No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Wells Fargo, the 4th largest US bank by market capitalization, has released a special report titled Understanding Cryptocurrency comparing digital assets to the invention of the Internet, automobiles and electricity.

The report, produced by the firm’s global investment strategy team, was published in early August, bullishly calling digital assets “the building blocks of the new internet.” A statement addressed to Wells Fargo investment clients said advances in digital assets offer new possibilities and investment opportunities.

Many expect digital assets to become the building blocks of the new internet, the internet of value

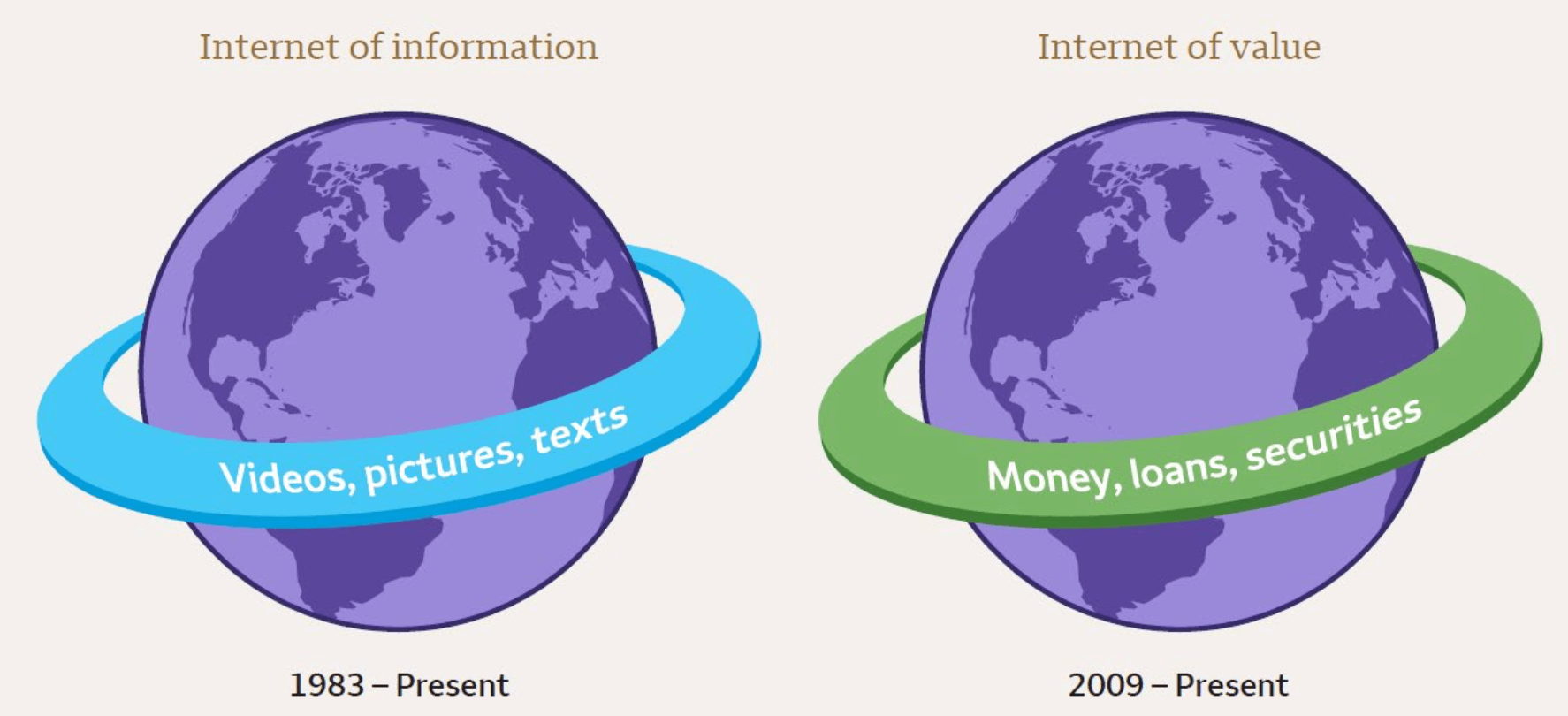

Just as the original Internet disrupted communication and information, the Internet of Value could disrupt the financial world. What does that mean for investors?

The term “Internet of Value” is not new. Speaking to Akiba of CryptoSlate at Paris Blockchain Week in March, Helen Hai, head of NFTs and Fan Tokens at Binance, said the Internet of Value is fundamental to how she approaches cryptocurrencies. However, it is a very meaningful term in defining the difference between web 2.0 and web3. The image below compares the two.

Interestingly, Wells Fargo has identified a key trend in the crypto industry to focus on technology rather than the big picture. The user experience within crypto and web3 is notorious for overly complicated dApps and wallet management. New users face very high barriers to entry. Seed phrases, passphrases, tokens, blockchains, and token transfers are all completely new to newcomers.

Wells Fargo said the purpose of its special report series on crypto is to “make sure newcomers understand the big picture concepts before they get buried in the details.” How important this is to the progress of crypto and web3 is an understatement. A household name in the banking industry that publishes special reports in favor of cryptocurrencies to educate non-crypto users about the long-term benefits of digital assets carries great weight.

While many investors embedded in the cryptocurrency industry do not trust traditional banks, a more significant subset of the broader US population still relies on prestigious banks. In addition to facilitating Bitcoin purchases as part of strategic diversification, support from such institutions will do much to establish the legitimacy of digital assets in the broader population.

The report declared all cryptocurrencies, smart contracts, and other tokens to be called digital assets. The use of this language itself is a tangible step towards improving the user experience by removing preconceived notions about terms like cryptocurrencies, NFTs and tokens.

In the final six pages of the report, Wells Fargo compared how the current version of the Internet has reinvented the post office, music store, landline phone and local news. Using these comparisons, I have attempted to create a scale to explain how the “Internet of Value” reinvents local currencies, payment networks, securities, property, and contracts.

Before attempting to explain Bitcoin’s Lightning Network, the report describes real-world examples of payment processing, money transfers, and other uses of digital assets. The instructional image reflects Jack Mallers’ demonstration of sending fiat currency using the Lightning Network. Wells Fargo declares:

Wells Fargo concluded its report by stating:

The main risks facing the industry are additional regulation, technology and business failures, operational risks in handling and storing digital assets, price volatility, and consumer protection limitations.

This is the fifth in a series of Wells Fargo’s special cryptocurrency reports. Our next report will cover the risks associated with investing in early-stage technology.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024