No products in the cart.

- Latest

- Trending

ADVERTISEMENT

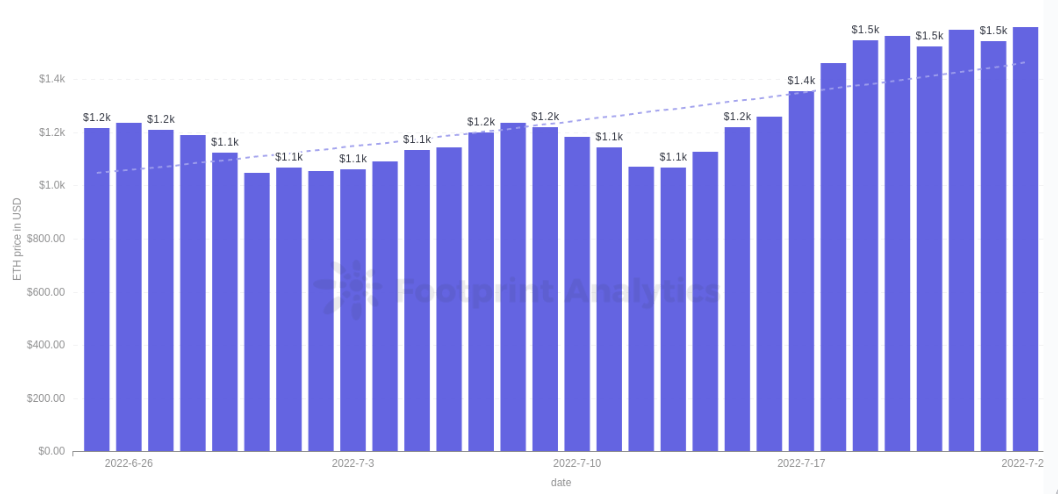

last week, ethereum After its release, the price increased significantly. Note From the last developer meeting that hinted at the timeline for the next upgrade, known as The Merge.

This upgrade changes how the network is protected, energy consumption and tokennomics. Staking will play an important role in it. So how should investors prepare for upcoming events?

The Ethereum blockchain is undergoing a series of upgrades that change from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism. The milestones to complete this are:

The consensus layer manages network security. The execution layer is where smart contracts are executed and transactions are created.

The name of this event has been updated from ETH 2.0 to “The Merge” as the upgrade connects these two chains to work as one.

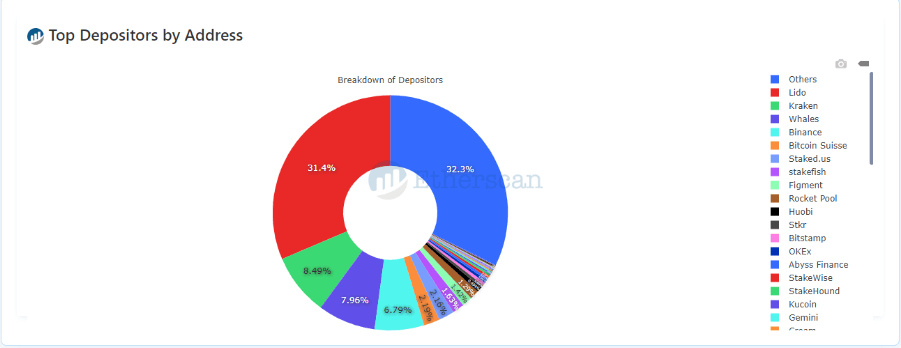

Since the beacon chain has already been operational since December 2020, a large portion of the ETH supply has already been staked and rewarded for operating the network. There are currently over 12 million of his ETH staked in BeaconChain smart contracts.

That number is almost 10% of what it is today ETH supplyAdditionally, this ETH is locked for the long term as there is no date to roll out the unstaking feature under the PoS ETH chain.

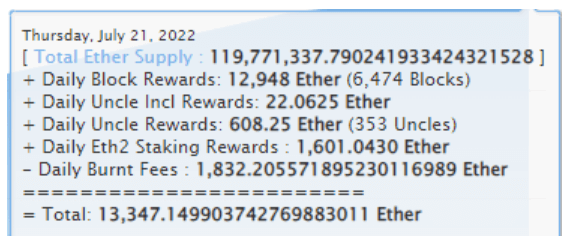

After changing to PoS, there will be no mining rewards. Therefore, on top of the 10% supply already locked in the staking contract, ETH emissions will be significantly reduced.

As per Etherscan, a total of 13,347 ETH was added to the current supply on July 21st. If we remove the block reward (mining) and leave only the staking reward (staking), the daily net result will be negative. This means that more ETH will be burned as a reward and the total ETH supply will decrease.

None of the following is intended to be financial advice and investors should always exercise extreme caution when trading cryptocurrencies. Analyzing the data presented, there are several investment strategies that investors can take.

