No products in the cart.

- Latest

- Trending

ADVERTISEMENT

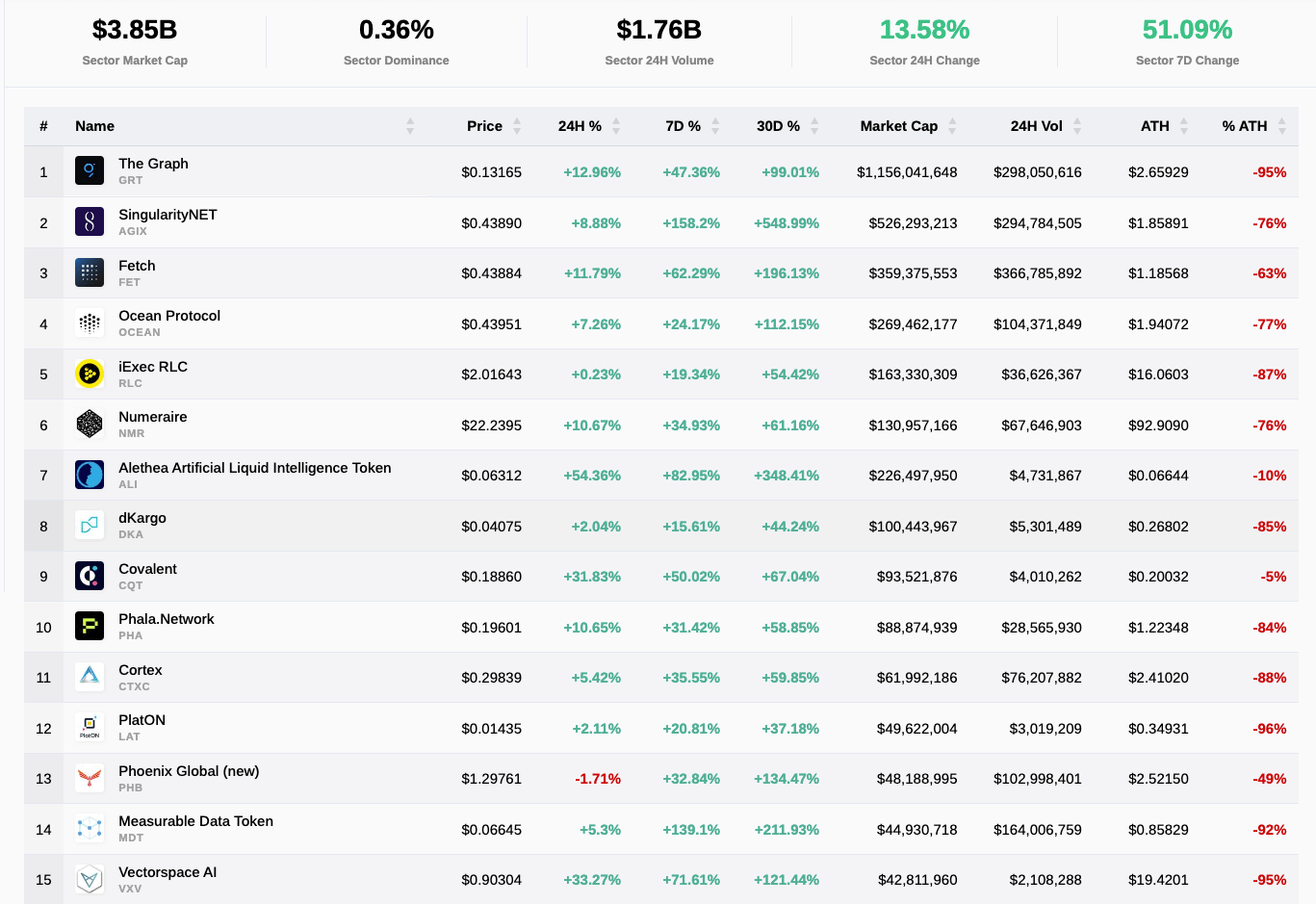

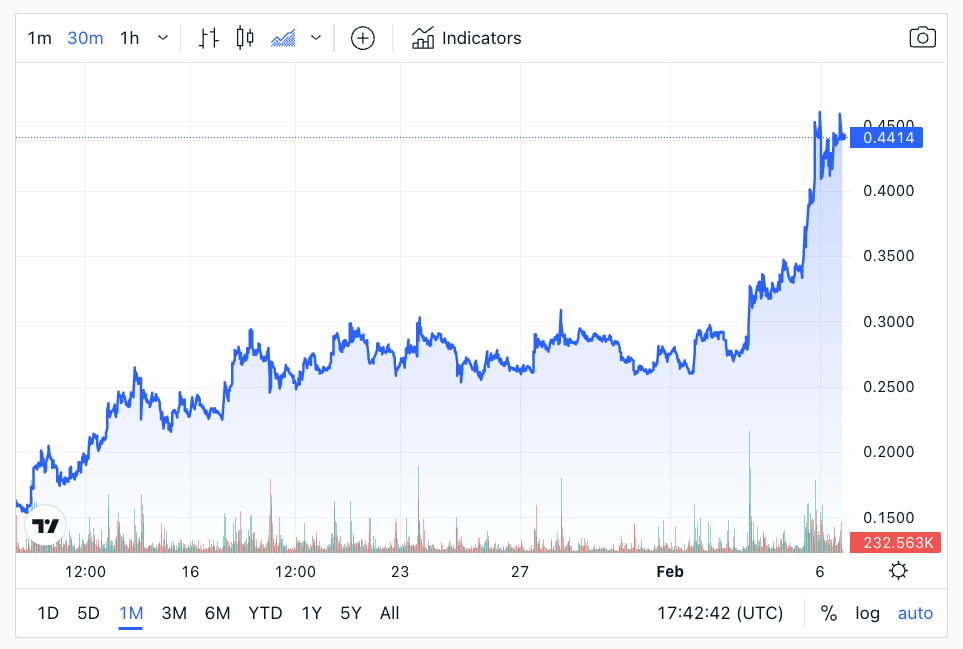

The AI crypto market sector continues to heat up with the top 30 tokens all green in the last 30 days, a trend that has many investors wondering.

The news has been widely successful Chat GPT, backed $10 billion by Microsoft (a significant portion of which Comes in the form of cloud computing creditsvia Microsoft’s Azure cloud platform); and a new push by Alphabet Inc. (Google’s parent company), reportedly late last week. investment At least $400 million in ChatGPT rivals, Anthropic.

ChatGPT is already upending many workflows and industries.This was the fastest app to achieve Achieved 1 million downloads in just 5 days After its release last December. It’s also integrated with Microsoft’s Teams, allowing the tool to act as a powerful virtual agent and office assistant.

The rapid rise of the AI crypto sector is also due to institutional investors continuing to look deeper into the sector.at Kathy Wood Recent ARK Invest ReportsFor example, she cited the confluence of AI and blockchain as part of broader changes over the next few years, saying investors will increasingly look to disruptive innovations in both sectors. I was.

But other analysts are more skeptical.

