No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Widely backed crypto analysts could deliver a much-needed blow to decentralized exchange (DEX) protocol SushiSwap (SUSHI) with the entry of a $47 billion asset manager said.

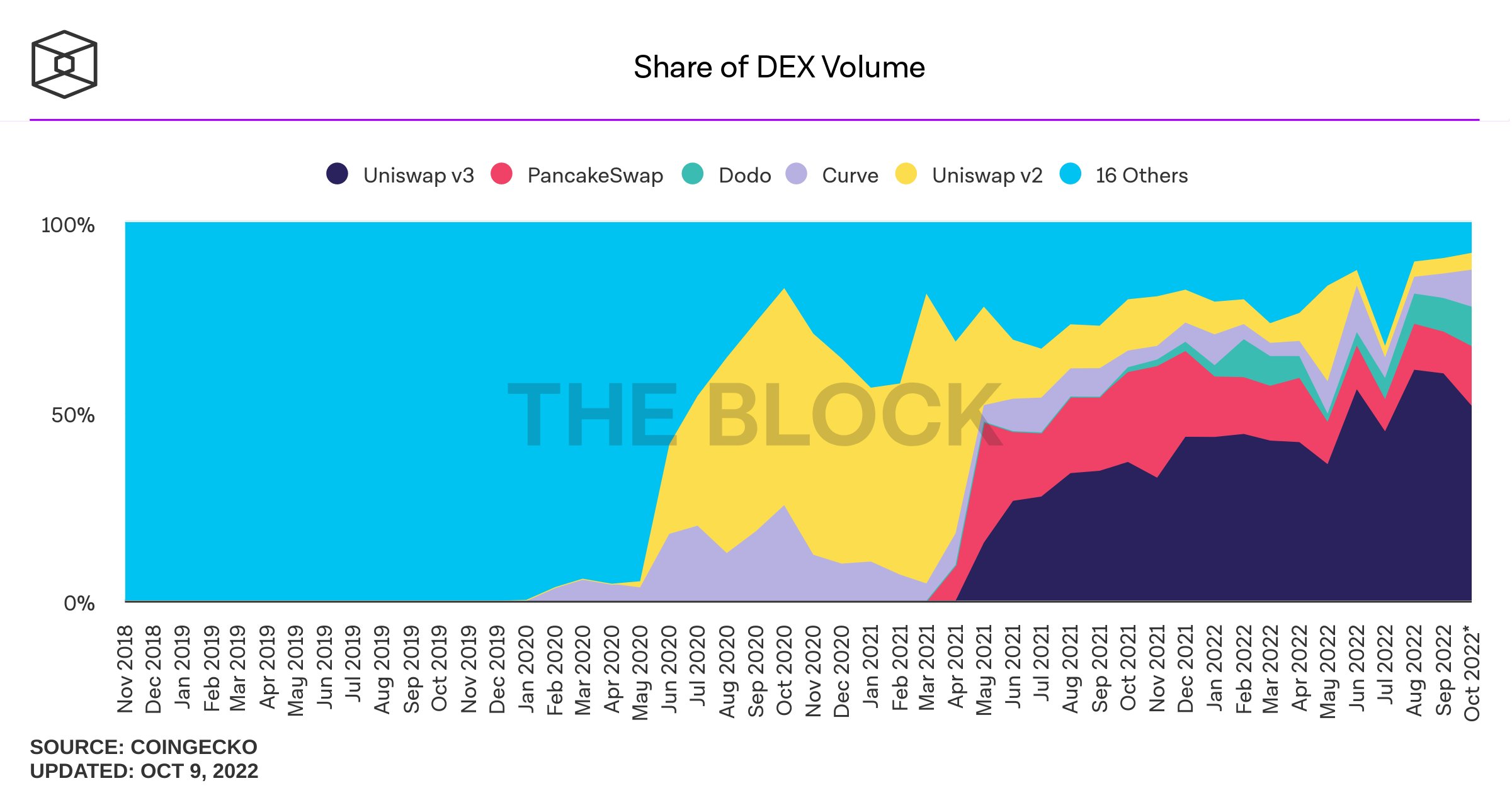

Will Clemente told his 660,800 Twitter followers that one consistent use case for cryptocurrencies is to allow market participants to trade highly illiquid altcoins on decentralized exchanges. I’m here.

