No products in the cart.

- Latest

- Trending

ADVERTISEMENT

The biggest news in the Cryptoverse on November 9th includes Binance’s decision not to go forward with the potential acquisition of FTX. Bitcoin has returned to $15,000 levels, with multiple stablecoins breaking below $1.

Binance revealed its intention to buy FTX on Nov. 8, but noted that it needs to perform due diligence before doing so. On November 9th, Binance announced that it had decided not to proceed with the acquisition.

According to the exchange, Binance changed its mind after a US agency launched an investigation into FTX.

As a result of our corporate due diligence and recent news reports regarding the mishandling of client funds and alleged investigations by US government agencies, we have decided not to pursue any potential acquisitions. https://t.co/FQ3MIG381f.

Binance (@binance) November 9, 2022

The market has seen $861 million in cryptocurrency liquidations in the last 24 hours. Of this, $259 million consisted of Bitcoin (BTC) shorts, which helped bring Bitcoin to $17,000.

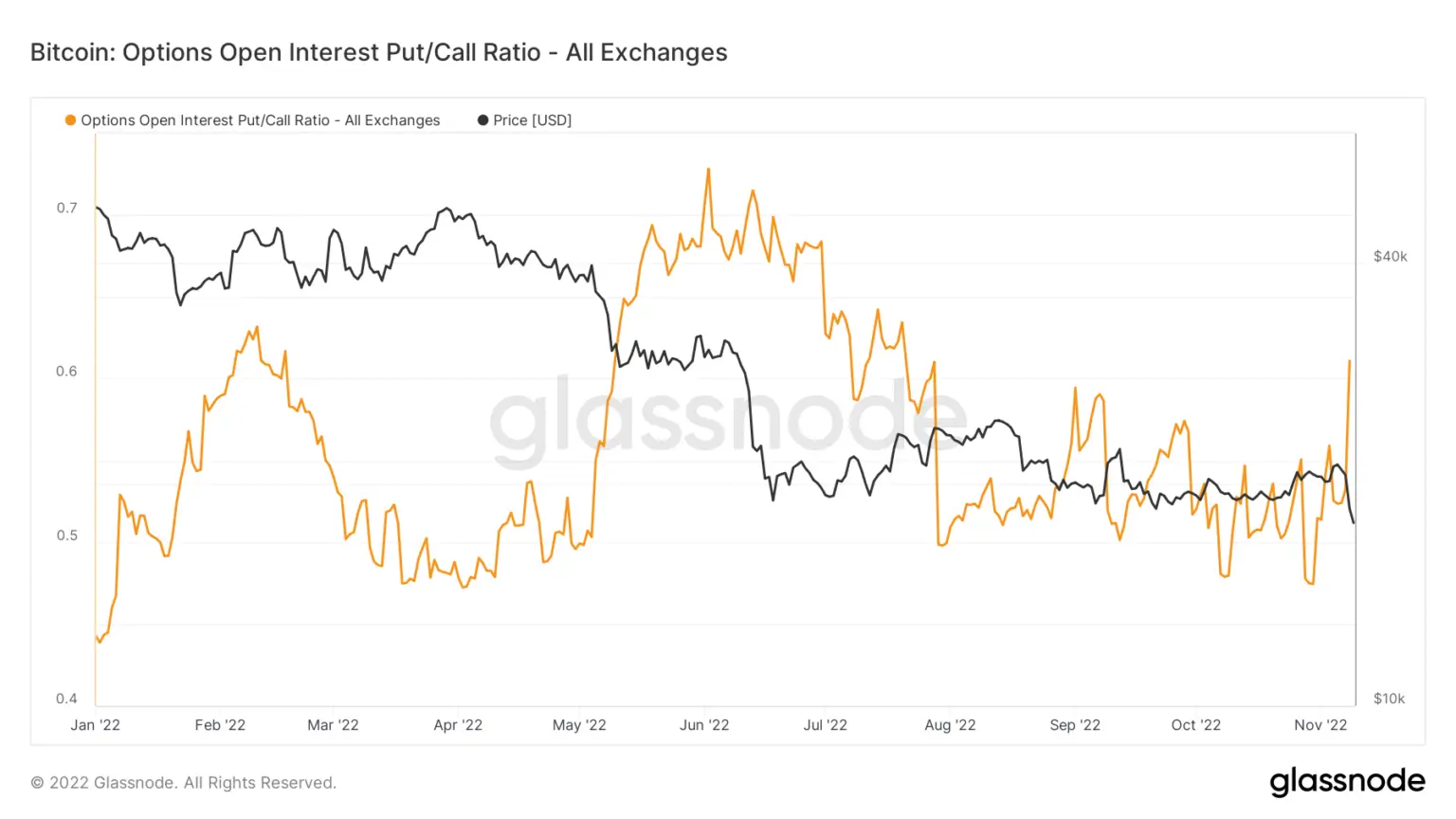

Looking at the options open interest put/call ratio (OIPCR), investors are leaning to buy, which suggests bearish market sentiment.

