No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Financial markets continue to price in peak central bank rates, including those in the US and EU. Economic growth has been stronger than expected as CPI inflation continues to rise and yields continue to rise.

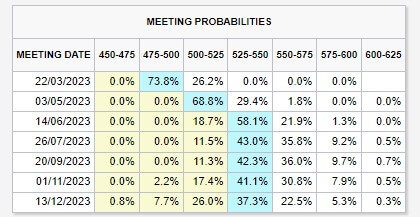

With swap prices in the US financial markets at a peak rate of 5.5%, the overall central bank motto is ‘higher in the long run’. The future Fed Funds rate is in line with no rate cuts through 2024 and three more 25 basis point rate hikes.

Inflation continues to riot in Europe as Eurozone headline inflation is forecast to drop to 8.3%. But it slowed down to just 8.5%. Energy inflation fell sharply from 19% to 13.7%. But the issue that caused concern was core inflation rising to 5.6% against a record high of 5.3%.

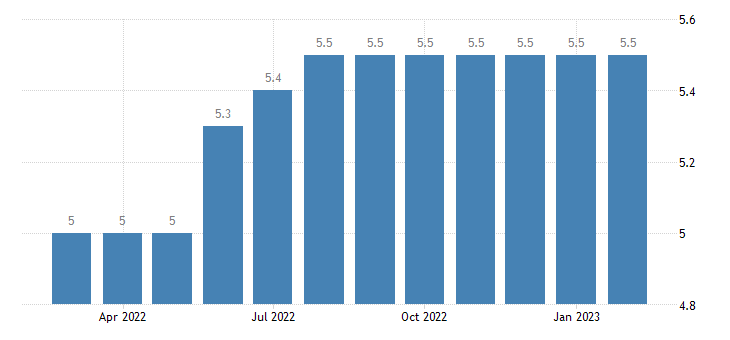

The Southern Region (Italy and Spain) S&P Manufacturing PMI for February fared better than expected in the expansion area. At the same time, Germany’s unemployment rate remained at 5.5% for his seven months, suggesting the workforce is more resilient than expected.

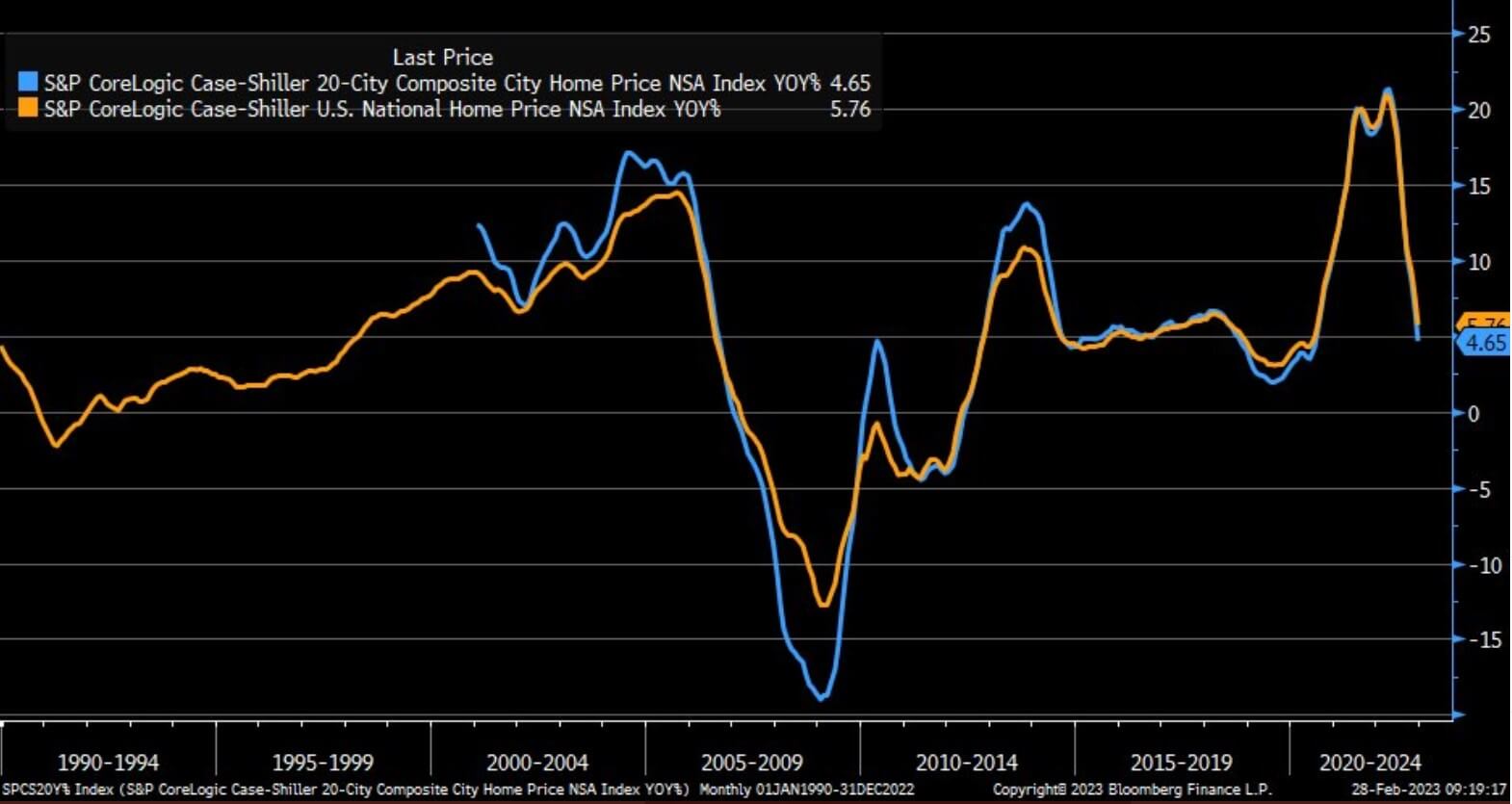

The S&P CoreLogic 20 Cities Home Price Index fell earlier than expected, slowing year-on-year price gains from 6.8% to 4.7%. The index is a trailing indicator of 3-month average prices going back to Q3 2022.

