No products in the cart.

- Latest

- Trending

ADVERTISEMENT

OpenSea, the leading NFT marketplace, Tweet On February 17, it announced that it would adopt a controversial move to temporarily waive market fees, intensifying its battle for market share with zero-fee platform Blur.

OpenSea cited fierce competition across the NFT space as the reason for the change of course.

There have been big changes in the NFT ecosystem, he said on Twitter.

October started to see significant volume, with users moving to NFT marketplaces that do not fully enforce creator earnings. Today, despite our best efforts, that change has been dramatic. We are accelerating.

OpenSea also announced it would revise its blocklist for other marketplaces that do not honor full royalty payments to creators, allowing sales on NFT marketplaces with similar policies, including Blur.

Competition between OpenSea and Blur has intensified since Blur’s native token launched on Tuesday.

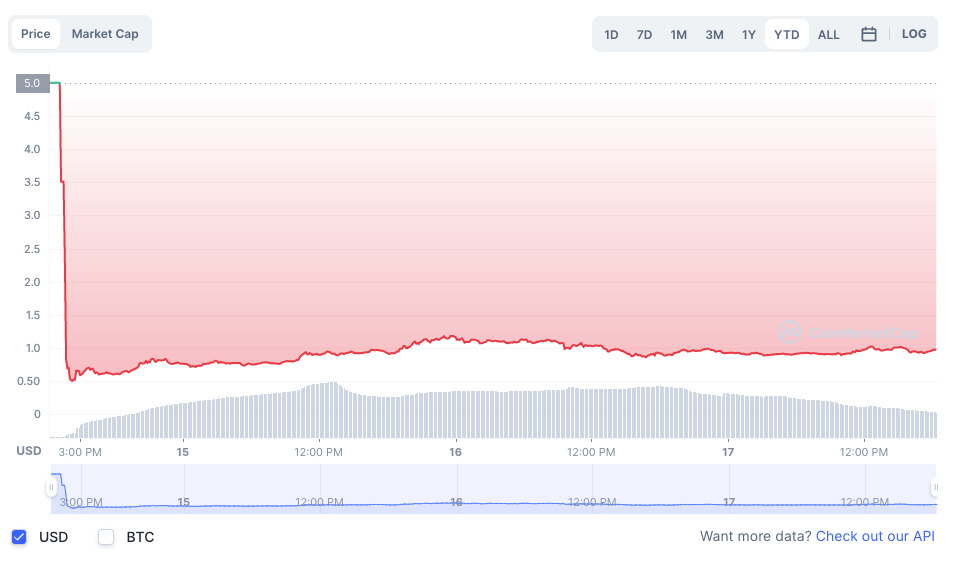

BLUR is currently ranked 117th among all cryptocurrencies by CoinMarketCap, with a 24-hour trading volume of $509 million. The coin is currently trading at $0.0976 after launching at $0.50 on February 14.

Shortly after the airdrop, the trading volume of the token reached $500 million.

