

Temasek Singapore’s state-owned investment firm which recently entered crypto VC investment, led an ambitious Series A funding round for FTX. Temasek acquired his 26.3 million shares, taking his 16% stake in that investment round. He also raised an additional approximately 5.4 million shares in his other three funding rounds.

FTX’s shareholder filings also disclose a number of other smaller investments of interest. Coinbase held 1.3 million shares of his preferred stock and 4 million shares of his common stock, making it a notable investment as the two exchanges were direct competitors.

Various other crypto-adjacent entities are also investing in FTX. Huobi or one of its executives held 247,700 common shares. Japanese crypto bank SoftBank, Bitcoin ETF applicant Van Eck, and investment firms Multicoin Capital and CoinFund held a mix of preferred and common shares.

FTX filings reveal relationship with billionaire hedge fund manager and crypto advocate Paul Tudor Jones. and became the 15th largest investor in FTX’s Series B funding round.

Other notable private investors include celebrity trainers Dennis and Katie Austin, “Shark Tank” host Kevin O’Leary (through O’Leary Productions), New England Patriots owner Robert Kraft (KPC through venture capital).

Kraft is perhaps the most notable of these names due to his previous ties to FTX and the New England Patriots. In June 2021, the exchange signed team his quarterback Tom Brady to a contract. Brady owned 1.1 million shares of common stock, according to shareholder filings. His ex-wife, supermodel Gisele Bndchen, 686,761 stock. Kraft held 155,144 preferred shares and 479,000 common shares.

Certain FTX associates, including former FTX CEO Sam Bankman-Fried and former Alameda Research CEO Caroline Ellison, were also named in the shareholder filing.

Please note that many of the above investments have been previously disclosed by the parties concerned. However, the filing does provide accurate data on the matter, revealing whether investors invested heavily or slightly in FTX.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024