No products in the cart.

- Latest

- Trending

ADVERTISEMENT

ACCOUNTING.com is a one-stop platform for crypto users to track their crypto portfolios and file crypto taxes. Founded in 2018 and headquartered in Switzerland.

It has a desktop platform and a mobile app. Both have user interfaces with insightful dashboards that help users track the performance of decentralized finance (DeFi), centralized finance (CeFi), and non-fungible token (NFT) transactions in real time. is equipped with

This helps users to easily classify transactions and transactions for the purposes of tax reporting in their respective countries or regions.

ACCOUNTING.com’s must-read review highlights how it works, key features, pros and cons, and why you should use it.

ACCOUNTING.com offers a set of tools to help you with the following tasks:

ACCOUNTING.com is integrated with over 400 cryptocurrency service providers, including cryptocurrency wallets, exchanges, and DeFi protocols, automatically capturing trades from cryptocurrency wallets and exchanges for the purpose of calculating profits and losses. can be imported. You can also analyze performance in real-time and dive deep into transaction history across cryptoverses.

Plus, ACCOUNTING.com lets you get your crypto tax report in just 5 clicks. Reports are available in FIFO, LIFO, and HIFO formats.

You can also check general crypto market performance, set alerts, research trending tokens, and share personalized and curated token lists via Twitter.

ACCOUNTING.com has over 400 integrations with crypto exchanges, wallets, blockchains and other crypto service providers to allow users to import transactions from other crypto platforms.

Integrated exchanges include Binance, OKX, FTX, BitPanda, FTX, Coin Spot, Kraken, Gemini, Poloniex and Kucoin.

ACCOINTING.com has a crypto portfolio dashboard on desktop, iOS and Android platforms, where users can automatically connect to all crypto exchanges and wallets to see their trading summary and net profit.

This allows users to automatically classify and calculate crypto taxes. This allows the user to consider all crypto activities including her DeFi staking, margin trading, mining and trading. The calculator applies generally accepted crypto tax principles when generating crypto tax reports.

In addition to helping with crypto tax reporting, the crypto tax calculator also helps identify tax saving opportunities.

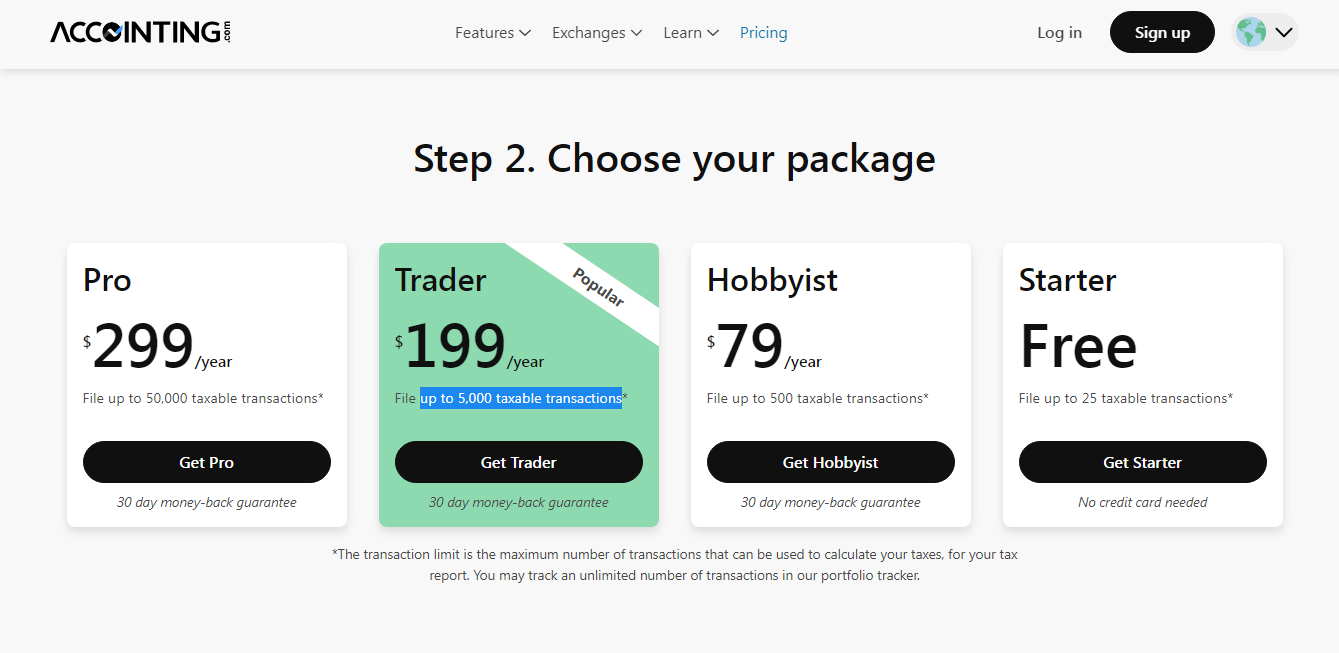

ACCOUNTING.com has four packages: Starter, Hobbyist, Trader and Pro.

Filing crypto taxes can be very difficult, especially if you are involved in too many transactions involving NFTs. It is to do, and it becomes even more difficult if you are trading or trading various crypto products.

ACCOUNTING.com provides a one-stop platform where you can generate crypto tax reports for filing crypto taxes. You can choose your package according to the number of transactions in the target year.

After signing up and paying for your chosen package, your crypto tax report will be automatically generated in about 5 clicks. Eliminate the hassle of manually classifying and calculating taxes due.

On top of that, they offer excellent customer service, have best-in-class accuracy when generating tax reports, and are a great help to newcomers in understanding how to go through the process of filing their crypto taxes. We provide a helpful and detailed instructional guide.

ACCOUNTING.com is a game changer in imposing crypto taxes on individual crypto users and organizations. We do not discriminate between individuals and companies. Midsize businesses, small businesses, large corporations, individual freelancers, crypto whales, non-profits, and governments choose from the same packages, depending on the number of crypto transactions under consideration.

It is ideal if you are looking for a platform to generate crypto tax reports as it can be linked to any crypto service provider. It integrates almost all crypto exchanges and wallets. Some of the exchanges and wallets that ACCOUNTING.com does not integrate with are because they do not have an API.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024