No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Director of Finance and Capital Markets, International Monetary Fund (IMF), Tobias AdrianWarned that more crypto projects, especially stablecoin, could fail.

Comments made on unwelcome news continue to hope that the worst is over, as investors are still alive from the terra implosion and the subsequent liquidity outflow.

Adrian told Yahoo Finance that he expects cryptocurrencies and other risk-on assets to be under further selling pressure in the event of a recession, giving way to future suffering.

Further expanding, the IMF director pointed out that the algorithm’s stablecoin was particularly vulnerable, saying that the knock-on effect of the recession could lead to “coin offering” failures.

“Some coin offerings can fail further, especially some of the most hit algorithm stablecoins and others that can fail.”

The algorithm’s stablecoin provides price stability through an automated process that mint more tokens when the price is above the pegs and burns the tokens when the price is below the pegs.

Stablecoin, an important algorithm currently in operation, is Tron’s USDD, Near Protocol’s USDN, and Ethereum’s Frax, which is partially secured by the algorithm.

However, according to Adrian, the provision of secured stablecoin is also at risk. In particular, Tether said Adrian was vulnerable “because it wasn’t supported one-on-one.”

“”[Some fiat-backed stablecoins] Backed by somewhat risky assets … It is certainly vulnerable that some stablecoins are not fully backed by assets like cash. “

Tether from the Attorney General of New York February 2021.. Subsequent reports indicate that reserves consist of significant non-current assets such as “commercial paper”, raising questions about the company’s ability to meet its obligations.

Since then, Tether has reduced its holdings of commercial paper by $ 5 billion to $ 3.5 billion.

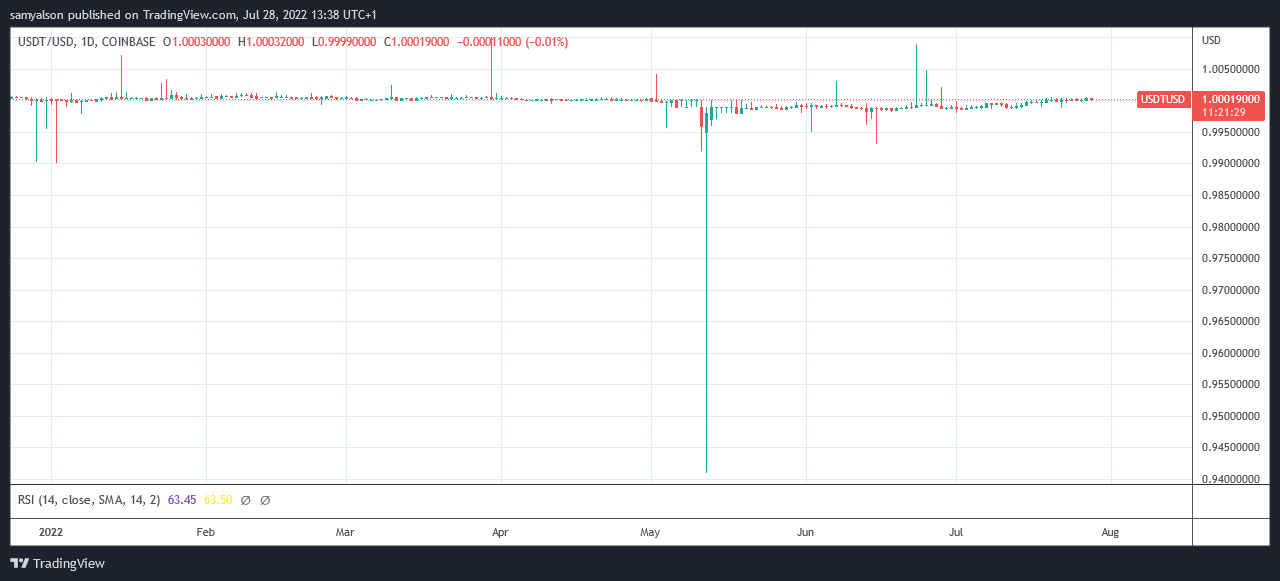

Tether fell well below the $ 1 price peg during the collapse of Terra to $ 0.94. At the time, Bitfinex CTO Paolo Ardoino downplayed the importance of the drop, saying the pegs weren’t broken, as holders could always redeem the face value directly from the company.

Previously, a recession was defined as negative GDP growth for the second consecutive quarter. However, policy makers have redefined the term as “a big picture of data such as labor market, consumer and corporate spending, industrial production, and income.”

This move was widely ridiculed as an incredible play by the current US administration.Political commentator Glenn Beck We called this a weak trick to win the losing debate while bringing in many other political hot potatoes.

Under Byden alone, the Left sought to redefine women, fetuses, domestic terrorists, riots, voter oppression, illegal aliens, anti-police, and now the recession. What a strategy! If you lose the argument, change the dictionary!

Glenn Beck (@glennbeck) July 27, 2022

On July 28, the Bureau of Economic Analysis of the U.S. Department of Commerce announced that U.S. GDP in the second quarter 0.9%Marks the second consecutive quarter of the economic contraction.

Despite the denial of the recession from the current administration, crypto investors would be wise to pay attention to Adrian’s words.

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

Price snapshot

Other contexts

Join now for $ 19 per month Explore all the benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024