No products in the cart.

- Latest

- Trending

ADVERTISEMENT

PlanB, the infamous creator of Bitcoin’s stock-to-flow (S2F) model, has abandoned its HODL strategy in favor of “quantitative investment via ByBit.

In a tweet on Friday, he announced a copy my trades partnership with Bybit.article in detail strategy It was released on Monday via PlanB’s website.

Our article on quantitative investing is almost ready. Includes trading rules over buy and hold 100x. You can copy my deal here (signup + deposit): https://t.co/8OI2agrLDD pic.twitter.com/jgW8AmCjlc

PlanB (@$100 trillion) August 5, 2022

The creators of S2F gained a large following online after creating a methodology for many investors to speculate on Bitcoin’s future price.

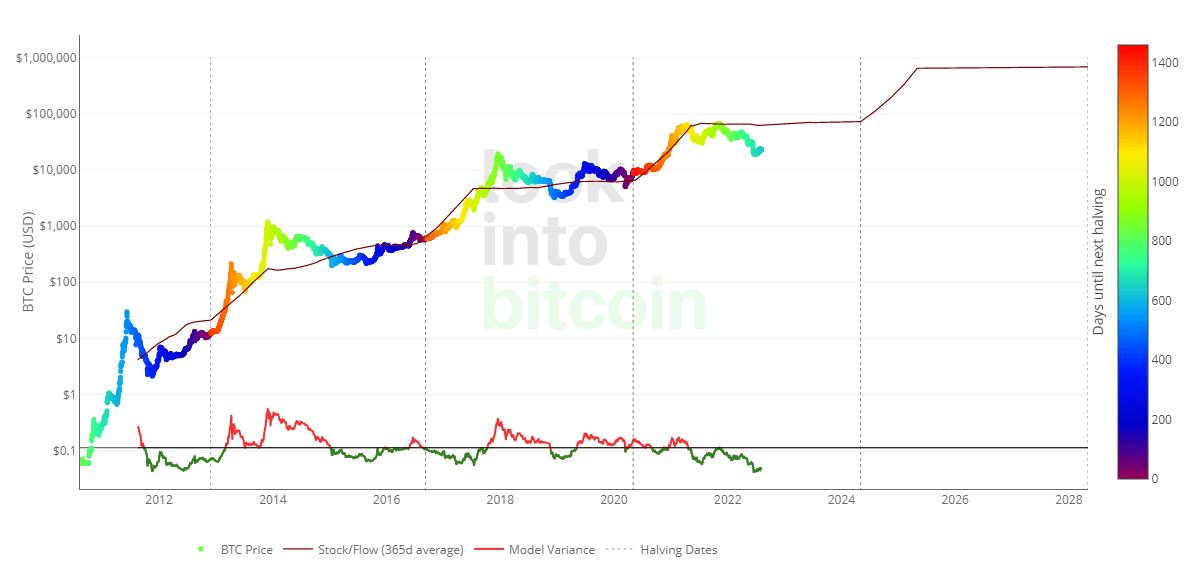

This model is based on a fixed supply of Bitcoin and a predefined release schedule tied to the Bitcoin halving. According to the Stock-to-Flow model, Bitcoin’s price will reach nearly $1 million by 2026.

Historically, the S2F model has been surprisingly accurate. However, the recent bull market has seen an increasing number of crypto-his natives abandoning the validity of this theory.

As far back as June 2021, Ethereum founder Vitalik Buterin explained that those who believe in this model deserve all the ridicule they get.

Stock-to-Flow doesn’t look good right now.

I know it’s disrespectful to moan unnecessarily, but financial models that give people a false sense of certainty and numbers are doomed to rise are harmful, and all the ridicule they get. I think it deserves it. https://t.co/hOzHjVb1oq pic.twitter.com/glMKQDfSbU

vitalik.eth (@VitalikButerin) June 21, 2022

This methodology confirms that buying and holding bitcoin offers the safest way to invest in bitcoin due to the assumption that bitcoin will continue to follow its predicted price over a specific timeframe. I’m here. The price may deviate from the model over a period of time, but it will eventually return to the inventory and flow line as the coin supply and distribution are fixed.

Criticism of S2F has been mounting during the bear market as the price of Bitcoin has fallen significantly below model predictions and has continued since December 2021.

PlanB appears to have taken the opportunity to deviate from its buy and hold philosophy to work with ByBit to facilitate a new trading system. His strategy is said to outperform the HODL approach by a factor of 100. New Articles on Quantitative Investing Released.

He claims to have received “the same reaction as when he published the S2F article in March 2019.” Still, most of the criticism comes from people questioning the move away from HODLing to copy trading. A copy of the trading page on ByBit’s website states that the principal his trader has “up to 30% Commission and 500 USDT Bonus

It’s interesting to see the same reaction as when I published an article on S2F in March 2019 when BTC was under $4,000 and demanding $55,000. Scammers, Demand not in model, $55,000 is unacceptable.

Now people hate exchanges because they can’t imagine 100x B&H outperformance in 10 years. Let’s wait for the article. https://t.co/tjDpqnA2NxPlanB (@$100 trillion) August 6, 2022

Quant trading strategies are fully outlined in a PlanB article titled Quant Investing 101. The core philosophy seems to be based on backtested Bitcoin RSI level trading over the past decade.

Below are the details of the trading rules that PlanB uses for its strategy.

“IF (RSI is above 90% and below 65% in the last 6 months) THEN Sell,

IF (RSI has fallen below 50% in the last 6 months and is up +2% from low) THEN buy, ELSE hold.

For more information on how to optimize your bottom line with ITM options, read the full article on PlanB’s website.

Hodlonaut, author of Bitcoin Zine, Citadel21, tweeted that he was disappointed with the concept of partnering with what PlanB called a leveraged shitcoin casino and refusing to buy and hold.

Wait, am I understanding this correctly? Is PlanB telling people to sign up at a leveraged shitcoin casino, copy his trades, and earn 100x more BTC than if you just buy and hold?

I must be misunderstanding something, right?

right?

hodlonaut (@hodlonaut) August 7, 2022

Cory Kilppsten of Swan Bitcoin, one of the first to identify the problem with Celsius, even called PlanB a crook.

plan brandlini @100 trillion USD It’s such a charlatan scumbag. What an absolute joke. pic.twitter.com/9sbMgakoQ1

Cory Clipsten (@coryklippsten) August 6, 2022

Cryptocurrency trader Eric Wall claimed that Bitcoin Maxis did not defend this scammer, spreading sentiment within the industry that PlanB is no longer relevant.

Thankfully, Bitcoin Maxis did not defend this charlatan Saifedeen, Adam Back, Caitlin Long, Vijay Boyapati, Pierre Rochard, Bitstein, Preston Pish and many other Swann Advisors, plus almost all Bitcoin podcasts were an irrelevant minority on the ground.scheme of things

Eric Wall (@ercwl) August 7, 2022

Additionally, a PlanB article on quantitative investing raises an interesting question, as it states:

“The content of this article is not financial advice. All content is for informational and educational purposes only.”

However, the article identified as a precursor To his copy trading strategy on ByBit. So while PlanB may say they don’t give investment advice, they encourage users to follow this strategy by copying his “quantitative investing” trades.

PlanB claims to provide information about its transactions on Twitter for free, allowing for a DIY option. Furthermore, he admits he only trades 10% of his portfolio “mainly for credit risk.”

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024