No products in the cart.

- Latest

- Trending

ADVERTISEMENT

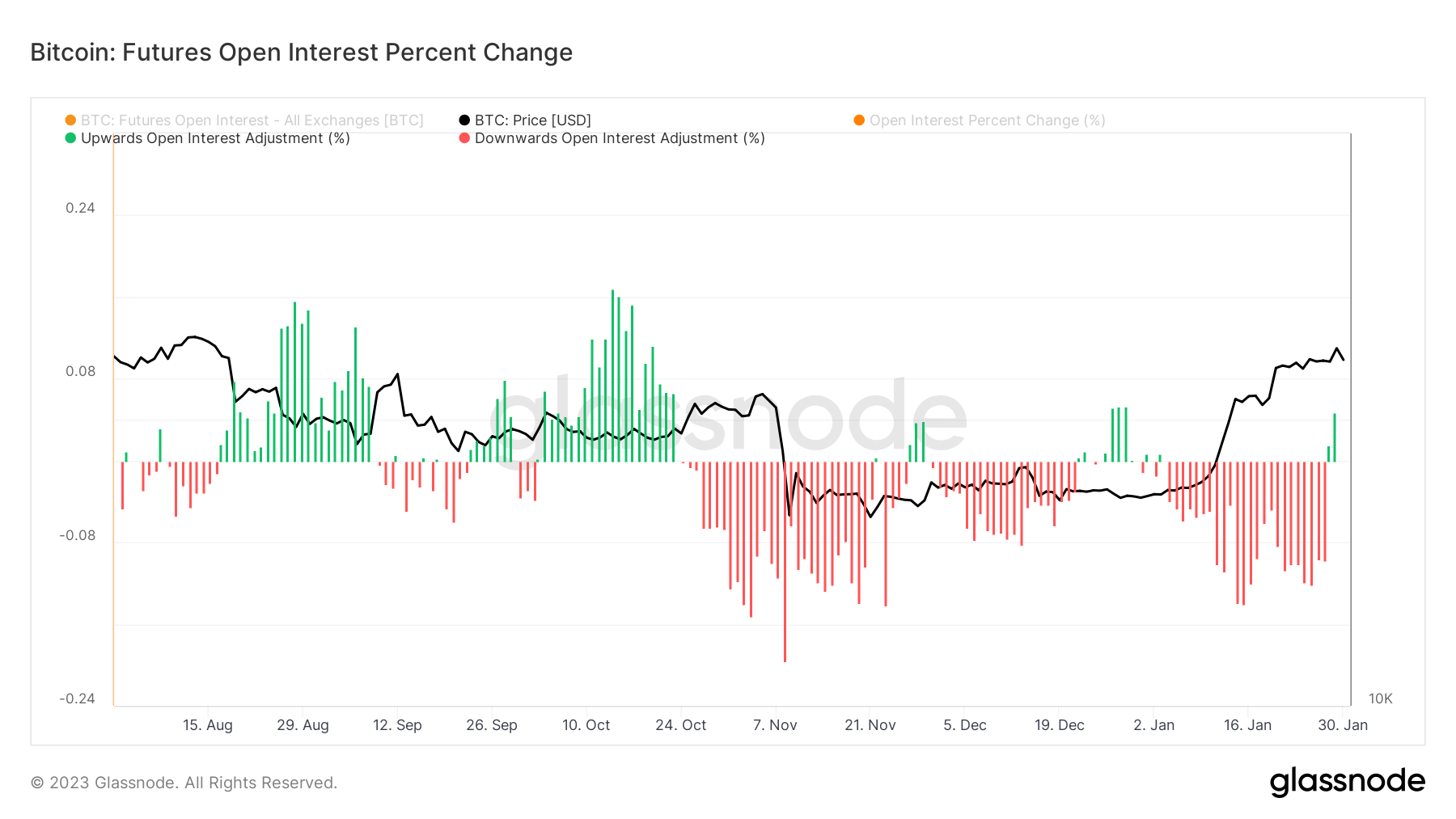

Futures Open Interest (OI) is the total number of open futures contracts for an asset held by market participants. The open interest of a futures contract for a particular asset changes daily and represents the amount of cash flowing into the market.

A rising OI means more money is moving into futures contracts, while a downward trend indicates positions are closing and money is moving out of the market. During price action, an increase in OI is often used to confirm a general trend in the market. A rise in OI in a bear market indicates that the trend will continue down. In contrast, his OI increase during the bull run indicates an upward movement.

CryptoSlate’s analysis of open interest in Bitcoin futures showed a notable increase in OI.

This rise marks a significant recovery in the futures market. The FTX crash has significantly reduced his OI, wiping out 40% of his open futures contracts since mid-November.

Around 433,000 BTC are currently allocated to futures contracts, down significantly from the 666,000 BTC recorded in November. A drop of at least 95,000 BTC could be attributed to the collapse of FTX.

The OI rebound started in mid-January. Most of the growth can be attributed to increased institutional interest in Bitcoin futures according to CryptoSlate analysis. 20% of total OI in Bitcoin futures came from CME. Virtually inaccessible to retail investors, CME Bitcoin futures are a good indicator of institutional interest in the cryptocurrency market.

On January 30th, Bitcoin futures OI posted its biggest gain since the beginning of the year. This shows that investors are gearing up for a big move in the market.

This increase in OI has contributed to the recent rise in Bitcoin price.

