No products in the cart.

- Latest

- Trending

ADVERTISEMENT

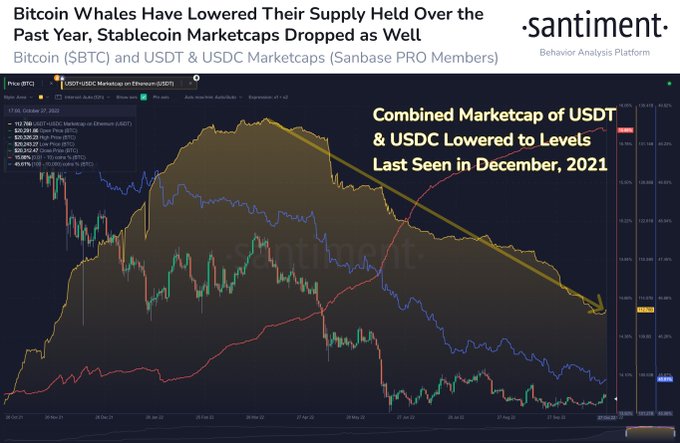

Santiment, an analytics platform, uses the well-funded Bitcoin (Bitcoin) investors withheld funds following the sale of cryptocurrencies.

santimento To tell Crypto whales may have invested in government debt in the US and other countries as a result of rate hikes by the Federal Reserve and a bleak economic outlook.

What gave traders hope was the fact that the massive market capitalization of stablecoins was growing until May of this year.

But when the Federal Open Market Committee (FOMC) rate hikes and recession fears really start to dominate investors’ speculative decisions, big holders are putting aside such massive dollar-pegged cryptos. Justifying it has become much more difficult.

What is very likely is that these large institutions and whales are instead holding their money in US and global government bonds. Cryptocurrencies are too unattractive for them (for now) with so much uncertainty going on through 2022.

According to Santiment, the total market capitalization of the stablecoin Tether (USDT) and the yen-backed USD coin (USDC) have fell Lowest price in 10 months.

For Bitcoin bulls, the analytics platform says BTC will likely rise in value as the market capitalization of the largest stablecoins begins to swell.

Bulls will want to wait and see if the market capitalization of the largest stablecoins starts to rise again.

If so, even if Bitcoin and Ethereum whale supplies remain low, Bitcoin and cryptocurrency prices could justify a rise.

Bitcoin is trading at $20,616 at the time of writing.

Don’t miss the beat apply To get encrypted email alerts delivered directly to your inbox

check price action

Please follow us twitter, Facebook When telegram

surfing The Daily Hodl Mix

Featured Image: Shutterstock/GelgelNasution

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024