No products in the cart.

- Latest

- Trending

ADVERTISEMENT

New CryptoSlate Research Using Glassnode Data Reveals Small or Retail Bitcoin (BTC) Owners Amass Flagship Digital Assets While Whales Dump Holdings became.

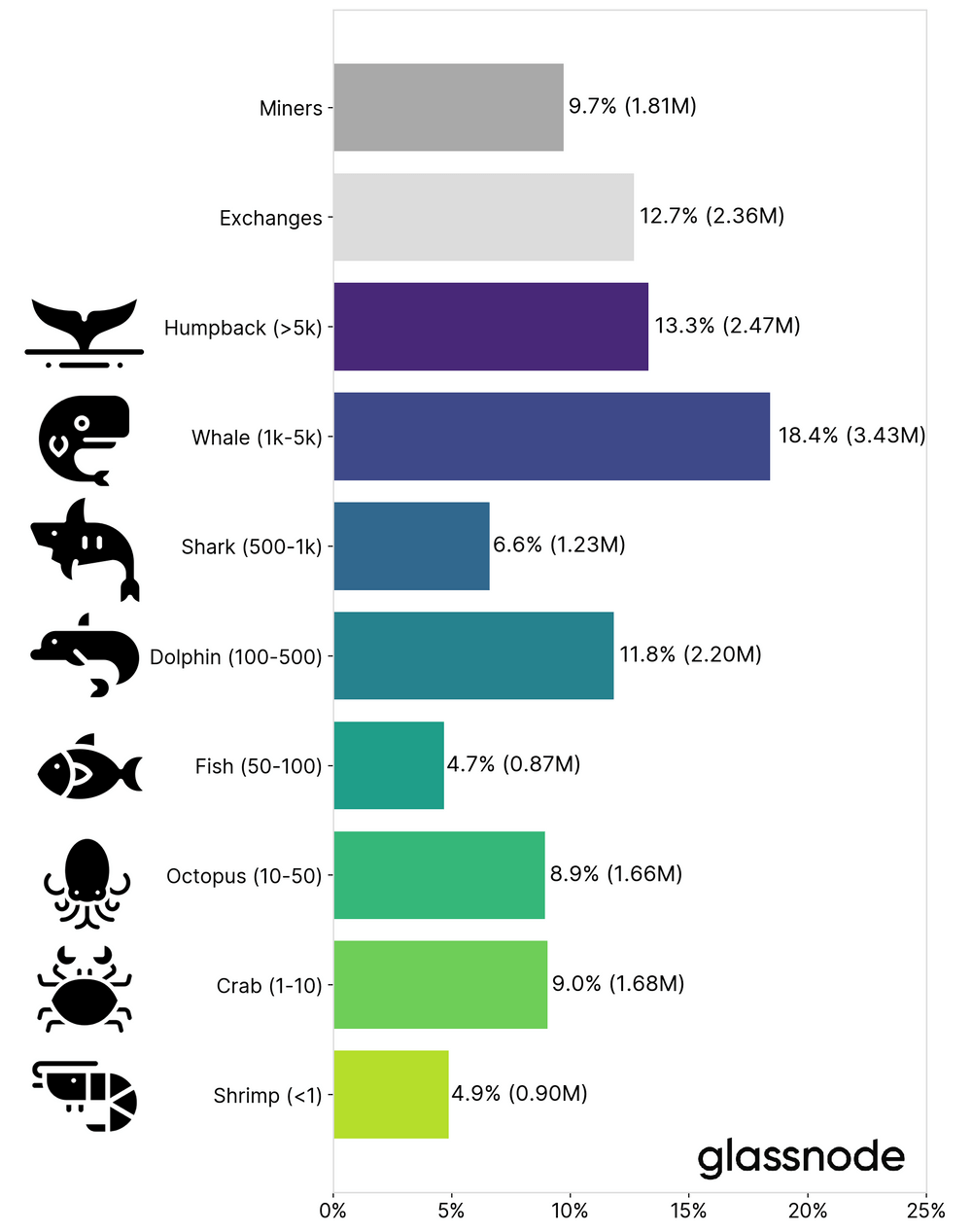

Small holders have less than 10 BTC in their portfolios, also known as ‘crabs’ or ‘shrimp’, while whales have over 1000 Bitcoins in their portfolios.

