No products in the cart.

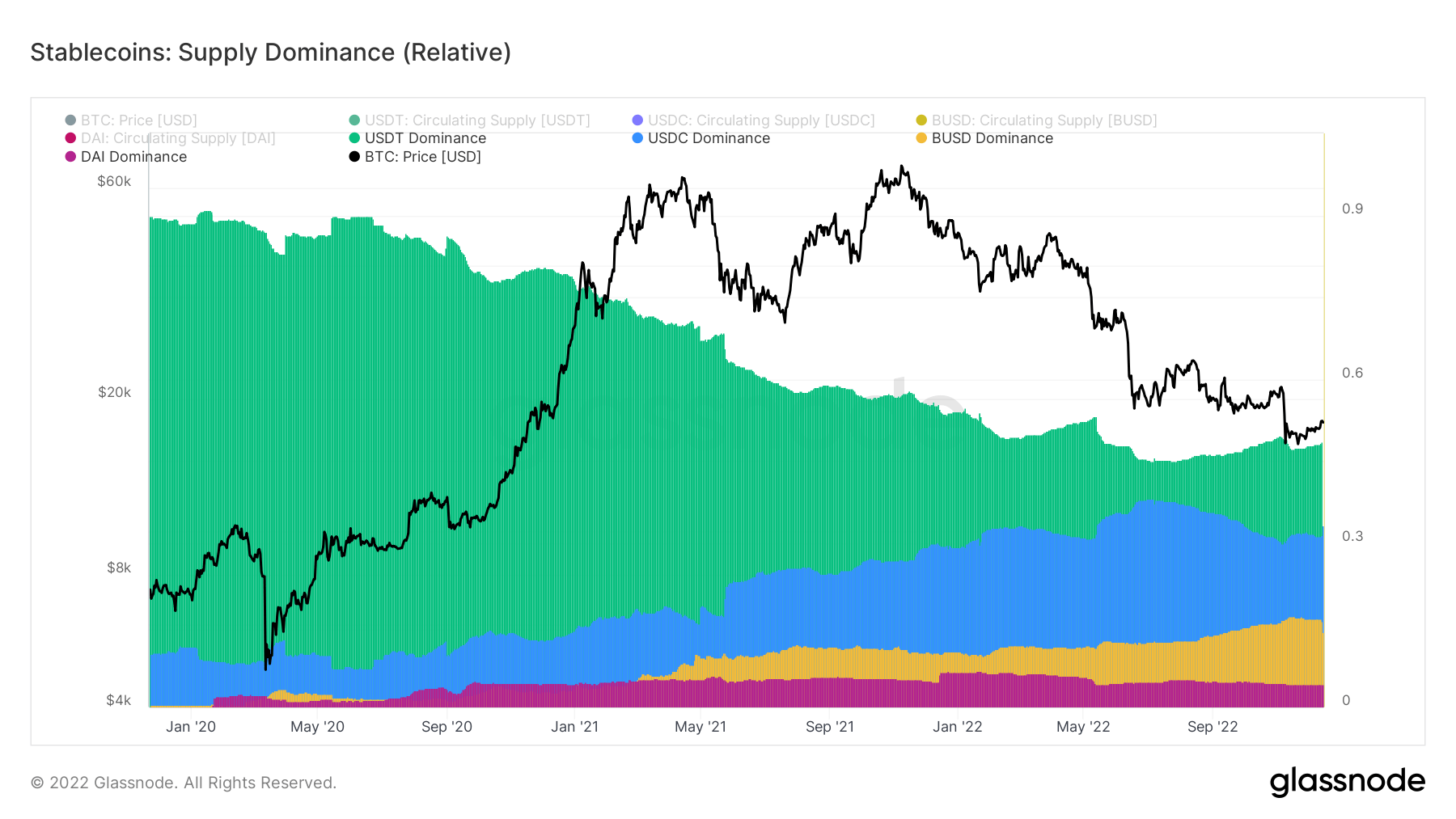

According to on-chain data provided by Glassnode, Tether (USDT) dominated 89% of stablecoins globally in 2019 before dropping to just under 50%. crypto slate.

