No products in the cart.

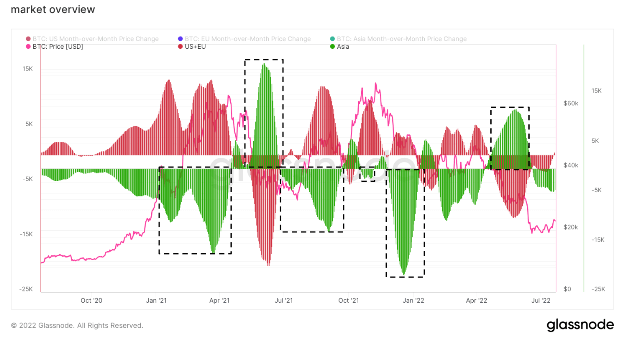

To get a solid understanding of the global market, we need to zoom out the daily and weekly closing prices. One metric that provides a good outlook for the overall health of the market is monthly (MoM) price changes. This metric shows a 30-day change in regional prices set during working hours in the US, EU, and Asia. Prices in these regions are typically determined by calculating the cumulative sum of price fluctuations in each region over a 30-day period.

Analyzing the changes in Bitcoin’s MoM price from October 2021 to July 2022 reveals some interesting trends.

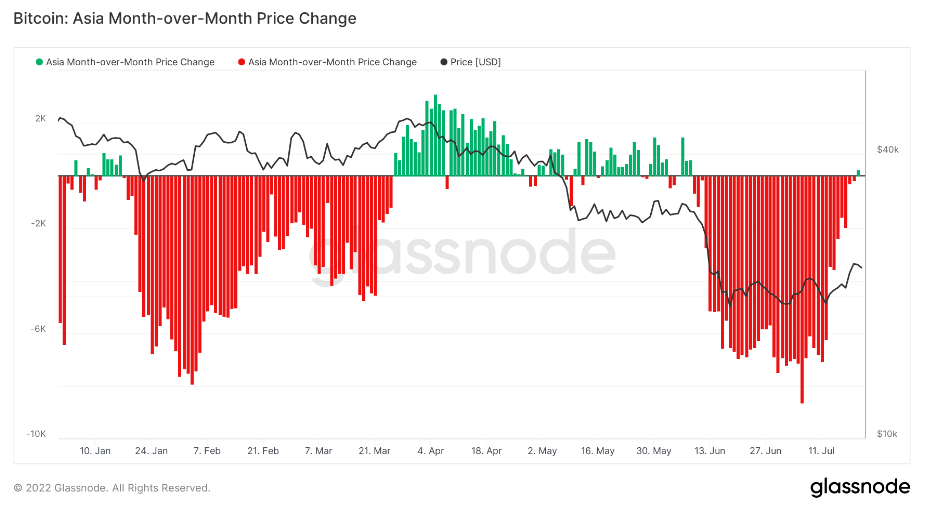

At the beginning of May 2022, a trend towards the region’s increasingly bullish sentiment towards Bitcoin began in Asia. The trend highlighted by the black squares in the graph above shows that Asian investors are making the most profits in the crypto industry.

The graph above clearly shows that Asian investors have dominated the crypto market over the last two years and that most of the smart money in the market appears to come from the Far East. Asian investors were able to sell the top in early 2021, then the summer bottom in 2021 and sell the first pump in the summer lows.

When Bitcoin fell to $ 40,000 at the end of last summer, Asian investors first bought and sold the dip in November 2021 when Bitcoin regained its all-time high.

In May 2022, Asian trading volume was the highest since last summer when the region was taking advantage of low prices at the expense of mass sales in the US and EU. The collapse of Luna and the ensuing bankruptcy of some of the industry’s largest players like Three Arrows Capital and Voyager have made Europeans and Americans more afraid of the crypto market than ever before. The surrender of miners and the broader macroeconomic outlook could not improve the situation.

However, the Asian-led story seems to be changing rapidly.

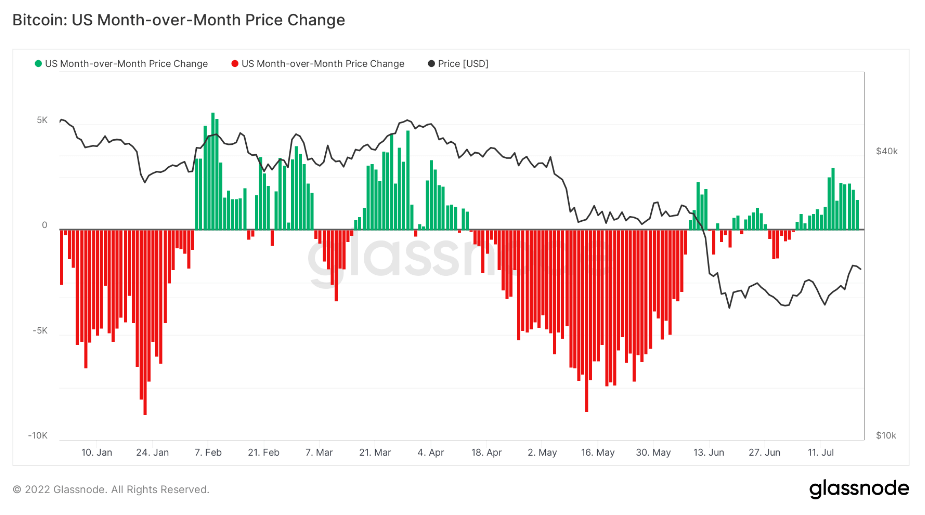

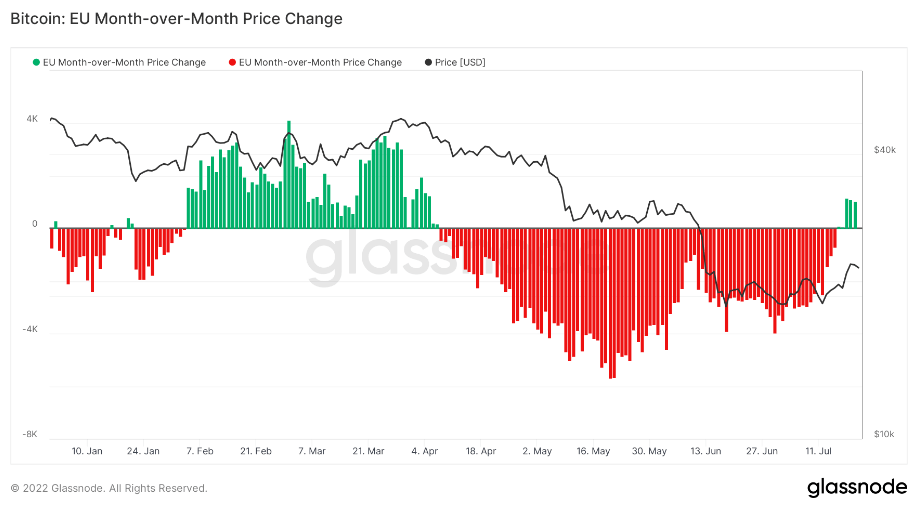

According to data from July 2022, accumulation is progressing outside of Asia, and the US and EU markets have begun to accumulate collectively for the first time since early April. This may indicate that the West is beginning to see Bitcoin as a valuable asset in times of macro and geopolitical uncertainty.

Posted in: Research, Transactions