A CryptoSlate study found that retail owners’ control over the bitcoin supply increased from 14% to 15.3% during the bear market, with a further 1.3% unperturbed by recent price movements.

Bitcoin’s plunge to the $20,000 level has reportedly made the asset “attractive and affordable” for this class of investors, allowing individual owners to earn around 60,500 BTC per month, the most aggressive in market history. had purchased.

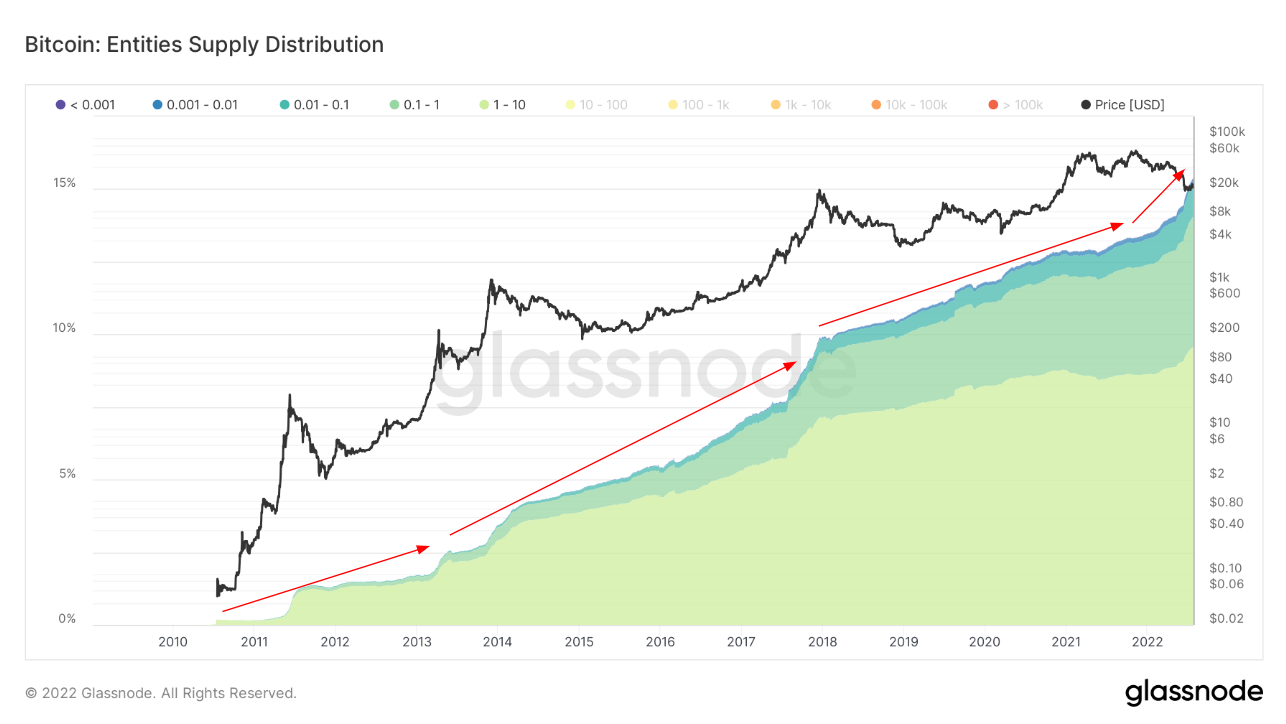

Meanwhile, throughout Bitcoin’s history, this group has continued to grow and has been the backbone of the asset’s bottom formation during bear market cycles.

Its growth has accelerated despite economic uncertainties and geopolitical challenges plaguing the world in recent months. Moreover, this growth has occurred when the price of Bitcoin recorded a 66%% drop from its all-time high.

Data shows that not only are retailers on board, but they are also contributing to the network’s rapid growth. It also shows that Bitcoin adoption continues to grow despite the impact of the bear market.