OIPCR is calculated by dividing the total number of put positions on a given day by the total number of call positions. Since the FTX crisis began to unfold, it hasn’t yet looked as extreme as it did during the Luna collapse, but it has skyrocketed.

After the market collapse caused by the FTX crisis, Binance CEO Changpeng Zhao said the exchange should share Merkle-tree-reserves to prove it is not insolvent.

All crypto exchanges must be Merkle Tree Proof of Reserve.

Banks operate on partial reserves.

Crypto exchanges should not.@Binance Proof of reservation will start immediately. Full transparency.CZ Binance (@cz_binance) November 8, 2022

Following Zhao’s lead, several major exchanges including OKX, Huobi and Kucoin have said they intend to open up their funding reserves to address current contagion fears in the market. .

Gate.io became the first exchange to publish the Merkle Tree Proof of Reserve.

Part of FTX, Solana (SOL) has taken part in the recent FTX crisis, losing 51% of its value since the beginning of the week. But it may not have found its downfall.

Solana’s staking lock-in period in the current epoch will end in less than 24 hours, unlocking approximately 18 million SOL tokens. Investors may let go of their positions, triggering a “second wave of selling”.

Binance’s CZ has commented on the exchange’s intention to buy FTX, saying it’s not a particularly favorable situation for the cryptocurrency community and therefore not a “win” for Binance.

he said:

“Don’t look at it as ‘our win’. User confidence is greatly shaken. Regulators will scrutinize exchanges further. It will be difficult to get a license all over the world.

Stablecoins fell below $1 due to market turmoil. Tether (USDT), USD Coin (USDC), Dai (DAI), and Binance USD (BUSD) all dropped to around $0.998.

It doesn’t look like the drop will lead to a spiral like Luna’s, but it does indicate that the emotions are quite frightening.

FTX founder Sam Bankman-Fried’s venture capital firm, Alameda Research, has taken a fair share of FTX’s tremors. Alameda’s official website is inaccessible as of November 9, along with his website at FTX Ventures.

Cryptocurrency reporter Wu Blockchain has called on Circle and Tether to disclose their financial ties to Alameda and FTX.

Tether CTO Paolo Ardoino quoted this tweet, saying that Tether has zero exposure to FTX or Alameda. Meanwhile, Circle CEO Jeremy Allaire published a thread assuring the community that Circle is safe. He said:

Circle has never loaned to FTX or Alameda, has never received FTT as collateral, and has never held or traded in FTT. not.

Coinbase CEO Brian Armstrong posted a thread on Twitter to join Tether and Circle, stating that Coinbase has no material exposure to FTX, FTT, or Alameda.

1/ First of all, I have a lot of sympathy for everyone involved in the current situation with FTX.

Brian Armstrong (@brian_armstrong) November 8, 2022

He called the current situation “a result of unsafe business practices” and shared his sympathy for those affected by the current crisis.

Galaxy Digital’s Q3 2022 report shows the company has around $76.8 million in exposure to FTX. The company said $47.5 million of its $76.8 million is currently “in the process of exiting.” Galaxy Digital has not disclosed any information about his remaining $29.3 million.

The Ontario Teachers’ Pension Plan, Canada’s third largest pension fund, joined FTX’s $400 million Series C funding round in January, along with organizations such as SoftBank, Lightspeed Venture Partners and Paradigm.

A spokesperson for the fund revealed that the organization had invested $200 million in FTX, adding that it had no further comment at this time “given the fluidity of the situation.”

Wintermute CEO Evgeny Gaevoy has shouted out to Three Arrows Capital founder Su Zhu, saying he shouldn’t try to use the current market crisis to clear his name.

Man really doesn’t automatically start Ark of Redemption because SBF is a bigger villain than you.wiped clean https://t.co/7AuvsPstp6

Hopeful Cynic (@EvgenyGaevoy) November 9, 2022

Gaevoy said these in response to Zhu’s tweet on November 9th. Zhu said part of him wants to “rebuild with a new purpose.” In addition to Gaevoy, a large portion of the community also reacted very negatively to Zhu’s tweet.

Volume founder Tariq Lewis, designer of the Paloma protocol, spoke to CryptoSlate about Paloma’s vision.

Paloma is a Cosmos (ATOM) based SDK blockchain focused on increasing transaction volume across all blockchains. The company believes in a multi-chain future and aims to enhance it by increasing the transaction volume shared between chains.

Paloma can collect and verify all kinds of data from one blockchain and share them with another. This allows a chain to monitor another blockchain without dedicating a set of validators while increasing shared security.

