No products in the cart.

- Latest

- Trending

ADVERTISEMENT

The NFT boom of 2021 has swept almost every industry, making non-fungible tokens world-famous, and NFTs, once reserved only for a small niche of crypto enthusiasts, are joining the cryptocurrency scene. A legacy brand that has grown to become an eye-catcher. go crazy

Many legacy brands go deep into the ecosystem by issuing their own non-fungibles after purchasing popular NFT collections such as BAYC and Cryptopunks. At the time, with brands like Nike, Adidas, Dolce & Gabbana, and Tiffany frequently appearing in crypto headlines, it was certainly newsworthy that the companies created their own NFTs.

As the weeks went by, a persistent crypto news cycle drowned out stories about NFTs published by these brands, causing NFTs to disappear from the industry’s radar. Many have started to wonder how these NFT collections survived the bear market and how the brand is profiting from sales.

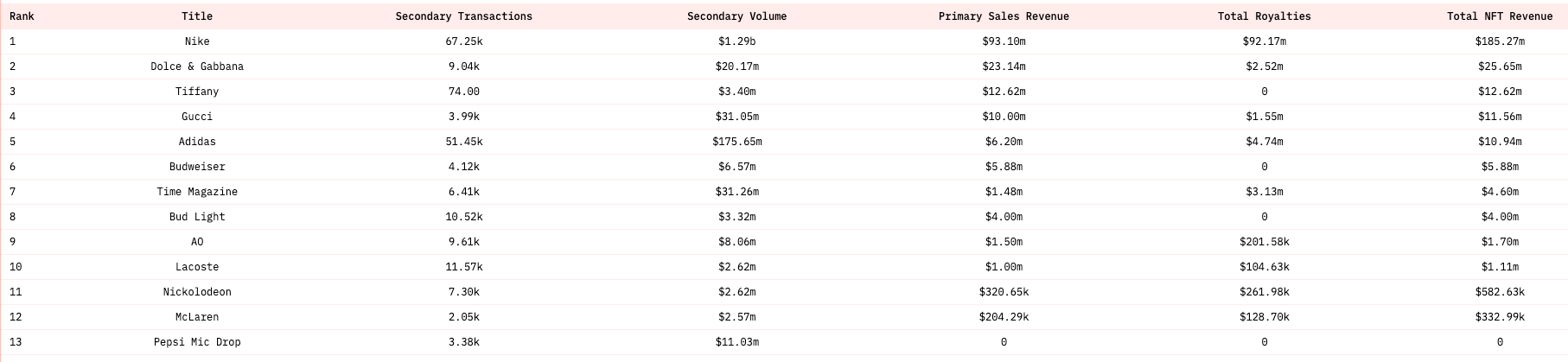

according to data According to Dune Analytics, Nike ranked highest among all brands that have issued NFT collections on Ethereum with total revenue of $185.27 million. Nike got him $93.1 million in primary sales of NFTs, and another $92.17 million in royalties.

The Cryptokicks collection has recorded over 67,250 transactions on the secondary market with a total circulation of $1.29 billion. That’s almost 10 times what his competitor, Adidas, has recorded.

High fashion giant Dolce & Gabbana ranked second with total sales of $25.65 million. Of the $25.65 million, only $2.52 million came from royalties. That’s because the Genesis virtual collection only saw about 9,000 secondary deals.

Tiffany & Co. was the third-largest revenue earner from the NFT collection, earning $12.62 million. However, its collection of 250 NFTiffs received no royalties back as all owners exchanged their tokens for custom cryptopunk pendants.

Following in Dolce & Gabbana’s footsteps was Gucci, with $11.56 million in revenue from NFTs. His NFT collection, in secondary volumes, has grossed him over $31 million.

And while Nike’s main rival, Adidas, made just $10.94 million in revenue, its NFT collection fared significantly better in the secondary market. The “Adidas Originals Into the Metaverse” collection gave the owner exclusive rights to his Adidas merchandise throughout the year, and on the secondary market he generated over 51,000 transactions, generating $175.65 million.

Budweiser, Time Magazine, and Bud Light posted $5.88 million, $4.6 million, and $4 million in total revenue from their NFT collections. Neither Budweiser nor Bud Light profited from the royalties. Australian Open and Lacoste grabbed $1.7 million and $1.11 million from collections.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024