With the somewhat solidly dated release of The Merge, there is a short period of time when the ETH supply continues to grow. After that, it will be “deflation”. If an investor believes that his ETH will take a proper position in the cryptocurrency market and its demand will increase, the price of ETH will rise. Although we have already seen some price action, there is still room for upside as the incentive to increase the amount of staked (and out of circulation) ETH increases.

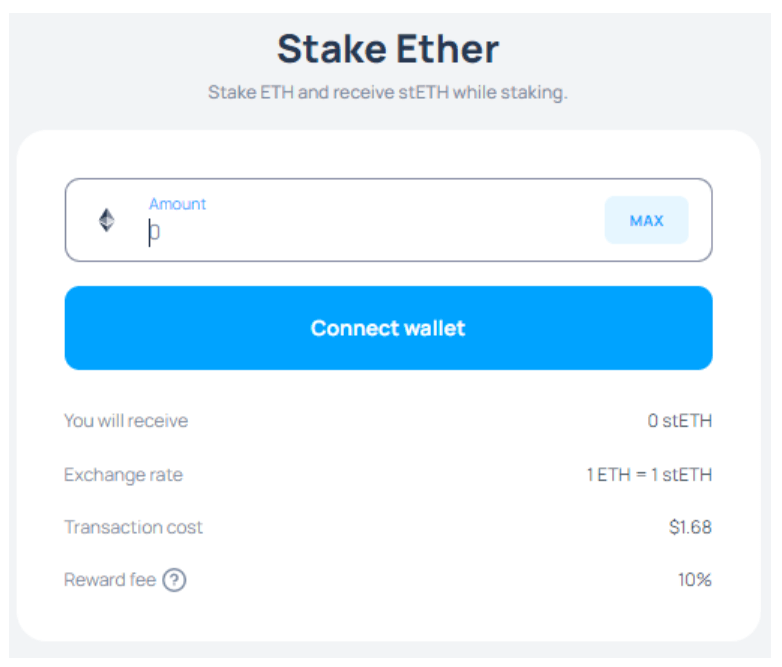

ETH sent to the beacon chain staking contract is locked for an unknown period of time, and the minimum amount required to send is relatively high (at least 32 ETH). pool Created to help users wager ETH. Part of these pools he created ERC-721 tokens as tradeable receipts for staked ETH.

Examples include Lido’s stETH token and Rocket Pool rETH. When a user visits the platform and stakes her ETH, tokens are created 1:1 against her ETH.

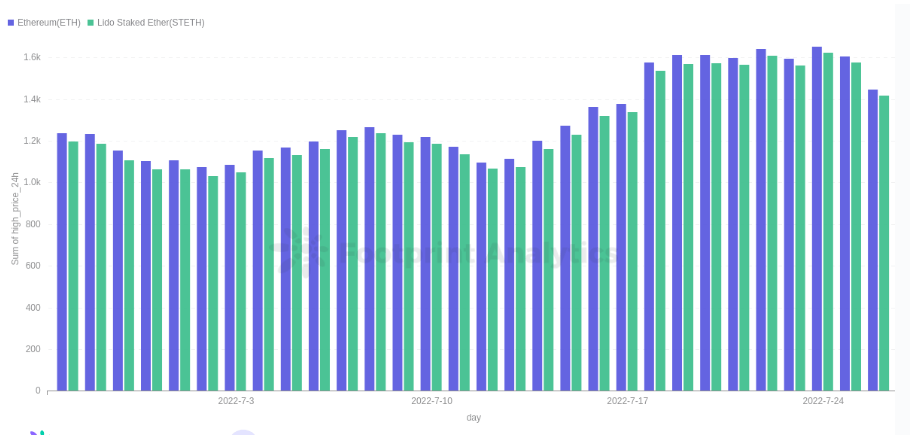

However, as it is a receipt for future redemption, it will trade at a discounted price compared to the ETH price. This discount is not fixed.As we can see the market determines its value in the footprint chart below:

Purchasing the staked version will generate an additional 2-3% return and associated interest for investors if they are willing to wait for the release of the unstaking feature after PoS is implemented on the Ethereum blockchain. To do. We don’t have a date for deploying (unstaking) this feature, but a rough timeline is 6-12 months after the “merge”.

In the long term, if Ethereum maintains a relevant and dominant position in the blockchain and the blockchain industry continues to grow, the price of ETH will continue to rise as the token transitions from inflationary to deflationary releases. Rise with Merge. This is a logical price action as supply has shrunk and demand has remained the same (and possibly increased).

As an additional opportunity to increase profits, purchasing the Liquid Stake version of ETH can bring in additional profits if the investor can wait more time.

The footprint analysis community considers this work By Thiago Freitas, July 2022.

Source: merge

The Footprint Community is a place to help data and crypto enthusiasts around the world understand and gain insights about Web3, the Metaverse, DeFi, GameFi, or any other area of the emerging blockchain world. Here you’ll find vibrant and diverse voices who support each other and move the community forward.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024