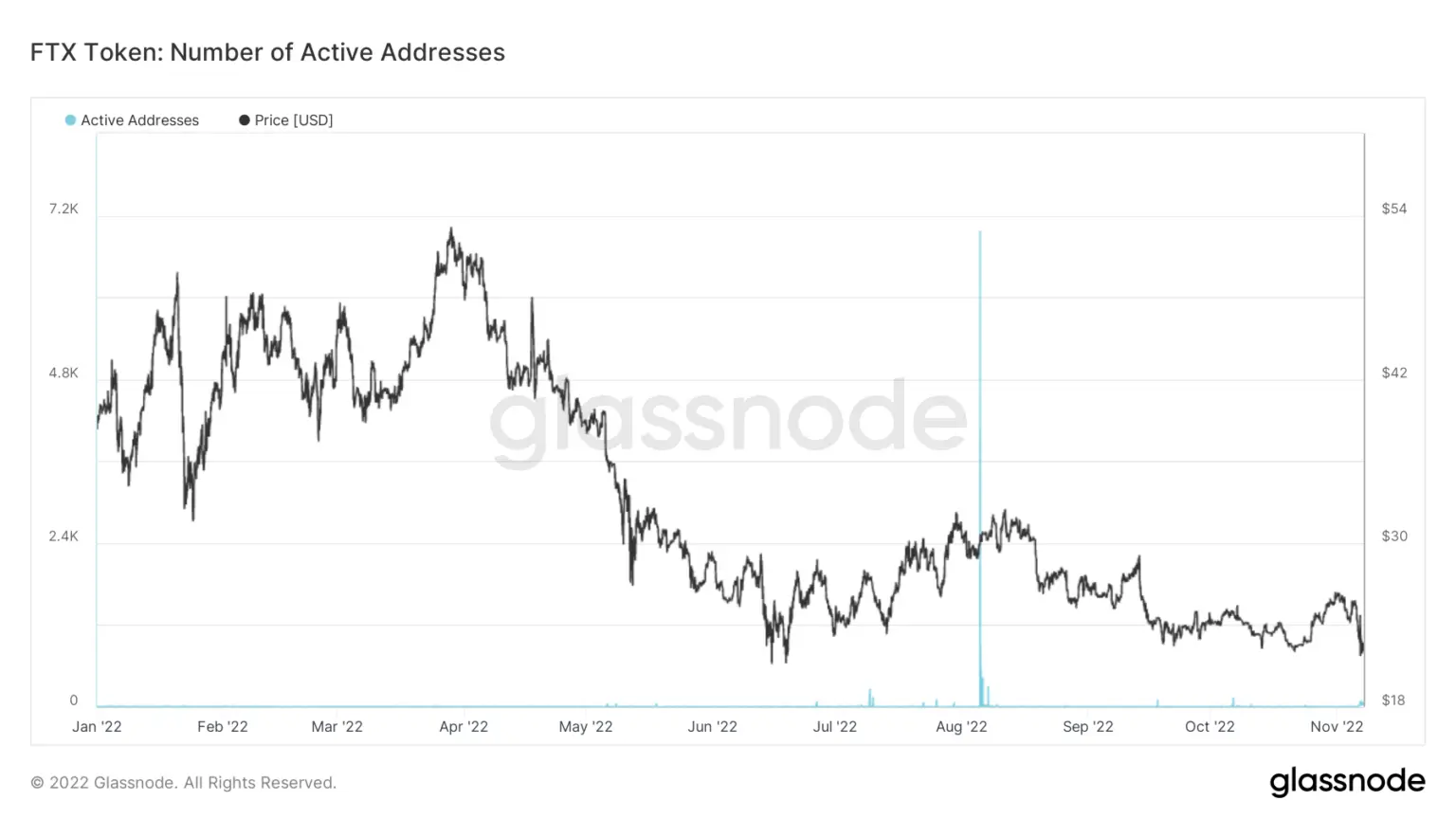

According to data analyzed by CryptoSlate analysts, the number of active addresses holding FTX tokens (FTT) has been close to zero since the beginning of the year. Long before the FTX crisis began, FTT holders seemed to be inactive on-chain.

FTT holders may use FTX custodial wallets instead of cold wallets, as most transactions on exchanges are done off-chain and FTT is FTX’s native token.

Now, the Terra-Luna crash in May was far worse than the current FTT crisis. That said, it’s worth mentioning that we’re only days away from FTX’s demise, and its true extent may yet to be revealed.

