No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Analytics platform Santiment has spotted two crypto assets that have seen triple-digit growth in relatively short periods of time.

UniSwap (UNI), Santiment, a decentralized finance (DeFi) platform, To tell This crypto asset has risen over 150% in almost two months.

Uniswap has crashed in the last 7 weeks, separating from other altcoin packs in several instances, and surged +153% since June 18.

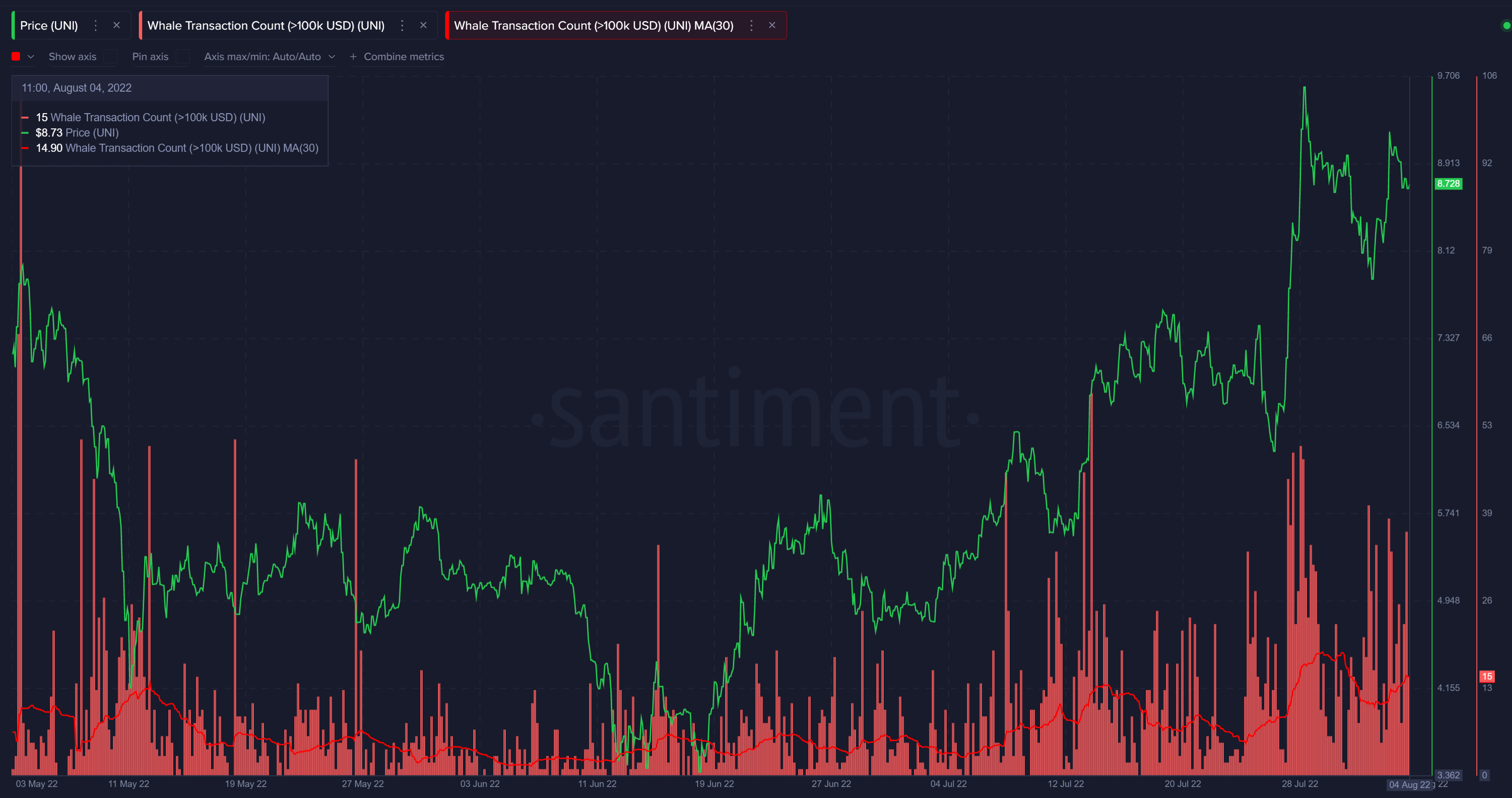

According to Santiment, Uniswap’s daily address activity is increasing, and large holders of crypto assets also continue to accumulate.

It is also great to see that shark and whale addresses have become a larger and larger share of the overall Uniswap supply since May. A cumulative spike was seen, followed quickly by continued price increases.

And for whales, the volume of large deals (deemed to be deals of $100,000 or more) is back to May levels. You can clearly see the big chunk of the big whale trade that started to form a week ago, just before the big price jump to $9.69. “

Uniswap is trading at $8.96 at the time of writing.

According to a crypto analytics firm, those who bought Uniswap 30 days ago are making double-digit profits, while those who bought crypto assets a year ago are still losing money.

As a result, Santiment says Uniswap’s price may fall in the short term, but is still undervalued in the long term.

The 30-day market value realized value (MVRV) is currently up to +22.5%, well above the backtested danger zone of +15% or more. But even if medium-term trading returns start to overflow, the good news is that long-term traders (365-day MVRV) are still well below the surface. This means UNI could fall in the next week or two, but the long-term future still seems undervalued.

MVRV is the ratio of the current price to the average acquisition price of a particular asset. An increase in MVRV value indicates an increase in potential profit.

next santiment appear Ethereum (ETH) with Scaling Solution Optimism (OP). According to the analytics firm, Optimism is experiencing a “classic dump and pump” move, rising more than 300% from July lows of $0.45 to August highs of $2.

Optimism is trading at $1.93 at the time of writing.

Based on the Elliott Wave theory, the analytics firm says optimism could undergo a correction of more than 30% to prices just above $1.297 in the short term.

We expect to see a correction near the bottom of the fourth wave soon, but not much more than that as the fifth wave tends to follow.

The Elliott Wave theory states that the long-term price trend of an asset moves in a 5-wave pattern, while the correction moves in a 3-wave pattern.

Don’t Miss a Beat Subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Ekaterina Glazkova

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024