No products in the cart.

- Latest

- Trending

ADVERTISEMENT

One of the most attractive things about Bitcoin for me is the ability to jump on-chain and track different indicators. As the years go by and more samples of how Bitcoin works, these indicators become even stronger.

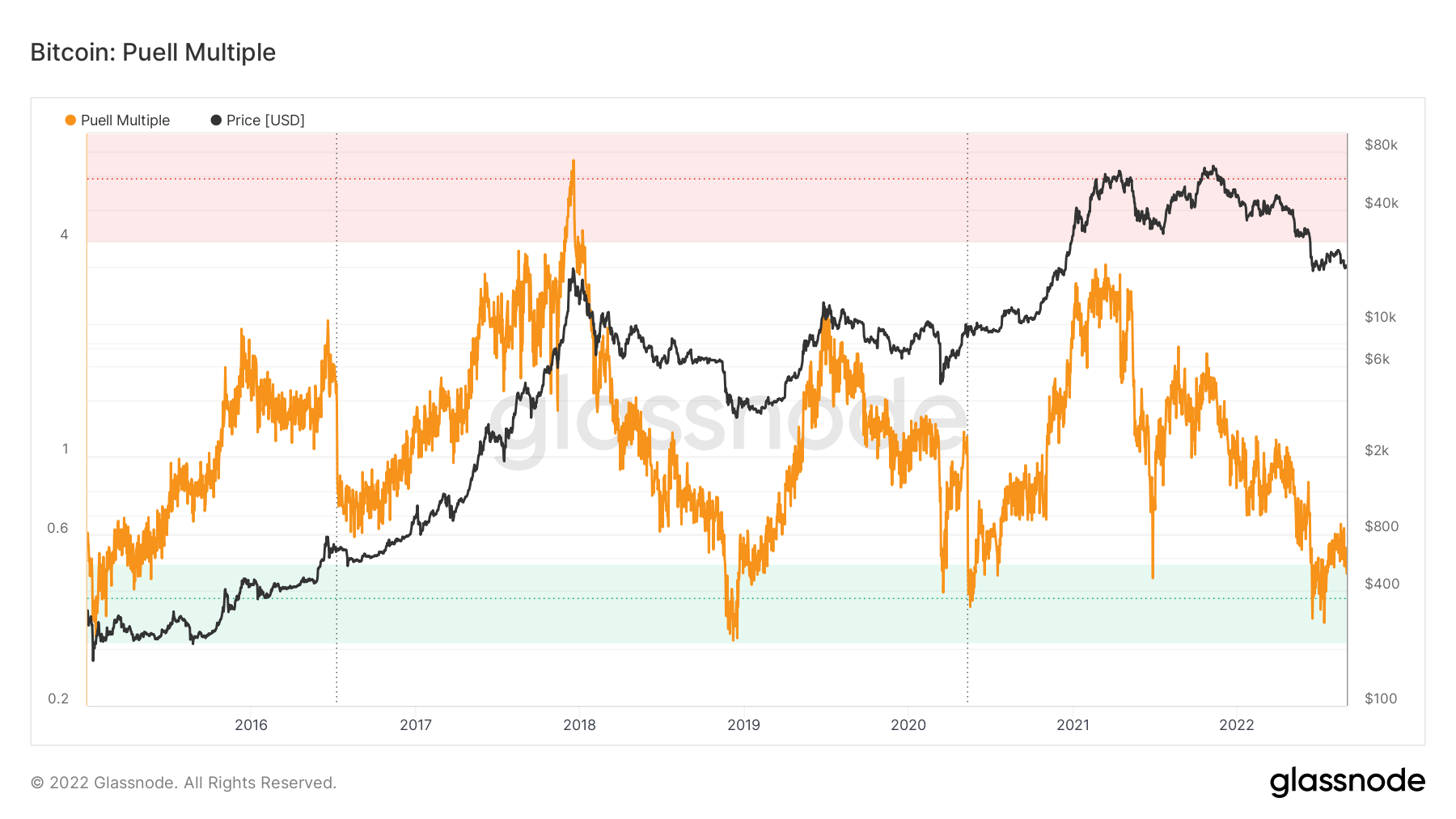

One of my favorite on-chain indicators is the Puell indicator. This takes the total minor earnings and adjusts it by the annual moving average. Therefore, to calculate the indicator, we take the mining profit and divide it by the 365-day simple moving average of mining profit.

Miner behavior often provides unique insights into the market. They are often seen as forced sellers because their earnings are in Bitcoin while their fixed costs (most electricity bills) are fiat currency. Obviously, they need to cover these fixed costs, so Bitcoin issuance from miners is always intrinsically related to price.

The Puell indicator roughly tracks whether the amount of Bitcoin entering the market is too much or too little compared to historical standards. When the Puell indicator enters the green zone of the chart below, the price tends to rise.