Interest rates on 30-year mortgages climbed above 7% again, but mortgage applications for homes fell by 6% last week, following an 18% drawdown the previous week.

The ISM service was released on March 3rd, showing that the US economy is still doing very well. Service exceeded expectations, prices paid were lower, employment increased and new orders increased.

The next FOMC meeting on March 22nd will have an update on the Fed’s dot plot and an update on the economic forecast summary.

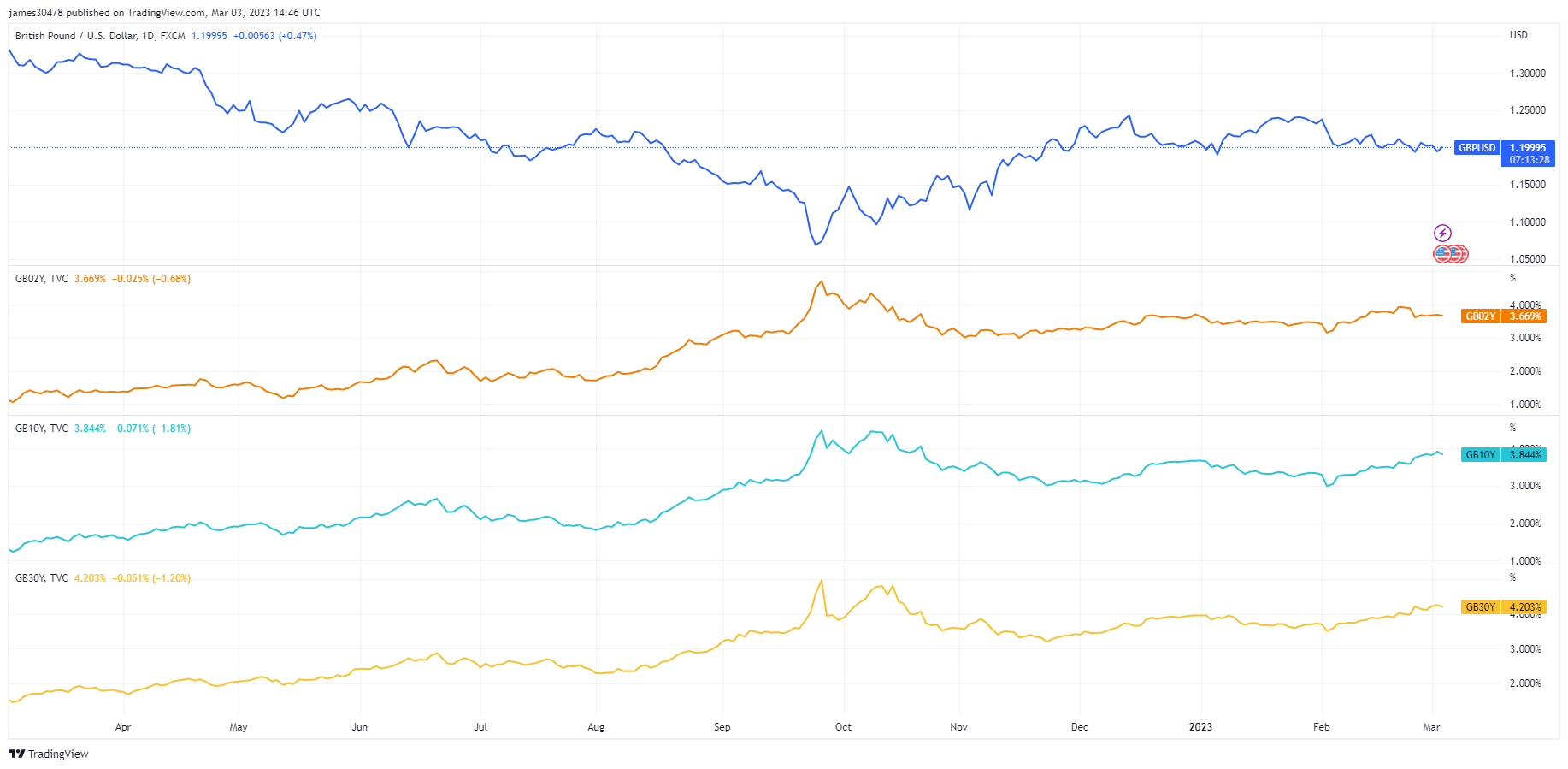

Troublesome times are approaching for the UK as food price inflation hit a record high of 17.1% and store price inflation accelerated by nearly double digits in February, according to the British Retail Consortium.

Yields go up and GBP goes down as the BOE struggles in a number of ways. Unlike his Fed and ECB, who devised hawkish plans for 2023, the BOE continues to flip-flop with no clear direction. The pound is close to year-to-date lows at $1.199 and the yield curve continues to steepen.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024