No products in the cart.

- Latest

- Trending

ADVERTISEMENT

A trading robot with a reputation for outperforming the digital asset market shares its latest portfolio allocation amid the ongoing bear market.

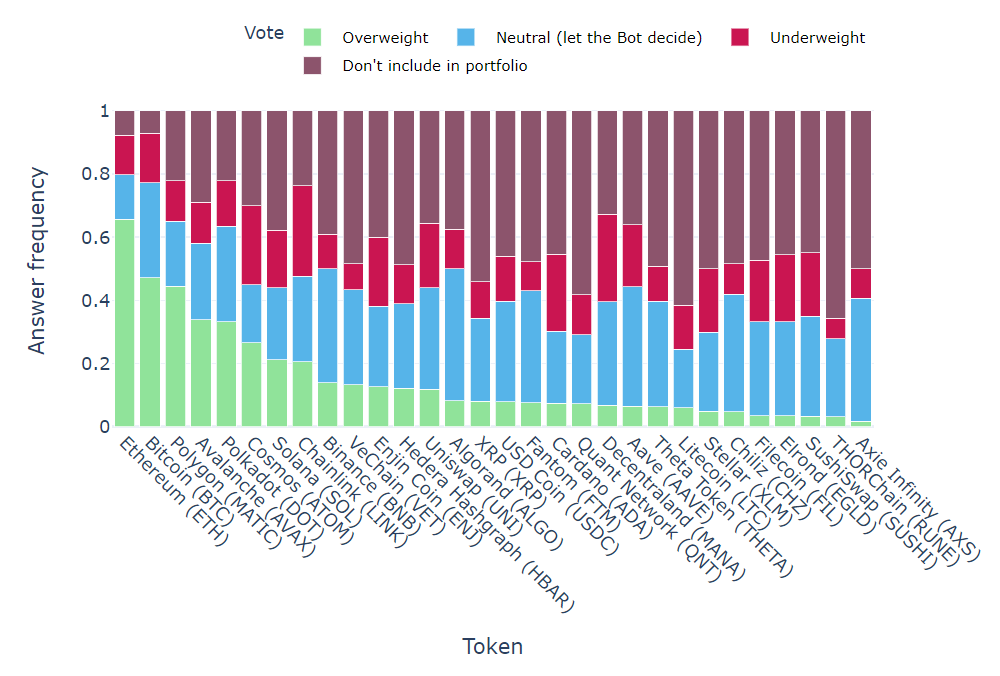

Every week, Real Vision Bot conducts a survey to compile an algorithmic portfolio evaluation that generates a “Hive Mind” consensus.

latest in bots data It became clear that traders strongly prefer Ethereum (ethereum), a majority of market participants voted to overweight their portfolios in ETH. Second place is King Crypto Bitcoin (Bitcoin), followed by a polygon (matic), a leading Layer 2 ecosystem designed to help scale Ethereum.

MATIC is Ethereum rival Avalanche (Avax) and the interoperable blockchain Polkadot (Dot). After these two coins will be Cosmos (atom).

Latest results of free RealVisionExchange crypto survey. Ethereum still leads, but Bitcoin returns to rank 2, followed by MATIC and AVAX. It shows that we are ready to take back.

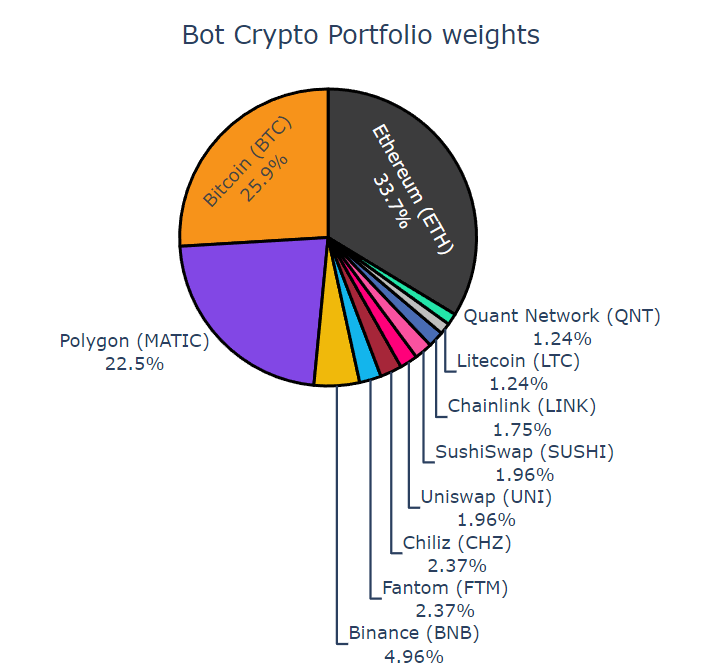

About RealVision Bots pickthe algorithm is weighted in favor of MATIC, indicating a decline in support for stablecoins and a higher risk appetite.

Latest Allocation of Free RealVisionExchange Crypto Portfolios. While the top three havent changed much, survey participants have reduced their cash exposure and are back to being completely risk-on. I will make a small bet.”

Real Vision Bot was co-developed by quantitative analyst Moritz Seibert and statistician Moritz Heiden.

Real Vision founder and macro guru Raoul Pal called The bot’s historical performance is “amazing”. A former Goldman Sachs executive says the bot outperforms an aggregate bucket of the top 20 crypto assets on the market by more than 20%.

Don’t miss the beat apply To get encrypted email alerts delivered directly to your inbox

check price action

Please follow us twitter, Facebook When telegram

surfing The Daily Hodl Mix

Featured Image: Shutterstock/Lotus_studio/monkographic

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024