No products in the cart.

- Latest

- Trending

ADVERTISEMENT

As most cryptocurrencies attempt to recover from the weekend’s slump, a trading robot with a reputation for outperforming the market reveals its latest portfolio allocation.

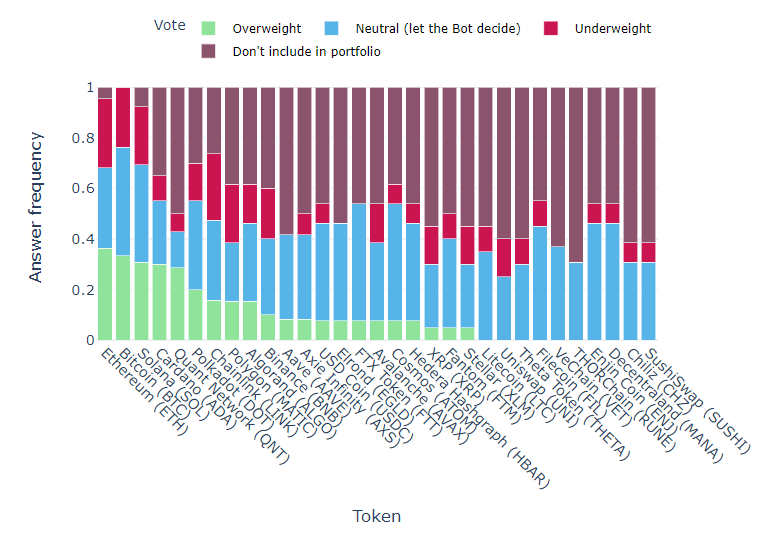

The Real Vision Bot conducts weekly surveys and compiles algorithmic portfolio evaluations to arrive at a collective consciousness consensus.

latest in bots data Traders’ risk appetite is down slightly from a week ago, with most market participants pegging cryptocurrencies Ethereum (ETH) at 36% and Bitcoin (BTC) at 33%, along with 19 altcoins. voted to overweight the portfolio.

Layer 1 smart contract platform Solana (SOL), fellow ETH challenger Cardano (ADA), and enterprise-level interoperability solutions provider Quant Network (QNT) tied for third at 30% weight distribution. was.

“Latest results from RealVision Exchange Crypto Survey. Lots of neutrals, not massive beliefs about being overweight. QNT makes top 5.”

1. Ethereum 36%

2. Bitcoin 33%

3. Solana 30%

4. Cardano 30%

5. Quant Network 30%

Cross-chain interoperability protocol Polkadot (DOT) comes in sixth with a 20% overweight, followed by decentralized oracle network Chainlink (LINK), layer 2 scaling solution Polygon (MATIC), decentralized network of Algorand (ALGO) were all 15%.

BNB, the native token of popular crypto exchange Binance, rounded out the top 10 with a 10% increased allocation.

Lending protocol Aave (AAVE) and play-to-earn battle game Axie Infinity (AXS) weighed 8% each, followed by six altcoins at 7%. Enterprise-grade blockchain platform Elrond (EGLD), FTX cryptocurrency exchange FTX Token (FTT), layer 1 smart contract platform Avalanche (AVAX), scalability and interoperability ecosystem Cosmos (ATOM), and decentralized applications Creation protocol Hedera Hashgraph (HBAR) .

Rounding out the list of crypto assets with a 5% overweight are distributed ledger XRP, enterprise-grade blockchain platform Fantom (FTM), and decentralized payments network Stellar (XLM).

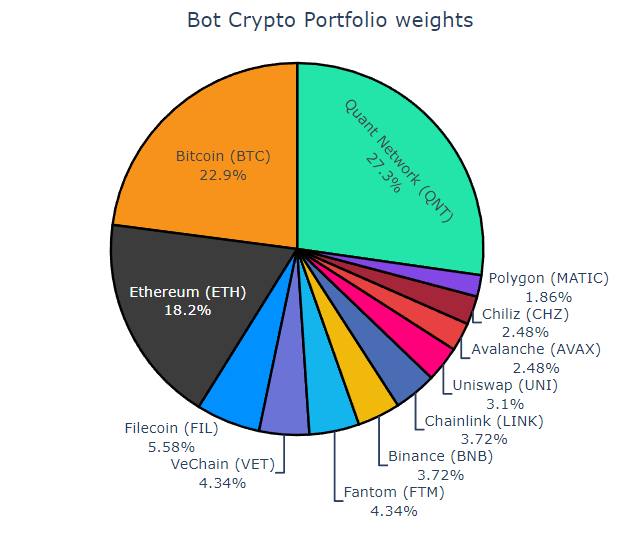

The exchange portfolio allocation based on the latest research shows Cardano leading with 18.9%, followed by Quant Network at 17.7%, Bitcoin at 11.8%, FTX Token at 10.1% and Ethereum at 9.45%. increase. Solana, Aave and Elrond line up at 8.86% and Polkadot is also on the list with his 5.45% allocation.

Bots can also compile their own custom portfolios and use Real Vision highlight Cardano and Quant Network were notable gainers this week while BTC, SOL and ETH fell slightly.

The latest weights in the RealVision Exchange crypto portfolio. Cardano and QNT lead based on more overweight than underweight votes.

Views on Bitcoin, Solana and Ethereum are more mixed, hence their lower weighting.

Real Vision Bot was co-developed by quantitative analyst and hedge fund CEO Moritz Seibert and statistician Moritz Heiden.

Raoul Pal, founder of Real Vision and macroeconomics expert, called the bot’s historic performance “amazing”, 20% higher than the aggregate bucket of the top 20 crypto assets on the market. It says it’s better than that.

Don’t Miss a Beat Subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Featured image: Shutterstock/vs148/WindAwake/VECTORY_NT/Mingirov Yuriy

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024