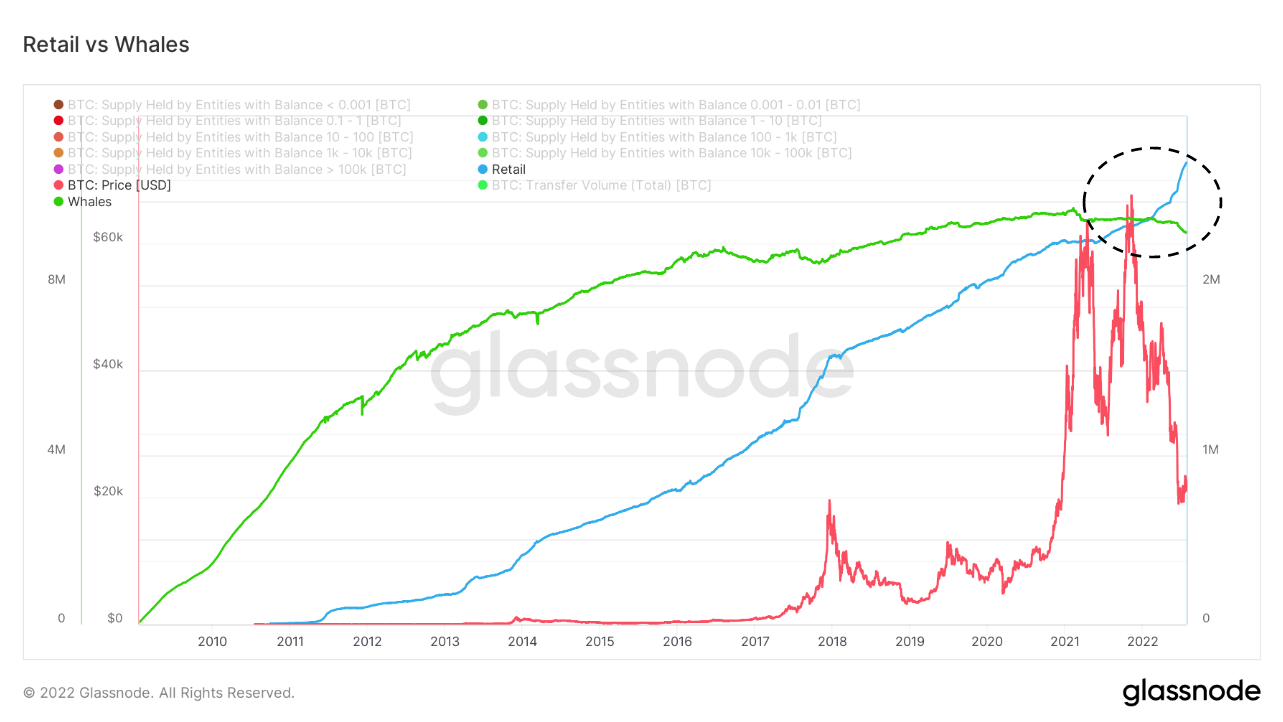

A CryptoSlate investigation revealed that whales have been dumping bitcoins since the beginning of the year.

Evidence of this is a recent esoteric study. clearly Institutional investors sold 236,237 BTC when Terra’s ecosystem crashed. Tesla, known as the bitcoin whale of institutional investors, said it sold 75% of its holdings during this period.

A recent tweet from Edris also lends credence to our investigation that whales are selling assets. Large entities are now holding their coins at a loss, forcing them to sell before they incur significant losses in their portfolios, Edris said.

#Bitcoin Whales sell at high prices

1. In the final stages of a bear market, even the strongest hands panic and start selling cheap hands. #bitcoin withdraw from the market as soon as possible.

Keep reading below pic.twitter.com/JZyqCDcFcp

Edris (@TradingRage) July 13, 2022

Despite the sale, whales still hold around 10 million BTC, more than four times more than private owners.

The chart below shows that retail investors may overtake whale owners if the dumping trend continues. This is a net positive for the network as more coins will be distributed fairly and less volatility in the long run.

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

Price snapshot

Other contexts

Join now for $ 19 per month explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024