No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Ethereum-based altcoin, which has recovered more than 11 times from the bottom of the year, is now likely to witness corrective action, according to a major analyst.

BarnBridge (BOND), a blockchain protocol aimed at tokenizing risk, exploded from a low of $ 2.18 in 2022 last month to a high of $ 24.99 on July 24, recording an increase of 1,046%. ..

Santiment states that some on-chain indicators are showing signs of significant growth amid BOND’s sharp rise in prices.

On-chain activity is increasing with price. It is generally good. More action can support price increases. [Also] This is the amount of new addresses that interact with BOND daily. Here too, new blood continues to flow into BOND. There is no difference with the price. Support only. “

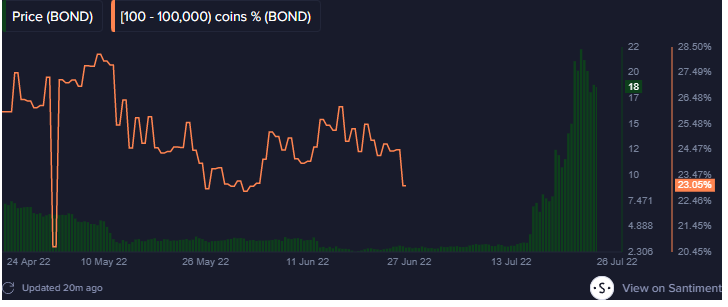

In addition, Santiment states that 100 to 100,000 BOND holders sold coins throughout the rally.

“Owners of 100 to 100,000 BOND have reduced their possession of this pump. They all gave up. And the price can continue to push this denial. To punish many owners who abandoned it.”

While many on-chain metrics support BOND explosions from the bottom, Santiment emphasizes that the coin is flashing a strong bearish signal.

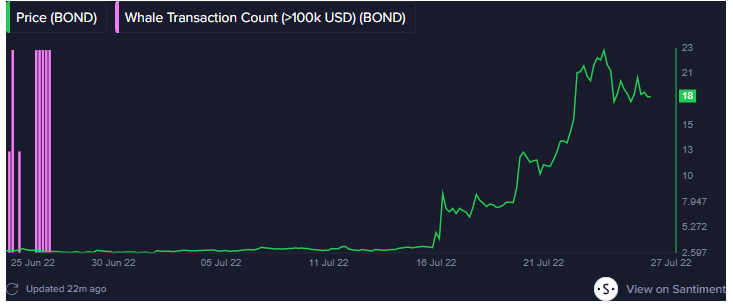

According to the Insight Platform, whale trading has already reached the top, indicating that BOND is at high risk of price adjustments.

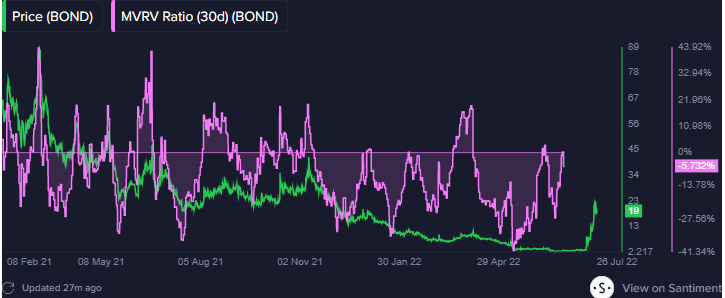

Santiment also found that the 30-day market value-to-realized value indicator, which shows the ratio of the current price to the average price of all coins / tokens acquired, is currently rising and BOND is overvalued. It states that it suggests.

“It’s too expensive. Basically, BOND hasn’t been this expensive since it matured. Very risky fixes and cooldowns.”

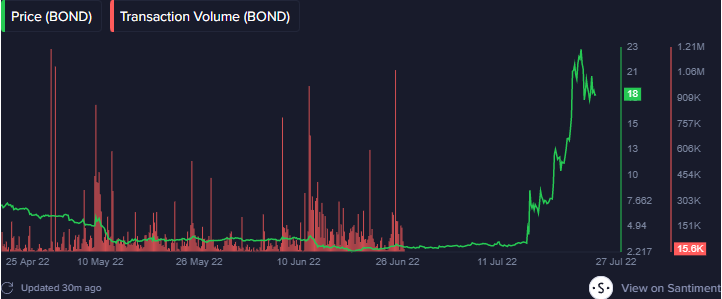

Another indicator of BOND’s bearishness is trading volume. According to Santiment, BOND trading volumes have peaked and are declining.

“This metric for on-chain alternatives to trading volume. This shows the number of BONDs moved on the chain. And it has already broken through and is declining. High risk.”

Finally, Santiment states that BarnBridge whales, or entities holding 1 million to 10,000 BOND, began distributing coins after a large accumulation in June, when the coins bottomed out.

At the time of writing, BOND was trading at $ 19.47, down nearly 3% on the day.

Don’t miss the beat subscribe and deliver encrypted email alerts directly to your inbox

Check price action

follow me twitter, Facebook When telegram

Surf the Daily Hoddle Mix

& Nbsp

Featured images: Shutterstock / laskoart / WindAwake

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024