Clemente says.

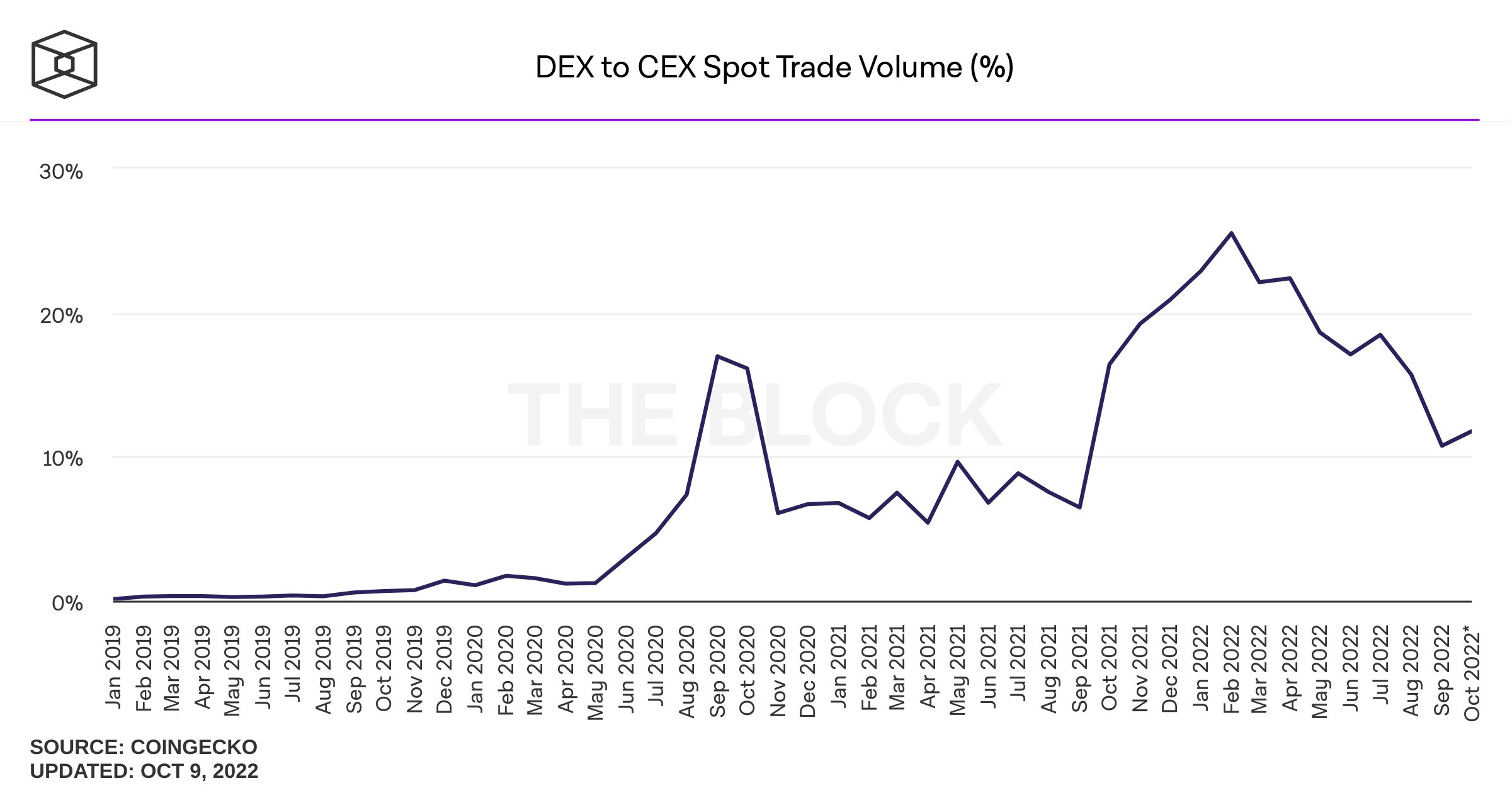

In fact, the ratio of DEX volume to centralized exchange spot volume is higher than it was in the middle of last years bull market. There is clearly an underlying and consistent demand to gamble at crypto casinos.

