No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Central Bank Digital Currencies (CBDCs) are similar to decentralized cryptocurrencies such as Bitcoin, but concentrate power and influence into a single entity. Its purpose may not match yours or mine.

CBDC development has accelerated in recent months. A hostile narrative has surfaced against them in connection with a number of political missteps that have come to light, including their mishandling of the health crisis.

CBDCs claim benefits such as increased financial inclusion and increased efficiency, but concerns over potential threats to individual sovereignty remain.

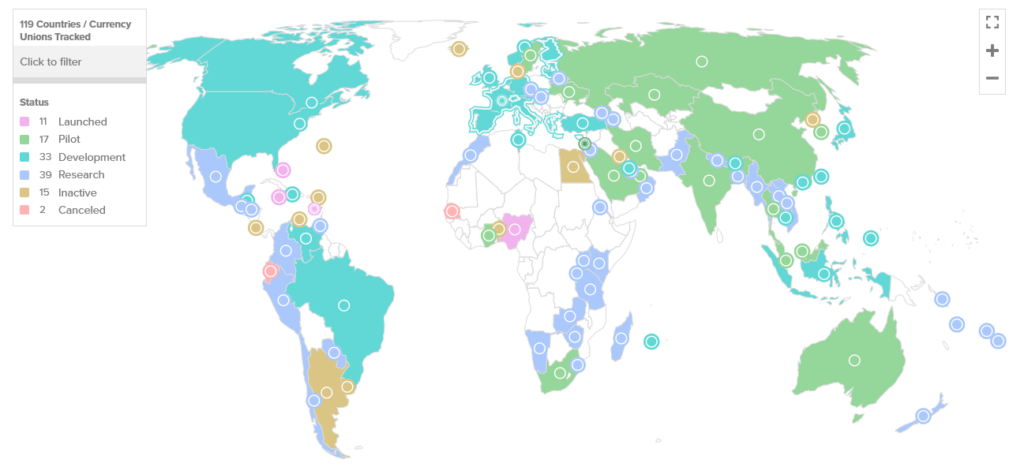

according to Atlantic Council, most countries have launched or are in the process of launching Central Bank Digital Currencies (CBDC). In this case, African countries stand out as outliers.

Proponents argue that minimizing the cost of currency, making cross-border transactions faster and safer, and tackling the problem of currency counterfeiting are justifiable reasons for implementing a CBDC.

Agustin Carsten, general manager of the Bank for International Settlements (BIS), echoed this sentiment last year, saying a CDBC could bring global financial stability while minimizing the risks associated with it.

Furthermore, Carsten eerily implied that only central banks have the right to oversee the money system, not big tech or private cryptocurrencies.

The soul of money belongs neither to Big Tech nor to anonymous ledgers.

In recent weeks, all G7 countries have moved into the development phase of their CBDC programs. Mexico has revised its rollout date to his 2024 and the digital ruble is conducting a test pilot, showing strong momentum for his global CBDC network.

Speaking to Fox News recently, an investment banker and former U.S. government official Catherine Fitz elaborated on the scathing description of CBDC, calling it the “final closing of the gates.”

Fitz spoke of general ignorance on the issue. I mean, how many people are obsessed with a system where our assets become the assets of the central bank and our citizens become extensions of the state?

“We don’t understand that when this gate is closed, we will literally be sitting in a system where central banks believe our assets belong to them…

Under the CBDC system, authorities may be able to control personal spending. Examples include blocking certain purchases or merchants, limiting spending or sending amounts, and setting expiry dates for money. As such, CBDC is not a currency. Instead, Fitz warned, they are a “control grid for financial transactions.”

She concluded that propaganda cannot convince us that a CBDC is convenient or necessary.

Fitz’s account was largely hypothetical, but factual cases have been found elsewhere that support her claims to a large extent.

On February 4th, the Bank of England (BoE) and the UK Treasury unveiled their CBDC roadmap, announcing a four-month consultation to survey public opinion on the digital pound.

according to Telegraph, the Treasury Department’s original plan is to limit users’ transfers to a few thousand pounds to prevent a possible bank collapse from rapid outflows. The Treasury Department said the transfer limit would encourage adoption while balancing implementation risks. However, he added that “these limitations may be fixed in the future”.

The Treasury Department may lift remittance restrictions in the future, but imposing restrictions first does little to inspire confidence among those tired of political hoaxes and double-talk.

The People’s Bank of China (PBoC) launched a digital renminbi program in 2018. 2014Since then it has gone through multiple phases of testing and development.of November 2020the first public test pilot was launched in Shenzhen, and has since expanded to 10 more cities. April 2022.

