No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Uphold was founded in 2015. It is a cryptocurrency exchange managed by Uphold Europe Limited and is registered with the Temporary Registration of Crypto Asset Companies of the Financial Conduct Authority. In addition, the issuance of electronic money under the Electronic Money Regulations 2011 is regulated by the Financial Conduct Authority (FCA).

Let’s move away from exchange controls and regulations and delve into how exchanges work and their strengths and weaknesses.

First, Uphold is a very unique trading platform that not only allows users to buy, sell and convert cryptocurrencies, but also trade precious metals, fiat currencies, and US stocks.

Cross-asset trading is also possible. This means that you can trade between any of the assets we offer. For example, you may choose to exchange cryptocurrencies for stocks or fiat currencies for precious metals. Therefore, you do not need a separate account to trade the various trading instruments offered by Uphold.

In addition to trading, Uphold also offers many other financial services. We offer a debit card called Uphold Card that allows you to pay using your crypto assets and in return get rewarded for your spending. You can also pay your friends and family around the world instantly with no fees.

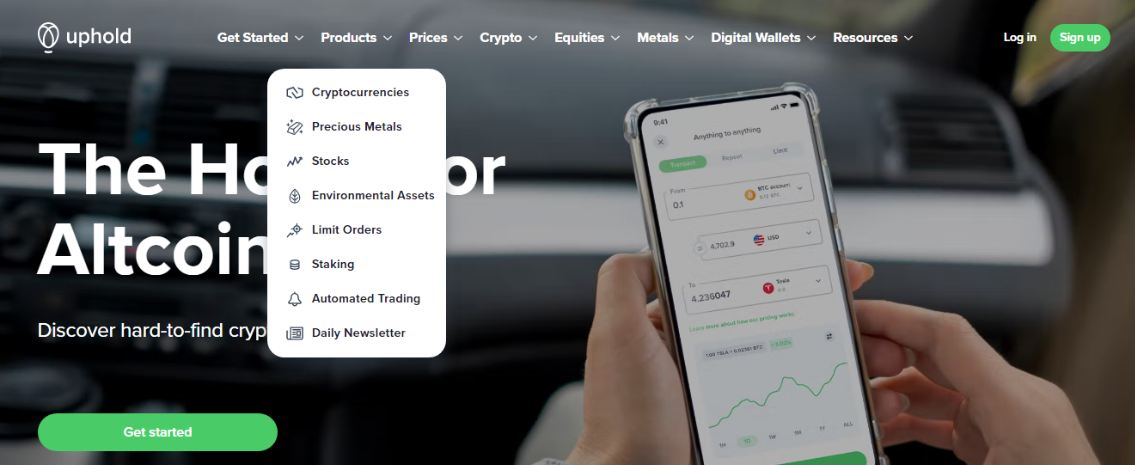

Products offered by Uphold

Products offered by Uphold

Uphold users can also receive payments from their employer in any currency they choose, including currency combinations. You can also withdraw funds directly to your bank account or crypto wallet. Bank withdrawals are possible in over 30 countries.

to the uphold Staking program This allows you to stake your crypto assets and earn staking rewards in return.

Also, automatic trading is possible. This means you can schedule your regular trades using AutoPilot. This allows you to set regular buy or sell orders to reduce the impact of price fluctuations.

Uphold offers 0% transaction fees, but charges a spread fee for buying and selling cryptocurrencies. For popular cryptocurrencies such as Bitcoin and Ethereum, fees can be as high as 1.2%. Spread fees can increase as market volatility increases.

The spread commission for other financial assets is fixed. Spread commission is 0.2% for fiat currencies, 1% for US equities and 3% for metals.

On the bright side, Uphold does not charge deposit or withdrawal fees.

1. Zero deposit and withdrawal fees.

2Uphold allows you to withdraw directly from your bank.

3It offers a debit card that allows users to directly pay for services using assets held in Uphold, earning rewards for their spending in return.

FourIt allows users to link any Bitcoin, Bitcoin Cash, XRP Ledger, Ethereum and Litecoin wallets.

FiveCross-asset trading is possible. A very unique one among crypto exchanges.

6This enables staking of cryptocurrencies, providing users with the opportunity to earn a partial income from their cryptocurrency holdings.

1One of the major drawbacks of using Uphold is the variable spread commission for buying and selling cryptocurrencies which is subject to market volatility. People who buy and sell popular cryptocurrencies pay the most.

2Uphold offers only one order type, Limit Orders. If you are looking for additional or more advanced order types like market orders, we recommend looking elsewhere.

3Uphold is not specifically optimized for cryptocurrency trading and investing, and lacks key cryptocurrency features such as NFTs.

FourThe number of cryptocurrencies offered by Uphold is limited compared to other cryptocurrency exchanges.

Five. U.S. stock and precious metals trading, as well as uphold cards and automated trading are not available in some regions.

Uphold is a great choice if you are looking for a platform that allows you to trade various assets. Uphold lets you trade cryptocurrencies, fiat currencies, US stocks, and precious metals.

The user interface is also easy to use, making it easy to start trading on the platform regardless of your experience level.

Uphold also allows you to trade between the various assets they offer. Trade fiat to crypto, fiat to US stocks, and more. This feature sets Uphold apart from its competitors.

You can also set up automated trading for regular buys and sells to reduce the impact of market volatility.

Uphold is an excellent platform for users looking to trade not only cryptocurrencies, but also other financial instruments such as precious metals and US stocks.

However, since the platform only allows limit orders, users have to deal with some limitations, such as the lack of more advanced order types. Its FCA compliance is also very strict and many accounts have caused him to be locked out.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024