In 2020-2021, other stablecoins such as USD Coin (USDC) and Binance USD (BUSD) started to rise, with USDC reaching 33% dominance and BUSD reaching 16% dominance. did. DAI, on the other hand, remained constant.

signs of recovery

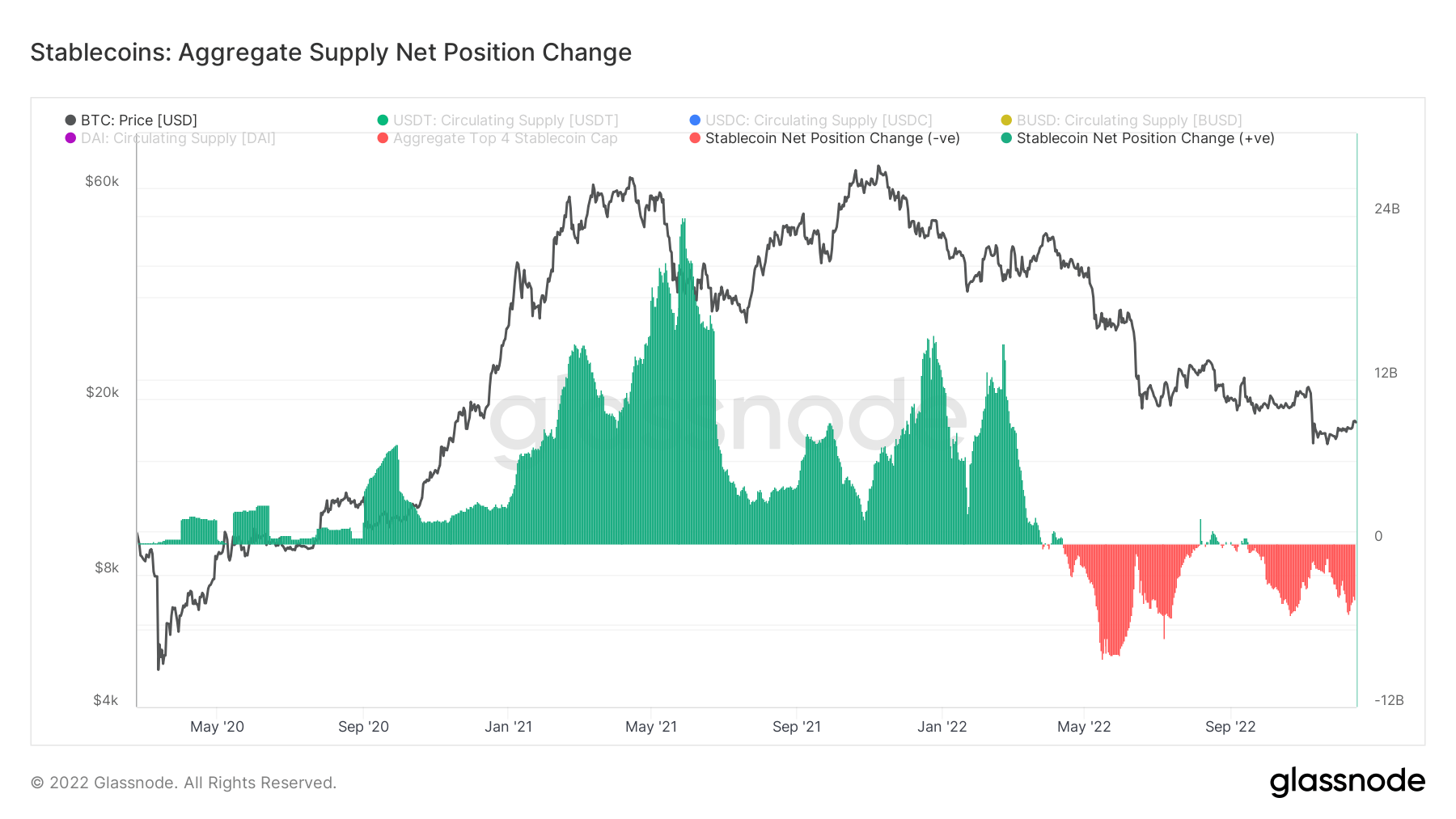

In May, USDT recorded $20 billion in redemptions, but has since started to recover. Stablecoin growth has slowed, with daily inflows reaching his $24 billion. Outflows have also increased, but peaked at just $8 billion, indicating that most of the capital remains in stablecoins.