Historically, market volatility tends to increase before and during Federal Market Open Committee (FOMC) meetings. FOMC holds 8 meeting Evaluate and implement changes in U.S. monetary policy annually

Rising interest rates and rampant inflation have made the past year’s FOMC meetings a major move in the market as investors turn to derivatives to hedge the market.

The FOMC meeting was mostly a bearish event for Bitcoin. Bitcoin tends to be highly volatile the day before, during, and after the conference. However, momentum tends to pick up in the days following the FOMC meeting as the market adds leverage.

A deeper dive into the futures market shows that the ongoing market volatility could turn into positive price action after the FOMC meeting.

Market movements depend on the difference between long and short futures contracts. When a long dominates OI, market swings tend to be positive, whereas when a short dominates his OI, it often leads to negative price movements.

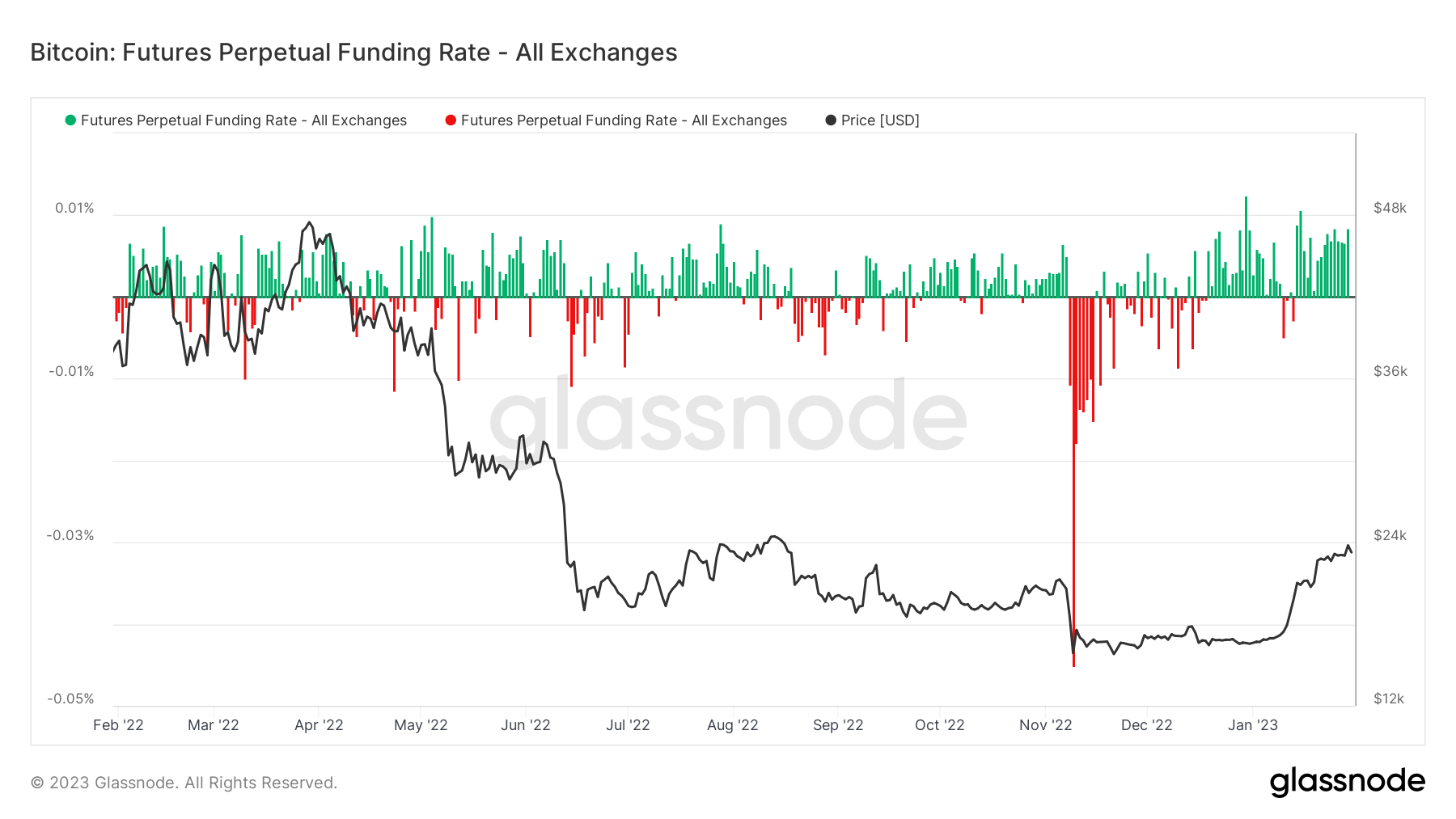

The perpetual funding rate is the average funding rate set by exchanges for perpetual Bitcoin futures contracts. If the rate is positive, the long position pays the short position the funding rate. A negative rate means that the short position has to pay the long position a rate to keep the value of the contract relatively stable.

Data analyzed by CryptoSlate showed that the long-term funding rate was positive, with longs dominating the market. The rise in the positive perpetual funding rate follows a period of aggressive short-selling that peaked during the FTX collapse.

Aggressive shorts are often bear market bottom signals, especially if the overall OI rise continues. If this pattern continues over the next few weeks, it could mean that Bitcoin could bottom out around $15,500 after the FTX collapse and continue its upward trajectory into Q1.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024