Individuals participate in the program by entering a lottery ticket through four major banks in China. A randomly selected winner will receive a portion of the allocated funds. In the Shenzhen trial, 50,000 winners each received a digital “red envelope” worth 200 yuan ($30). Recipients could spend the money at local retailers.

To September 2022, the program was expanded to provinces and tested in Guangdong, Hebei, Jiangsu and Sichuan. Most recently, Fujian province was included in the program in March 2023.

The CBDC financial tyranny described by Fitz is alarming enough in itself. But when combined with the social credit system, it becomes something of a dystopian nightmare.

China’s social credit system was first announced 2014, at the same time as the launch of the Digital Yuan Research Group. The planning document emphasizes the importance of managing a “comprehensive credit report” to promote social cohesion and increase trust within society.

It is an effective way to strengthen social integrity, stimulate social mutual trust, reduce social contradictions, and strengthen and innovate social governance, and build a socialist harmonious society. is an urgent requirement of

of system It applies to individuals and businesses and works like a Western credit score. Points are added and deducted based on desirable and undesirable behavior, as determined by the state. So, for example, late payment of business tax will result in a deduction.

The social credit score system is still in its pilot phase, so the ultimate outcome of low scores is unknown. However, punishments reportedly include banning trains and planes from traveling, banning children of low-scoring parents from attending certain colleges, notifying employers of employment decisions, and the possibility of audits and inspections. including public insults.

Reports also show that there are regional differences in scores, with certain behaviors penalizing some cities and others not.

There is no logical argument against deterring and punishing serious crimes. But citizens say even minor crimes such as jaywalking, walking dogs off a leash, cheating at video games, and not visiting their parents often are punishable, with serious concerns over political excesses. I am questioning.

Alex GladsteinChief Strategy Officer of the Human Rights Foundation said an integrated CBDC social credit system would set a terrifying paradigm. Given the Communist Party’s history of human rights abuses and lack of transparency, the concern is justified.

“If the government can take away your financial privileges by posting the wrong words on social media, saying the wrong things on the phone to your parents, or sending the wrong pictures to your relatives. Individuals self-censor and exercise extreme caution. In this way, controlling money can have a chilling effect on society.

Skeptics will say that the social credit system will never see the light of day, especially in “democratic” Western countries. Digital ID A program that rewards the practice of “net zero” in Rome and Bologna. Some argue that digital identities are the pioneers of social credit programs.

In recent weeks, a number of public figures have voiced concern over a coordinated attack on the cryptocurrency industry via the banking system, aka Operation Chokepoint 2.0.

While the program is not directly related to the push to CBDC, Coinbase former CTO Balaji Srinivasan has no doubt that the two are related.

In a March tweet, Srinivasan warned that the upcoming FedNow payment system is a predecessor to America’s CDBC system, and those who are unprepared will be locked in the ring-fence of digital finance.

In the latest development, law firms Cooper and Kirk have called on Congress to investigate the covert war on cryptocurrencies. They argued that recent regulatory measures are illegal, unconstitutional and intended to disrupt the digital asset industry.

They recommended several steps to hold regulators accountable. Administrative Procedure Law It also requires due process and investigation into whether regulators deliberately stifle private sector innovation.

Chris BreckDecentralization Advocate, and CEO breakfast report, told CryptoSlate that CBDC is marketed for efficiency, convenience and a better society. But behind the hopeful message is an attempt.”Eliminate our financial privacy and micromanage our lives.“

Nevertheless, Breck said the war was not lost and it was up to each of us to fight back by:

Bottom-up is buying a stateless, incorruptible currency like Bitcoin. Top-down is like Ron DeSantis who vowed to use the violent power of government to fight the government itself We support politicians.”

Both approaches could slow down CBDC implementation, but Blec wonders if they can be stopped altogether. He said a major social change would be required in the way we treat each other.

Pretty darkly, Breck doesn’t think society can put an end to CBDC. But he is optimistic that there will be opportunities for positive change after society collapses and the current cycle is over.

“I don’t know if that is realistic in today’s society. But we are becoming more and more optimistic about our NEXT society. “

Regardless of their differences, it’s hard to imagine people uniting against CBDC or authoritarianism in general. But in France, Holland and elsewhere, there are glimpses of national unity.

But the reality is that some people have a spell of discord over issues that matter little, and others are afraid to stand up and be counted.

Whether CBDC compliance or CBDC resistance, pain is inevitable. The choice each of us faces is to bear or resist the pain of submission.

Ultimately, the future of individual freedom and privacy is at stake. The question is what do you do to protect them.

Post editorial: How to resist CBDC and avoid a dystopian future first appeared on CryptoSlate.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024