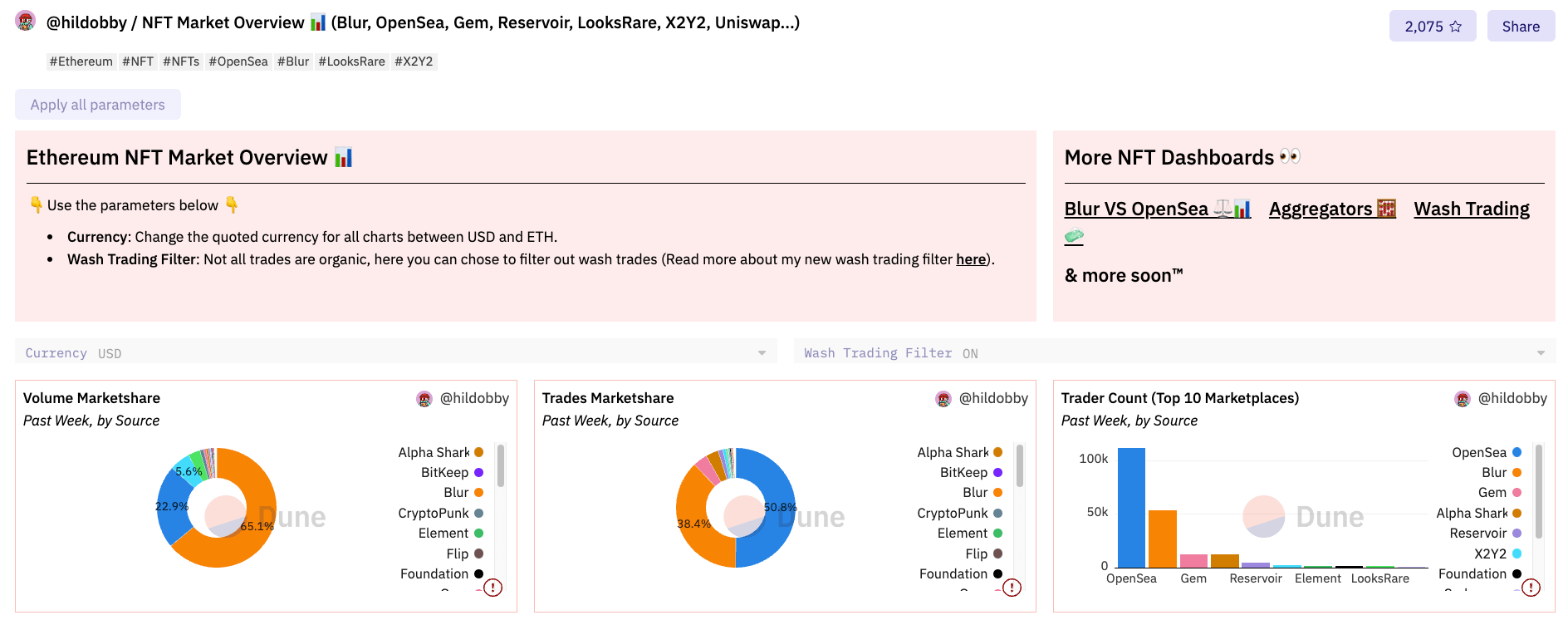

On February 15, Blur surpassed OpenSea in trading volume for the first time since its inception in October.

Despite Blur’s one-day loss, OpeaSea’s weekly volume was much higher. According to Nansen’s recent data, OpenSea’s weekly trading volume was 36,608 ETH. By comparison, Blur’s weekly volume was just 11,424 ETH. Between February 7th and his February 14th, OpenSea’s sales averaged 8.37x his Blur’s, and his number of wallets was about 8x. However, the gap between the two platforms narrowed to its minimum on Wednesday.

OpenSea’s total sales for the day were 19,908, only 1.63 times more than Blur’s 12,185 sales. A similar trend can be observed in the number of active wallets on each platform. The gap between the two is now only double, indicating that the competition between the two largest markets is becoming increasingly fierce.

On Wednesday, Blur blog post It is aimed at NFT creators, outlines the differences in royalty payment options between the two platforms, and encourages users to blocklist OpenSea so that creators can receive full royalties.

of discussion Issues over creator royalties have caused a rift between the two platforms. OpenSea took a tough stance on the issue by launching his Loyalty Enforcement Tool in November. A virtual pension in the Web3 digital economy.

In theory, royalties were once considered the holy grail for NFT advocates, and were touted as one of the key reasons why artists should embrace blockchain technology. In practice, this is under threat as many NFT platforms race to the bottom eliminating fees and royalties.

Right now, about 80% of the volume across the ecosystem is not paying full creator revenue, and the majority of the volume (even considering inorganic activity) has moved to the free environment. ‘, OpenSea confirmed on Friday.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024