The most recent time the Puell indicator fell into the “buy” zone was mid-June. Of course, it fell below $20,000 in the last week or so as comments on the Fed’s interest rate plans and inflation triggered a wave of risk-off sentiment across all asset classes.

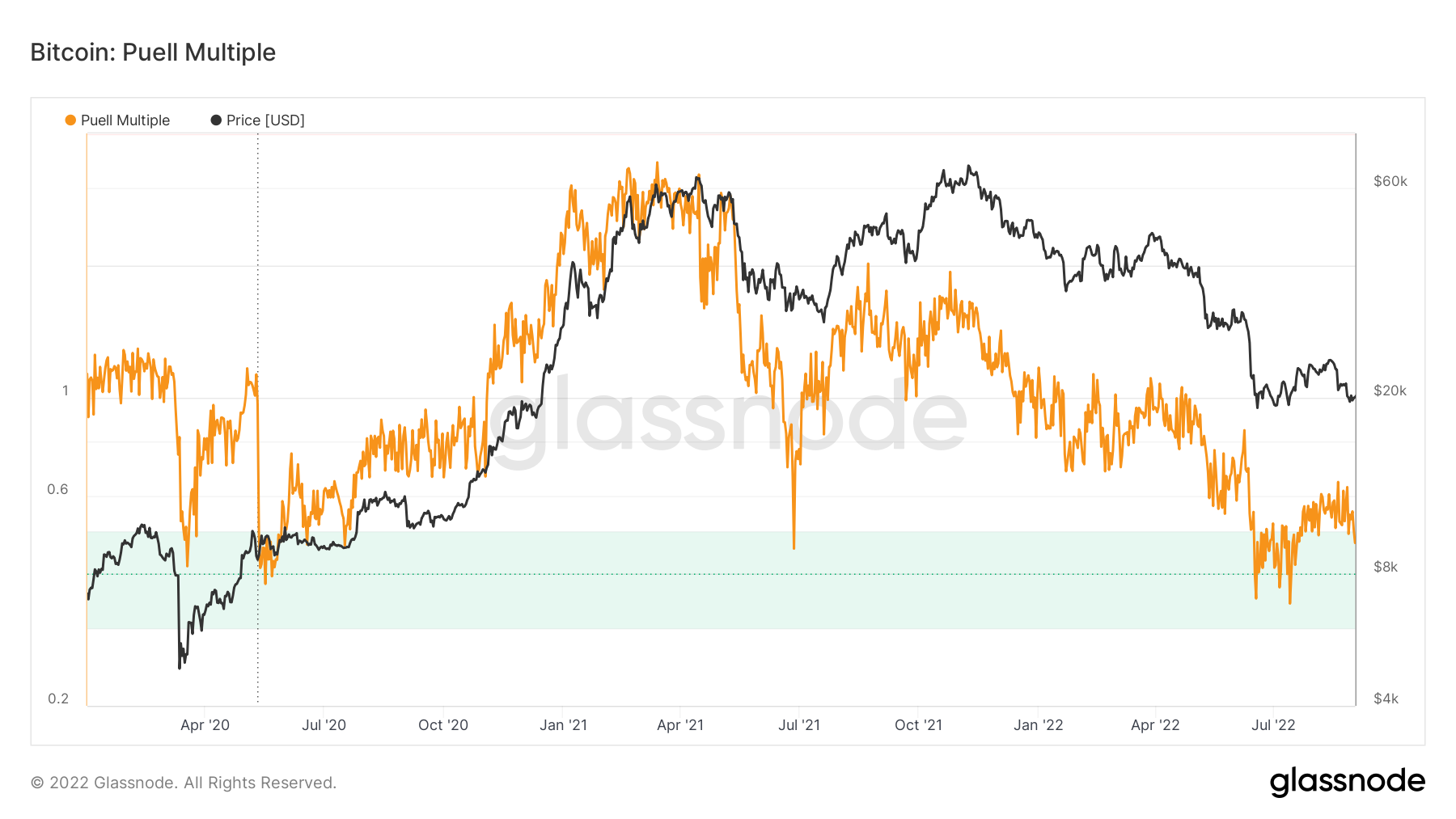

Interestingly, I noticed yesterday that the Puell indicator has returned to the “buy” zone. Expanding the period from early 2020 makes this a little clearer on the chart.

Again, I am always hesitant to use on-chain indicators alone. Nothing is more true than the current climate, which is so mixed.

This is the only time in Bitcoin’s short history that we have seen this macro blend. In fact, Bitcoin he just launched in early 2009, meaning it has existed during a period of sustained upside-only bull market dynamics. Therefore, the historical sample size of its price action is not long enough to draw firm conclusions.

The way I finally see the Puer indicator is that Bitcoin looks poised to go higher If The macro environment cooperates. But that’s a very big if. Macro developments have driven the market throughout the year and will continue to do so.

Bitcoin follows the stock market, which follows news on inflation, interest rates and the geopolitical sector. So while this is a bullish on-chain indicator for Bitcoin, it means nothing until there is further cooperation in the wider world.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024