No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Interlay has launched a wrapped Bitcoin asset called InterBitcoin (iBTC) on the Polkadot Chain. The product aims to expand the use of BTC for DeFi, cross-chain transfers, NFTs, etc.

iBTC already supports Acala and Moonbeam. However, the developer has put in $1 million in funding to extend the project to other chains. We have plans to launch soon on Ethereum, Cosmos, Solana and Avalanche.

iBTC is a Bitcoin-backed stablecoin maintained by a decentralized network of collateralized vaults and redeemable 1:1 with BTC.

Interlay’s mission is to realize the “essence of BTC” by extending its use to any blockchain.

interBTC enables the true liberal nature of BTC and decentralized finance. It is a 1:1 Bitcoin-backed asset, fully collateralized, interoperable and censorship-resistant. .”

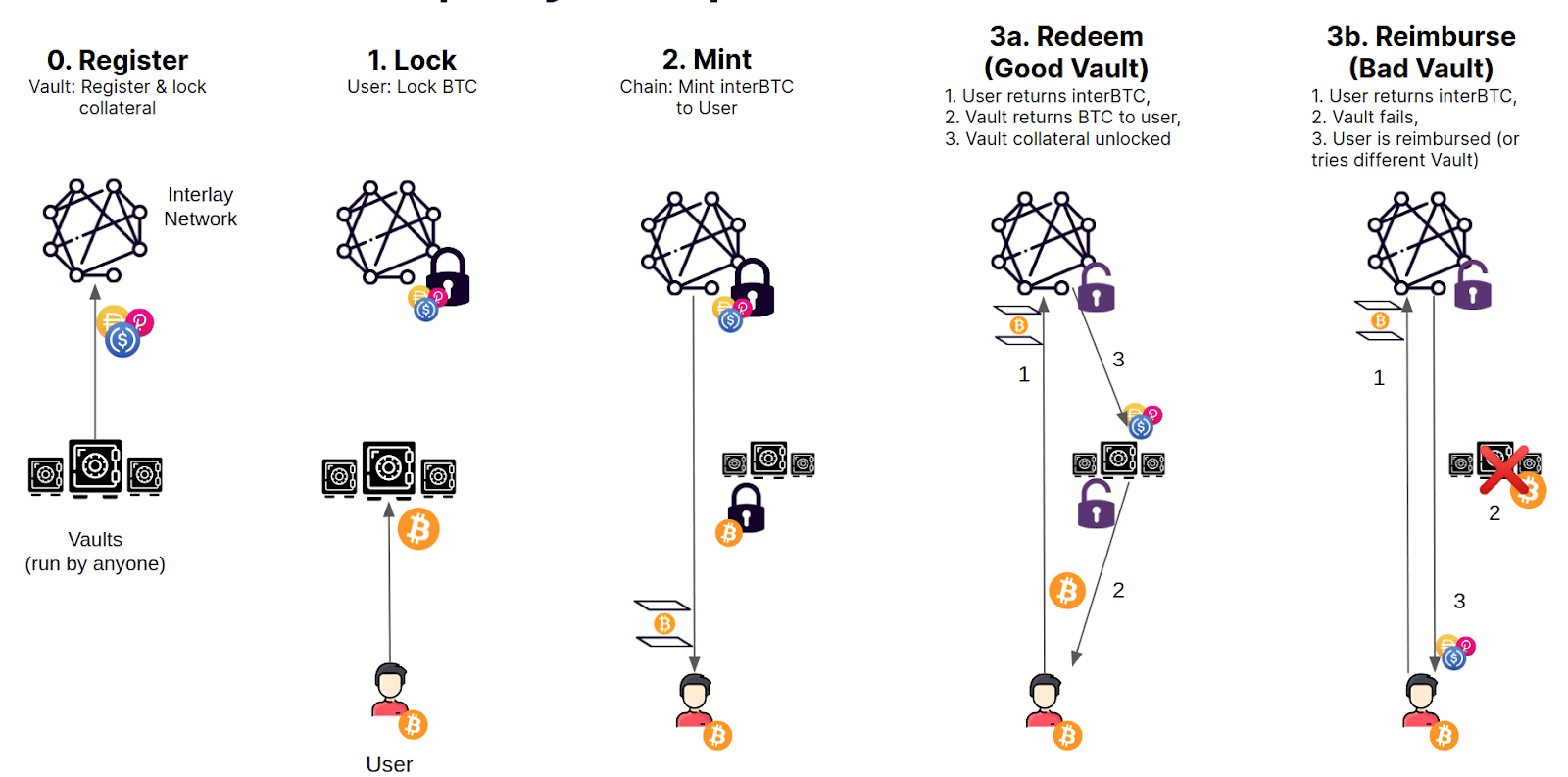

Underpinning this is a network of decentralized vaults, which the company says allows anyone to run and operate their own vault. A user locks bitcoin collateral into a vault, which creates and issues her iBTC to the user.

According to Interplay, iBTC is 1:1 backed and exchangeable with Bitcoin. Additionally, locked BTC is insured and refunded in the event of vault failure.

Interlay co-founder and CEO Dr. Alexei Zamyatin said iBTC brings the trust and security of Bitcoin to a more technologically innovative chain. In other words, it combines the best of both worlds while protecting the trustless nature of Bitcoin.

Bitcoin is the driving force behind global cryptocurrency adoption, and Polkadot, Ethereum, and others are where innovation is happening.

The project says iBTC is different from other cross-chain bridges in that users only need to trust Bitcoin and Polkadot. Moreover, “there is no single point of failure.” There is an automatic refund process for lost BTC from collateral insurance.

Several high-profile hacks, including the Nomad hack that exfiltrated $190 million, and the Ronin hack that earned the attackers $615 million, have put cross-chain bridges in the spotlight.

A recent report from data analytics platform Chainalysis estimated that $2 billion has been lost in cross-chain bridge hacks so far this year. Moreover, this kind of cybercrime now accounts for his 69% of all stolen crypto assets.

Chainalysis researchers say the problem is so prevalent that it poses a significant threat to public trust in blockchain technology.

To address this issue, Chainalysis called for more rigorous code audits and the use of established smart contract code as a template for new projects.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024