Despite the increased demand from crypto traders, Clemente emphasized that SushiSwap’s trading volume has dropped significantly this year.

Particularly due to leadership issues, SushiSwap’s trading volume (filtered for wash trades) is down an estimated 89% year-to-date, according to Messari. I am taking it.

But Clemente To tell Things are starting to look for decentralized exchange protocols after SushiSwap hired Jared Gray as head chef. Said He plans to restore sushi to its “rightful place among the industry.”

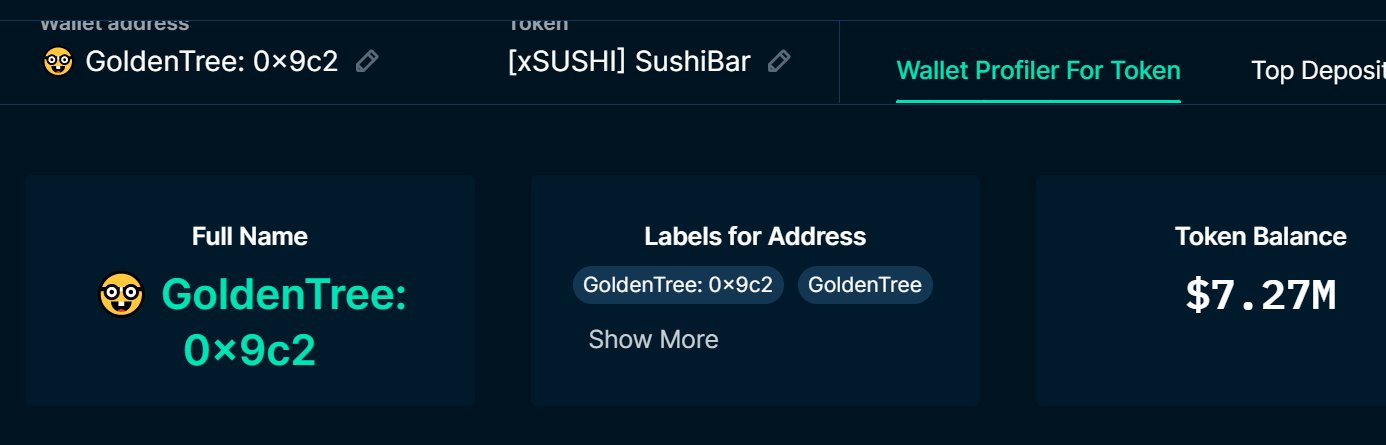

Clemente also stresses that New York-based asset manager Goldentree has a relatively small position in SUSHI.

“Next, [$47 billion] Asset manager GoldenTree has taken a $7.27 million position in Sushi. Post on the Sushi forum to express your commitment by publicly sharing your intent and wallet to make changes to turn the protocol around.

According to Clemente, GoldenTree’s entry and disclosure of its status could change the fortunes of SUSHI.

Aside from the assumption that the brilliant Avi Felman and GoldenTree will do everything in their power to keep their first major cryptocurrency public position intact, I think this presents an interesting asymmetric opportunity for SUSHI.

If GoldenTree adjusts for one positive change, we speculate that the market will bring several more changes. With two changes, the market extrapolates. This could create a recursive effect on the SUSHI turnaround narrative.

Similar to Alameda’s bet on DOGE, I think the asymmetry here is favorable in that Avi, GoldenTree, and the resources behind them are likely to implement at least some positive structural changes. increase.

At the time of writing, SUSHI is trading at $1.27, down over 8% for the day.

Don’t miss a beat subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/arleksey/WindAwake

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024