No products in the cart.

- Latest

- Trending

ADVERTISEMENT

With most cryptocurrencies giving up recent gains, a robot that has earned a reputation for outperforming the market is announcing its latest altcoin allocation.

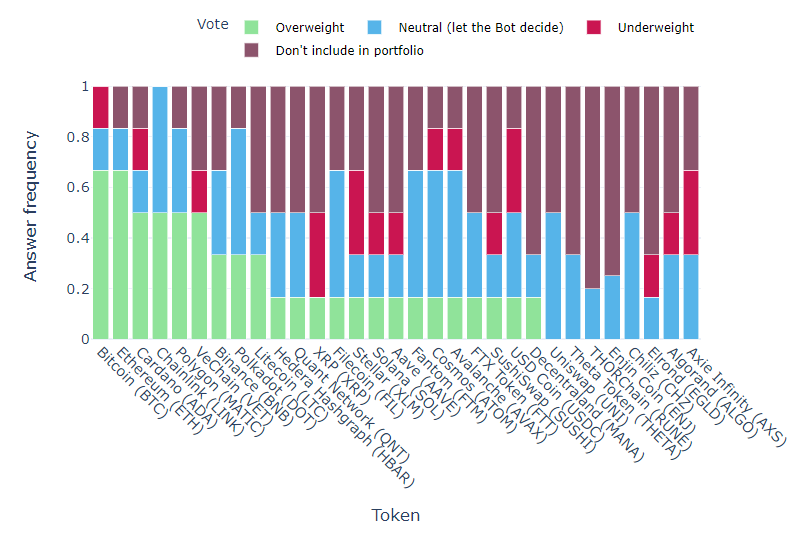

The Real Vision Bot conducts weekly surveys to generate an algorithmic portfolio evaluation that reveals a “hive mind” consensus.

latest in bots data Traders’ risk appetite remains aggressive, with most market participants seeing crypto heavyweights Bitcoin (BTC) and Ethereum (ETH) both at 67%, along with 21 alts. I am voting to overweight my portfolio in coins.

ETH challenger Cardano (ADA), decentralized oracle network Chainlink (LINK), and layer 2 scaling solution Polygon (MATIC) tied for third place with 50% of the votes for the overweight allocation.

Latest results of RealVision Exchange Crypto Survey. Cardano, Chainlink and Polygon surprised me with the same % votes overweight.

1. Bitcoin 67%

2. Ethereum 67%

3. Cardano 50%

4. Chain link 50%

5. Polygon 50%”

Supply chain management blockchain VeChain (VET) is below 50%, tied for seventh with a 30% increase in quota, with popular cryptocurrency exchange Binance’s native token BNB and cross-chain interoperability protocol Polkadot (DOT), and distributed peers. Peer-to-peer cryptocurrency Litecoin (LTC).

Participants will also be represented by Hedera Hashgraph (HBAR), a decentralized application building protocol, Quant Network (QNT), an enterprise-grade interoperability solution provider, distributed ledger XRP, decentralized storage network Filecoin (FIL), decentralized payment network Stellar (XLM), Ethereum competitor Solana (SOL), lending protocol Aave (AAVE), enterprise-class blockchain platform Fantom (FTM), scalability and interoperability ecosystem Cosmos (ATOM), Layer 1 Smart contract platform Avalanche (AVAX), FTX cryptocurrency exchange FTX Token (FTT), automated market maker SushiSwap (SUSHI), dollar-pegged stablecoin US Dollar Coin (USDC), virtual reality world Decentraland (MANA).

In the latest survey-based exchange portfolio allocation, Chainlink leads at 17.1%, followed by Ethereum at 14.3%, Polygon at 12.2%, Bitcoin at 11.9% and Polkadot at 8.57%. His eight other crypto assets fell within the 2% to 7% quota.

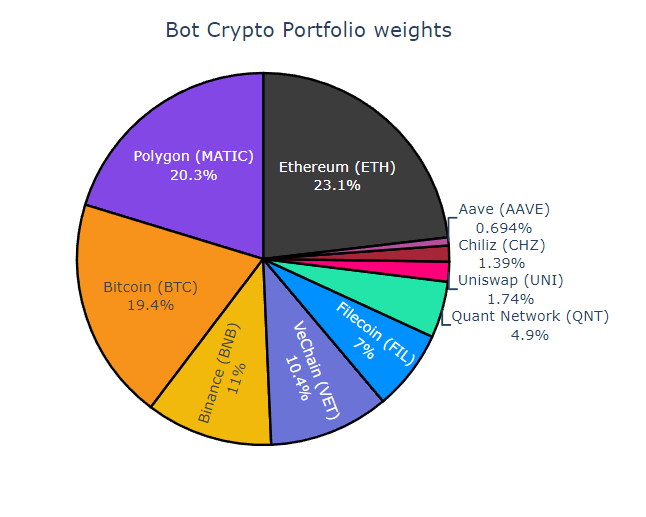

The bot itself also compiles its own portfolio and uses Real Vision Note Four digital assets account for almost 75% of weekly holdings.

RealVision Exchange Crypto Portfolio Latest Weights.

The bot sticks to Ethereum, Polygon, Bitcoin and Binance.

Real Vision Bot was co-developed by quantitative analyst and hedge fund CEO Moritz Seibert and statistician Moritz Heiden.

Raoul Pal, founder of Real Vision and macroeconomics expert, called the bot’s historic performance “amazing”, 20% higher than the aggregate bucket of the top 20 crypto assets on the market. It says it’s better than that.

Don’t Miss a Beat Subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Dai Yim

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024