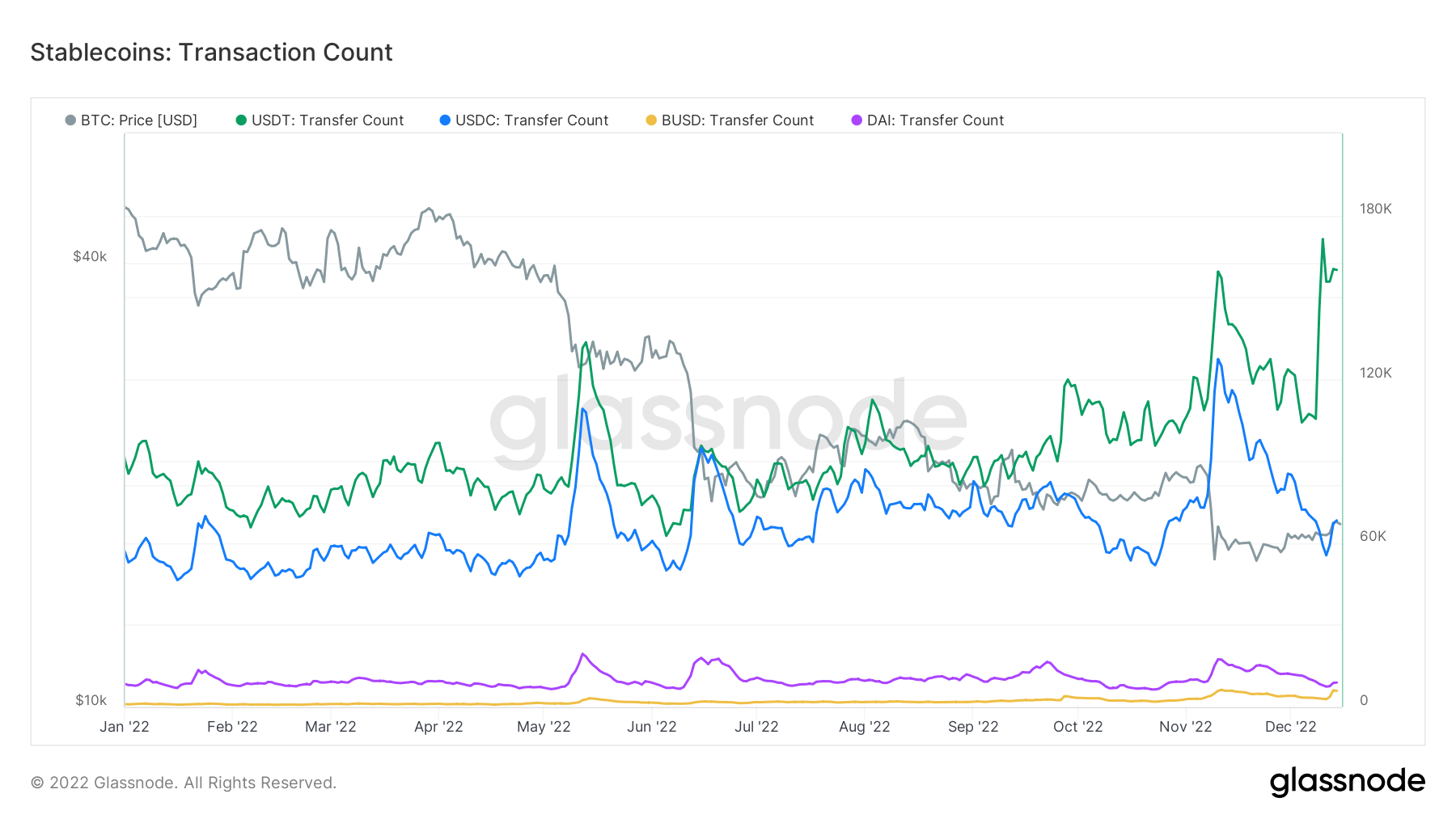

USDT is the only stablecoin that has posted higher highs in daily trading and is still in strong demand.