According to recent information JP Morgan Reportis based on a survey of 835 institutional investors in 60 global markets, with more than half of those surveyed agreeing that AI and machine learning will be the single most influential single investment in the next few years. “I think it’s going to be technology,” he said. The same survey, however, casts a shadow over institutional investment in cryptocurrencies, with nearly three out of four respondents saying they have no plans to trade cryptocurrencies.

So what does the recent rise in AI crypto prices explain? Let’s take a look at some of the underlying technologies behind the biggest movers and shakers in the space.

The Graph (GRT) market cap: $1.1 billion

GRT is the top-ranked AI crypto with a market cap of over $1.1 billion, with a $500 million advantage over its closest competitor (SingularityNET, which currently has a market cap of $517 million). GRT is a decentralized platform for indexing and querying data from blockchains, designed specifically for the decentralized web (Web3). It uses novel indexing and querying mechanisms that enable fast and efficient data retrieval from distributed sources, making it a critical infrastructure component of decentralized applications (dApps).

What sets GRT apart from other AI-based cryptocurrencies is its focus on providing efficient and reliable data retrieval for decentralized applications.

Additionally, GRT is designed to be a decentralized network, and validators are encouraged to contribute computing resources for data indexing and querying. This makes it a truly decentralized and open platform for data indexing and search, which sets it apart from other centralized solutions on the market.