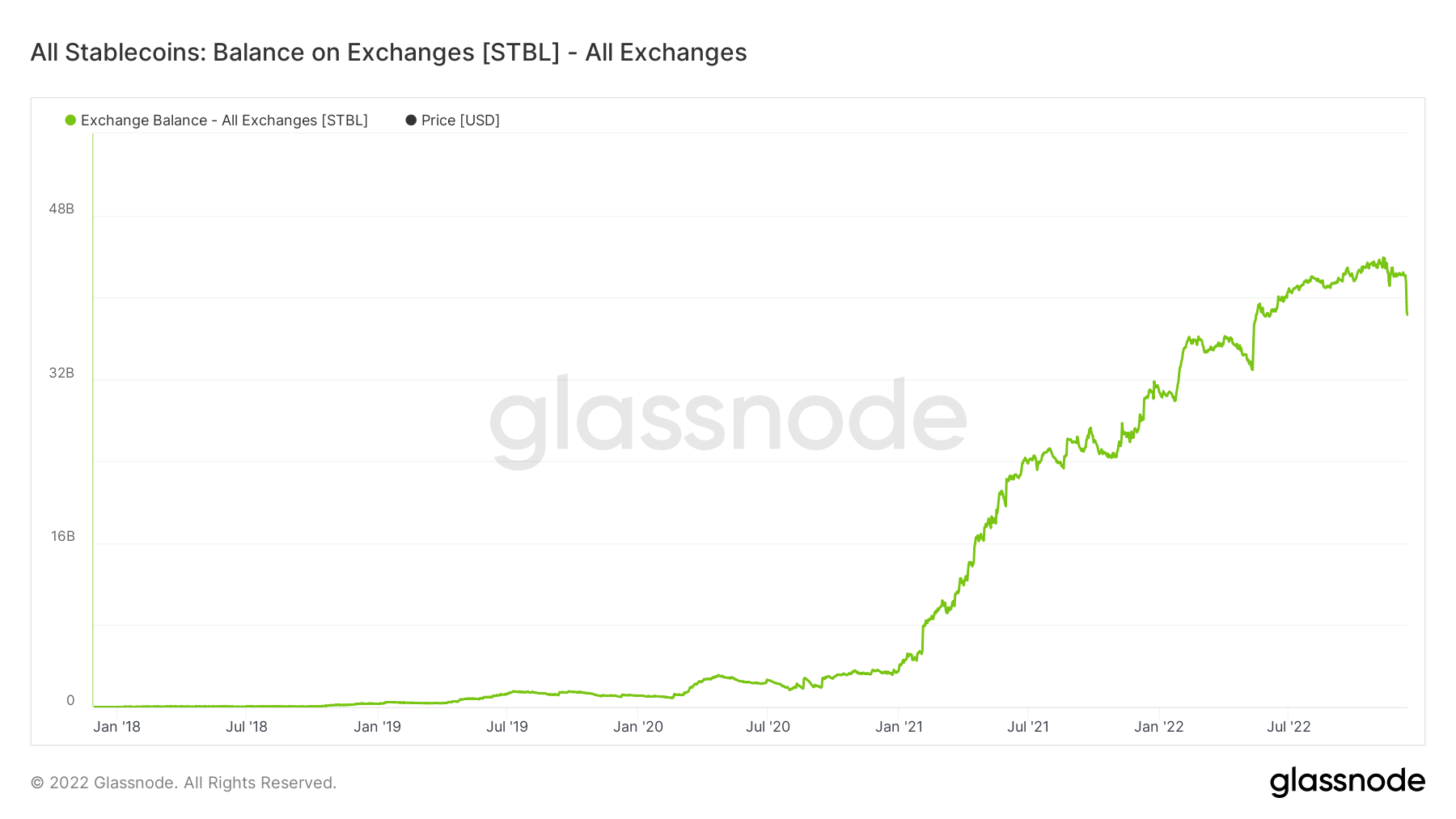

Total stablecoins on exchanges

There are about $40 billion worth of stablecoins on the exchange, with a total of $4 billion liquidated this week alone. This indicates that investors still believe in stablecoins and are likely waiting for the next bull market or plunge.

Analyzing the STBL crypto-asset Glassnode data, which aggregates data for all ERC20 stablecoins, we find that stablecoin growth was significant through March, with daily redemptions peaking at $24 billion.

From risk-on to risk-off

The risk-off environment has shifted from stablecoin inflows to outflows this year, although outflows have been relatively small, reaching up to $8 billion. Despite this, most of the capital remains a stablecoin.

USDC rose 10% over the same period and then rose to 33%. It peaked at 38% in June, leading to speculation about a possible USDT reversal.

BUSD, on the other hand, did not gain much traction until the second half, with a 10% lead. Since then, it has grown to a 16% dominance, gaining momentum, especially since his FTX demise.