Price: $13

24h%: +11.6%

7D%: +47.18%

30 days: +93.09%

%ATH: -95%

SingularityNET (AGIX) market cap: $529.62 million

AGIX is an AI marketplace that serves as an ecosystem for AI-related apps and projects. Focused on democratizing AI, it gained popularity by giving developers easy access to AI resources, allowing developers to create, share, and monetize AI services across the ecosystem. rice field. AGIX runs on both his Ethereum and Cardano and was created by a team of AI and blockchain experts led by Dr. Ben Goertzel, known for developing Sophia the Humanoid Robot.

AGIX was created with the goal of providing a decentralized platform for AI development. Sophia serves as a demonstration of what technology can do. AGIX is now primarily her AI marketplace, making its network available to various actors. It also includes a staking platform where AGIX tokens can be used to sustain his AI marketplace on the platform.

Current Price: $0.43

24h%: +2.35%

7D%: +152.41%

30D%: +491.69%

%ATH: -76%

Fetch (FET) Market Cap: $359.54 million

FET resides in the Cosmos ecosystem and essentially functions as a layer 1 protocol that allows users to consume peer-to-peer automated bot services using AI. Created by a team of experts in the fields of AI, Blockchain and Cryptography. The team was founded by Humayun Sheikh, Thomas Hine and Toby Simpson. All have extensive experience in developing intelligent systems and distributed technologies.

What makes FET unique is that it uses AI and blockchain technology to create a decentralized network for intelligent automation. This network will enable self-organizing systems and provide a platform for the creation and deployment of other AI-powered decentralized applications. But unlike Singularity, which is essentially an AI marketplace, Fetch uses agents to create smart contracts that can detect and execute specific functions.

In addition, FET has a unique consensus mechanism that combines elements of Proof-of-Work (PoW) and Proof-of-Stake (PoS), using this unique consensus mechanism, intelligent automation and automation It operates as a decentralized AI-powered network that enables – Organizing system.

Fetch.ai’s digital tokens serve as a means of accessing the platform’s resources and services, providing a direct incentive for token holders to actively use and participate in the network, thereby focusing on intelligent automation. is guessing.

Price: $0.43

24h%: +15.71%

7D%: +61.83%

30th: +177.88%

%ATH: -63%

Ocean Protocol (OCEAN) Market Cap: $272.29 million

OCEAN is a big data project created by a team of experienced technology and business experts, led by Bruce Pon and AI researcher Trent McConaghy.

In 2017, we created Ocean with the idea that the two could be combined to act as a decentralized data storage and privacy service (think VPN, browser, etc.). They offer Data NFTs, Data Farming, Ocean DAOs and ecosystem expansion. Data NFTs developed by OCEAN provide an IP framework that combines ERC20 and ERC721, potentially enabling multiple revenue streams for the base IP using various sublicenses.ocean was also taken up Featured on the World Economic Forum’s list of Innovators in the Data Economy.

Price: $0.43

24 hours: +4.71%

7D%: +18.3%

30D%: +102.81%

%ATH: -77%

VAIOT (VAI) market capitalization: $40.34 million

Interest in VAI seems to be growing due to the fact that VAI has a very low price when it comes to cryptographic AI, with a market capitalization of just $40.34 million, and that it offers intelligent services powered by IBM. We provide businesses and consumers with a portfolio of blockchain-based AI assistants and on-chain intelligent contracts to provide automated services and transactions.

Similar to ChatGPT’s integration with Microsoft’s Teams, VAIOT will combine AI and blockchain to create a collection of business-focused intelligent virtual assistants for both consumers and businesses. These virtual assistants serve as a new digital medium for selling, offering products and services, and conducting transactions, and importantly, are focused on enabling mobile integration (along with many others). of AI-focused apps is something we tend to ignore and choose to focus on instead). desktop application).

VAIOT’s ultimate goal is to create a digital platform for both business-to-consumer (B2C) and consumer-to-consumer (C2C) transactions between users, utilizing VAIOT’s blockchain and VAI tokens. It seems to be in

Price: $0.20

24 hours: +9.4%

7D: +83.48%

% from ATH: -29.55%

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024