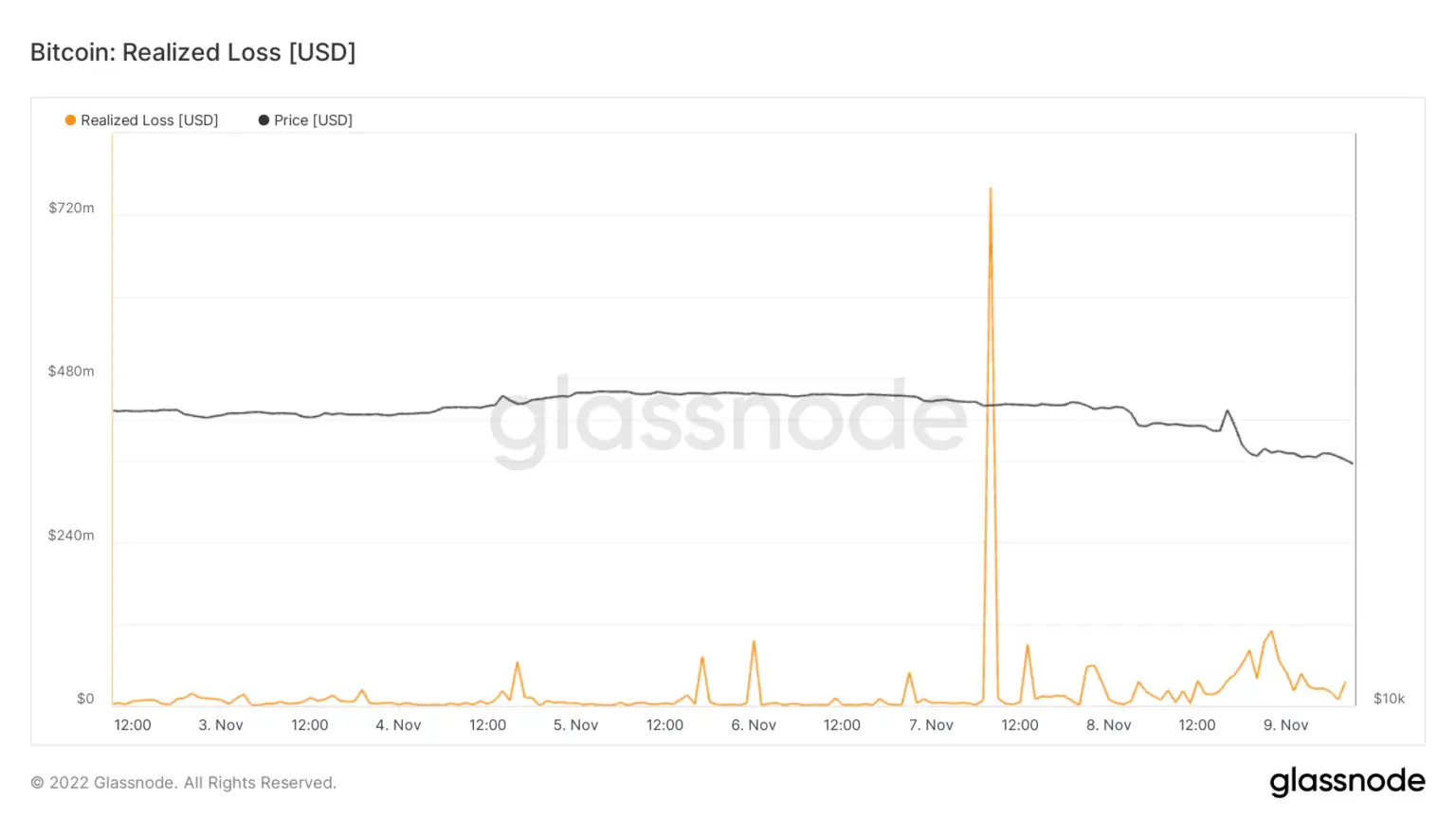

Analysts at CryptoSlate have looked at Bitcoin’s realized loss indicator and found that it indicates serious tensions in the market.

The metric shows several spikes in realized losses in the $50 million to $100 million range between November 4th and November 6th.

The same indicators showed billions worth of realized losses during the Luna collapse. However, the full impact of Luna’s collapse was visible only after the ripple effect it started was fully magnified. So it might be too early to say it was much more serious than the FTX crisis.

Lucas Nuzzi, head of research and development at Coinmetrics, tweeted on Nov. 9 that he had found evidence that FTX may have provided a major bailout to Alameda in the second quarter of 2022. claimed. Nuzzi said FTX’s current situation is a result of its bailout.

according to new york timesTwitter has submitted the necessary documents to register with the legal authorities so that payment processing can begin.

Accenture has announced a deal with Japanese telecommunications giant NTT Docomo to accelerate Web3 adoption. The duo will focus on addressing societal issues, establishing secure technology for Web3, and developing talent.

Over the past 24 hours, Bitcoin (BTC) has fallen more than 13% to $15,900, while Ethereum (ETH) has also fallen nearly 15% to trade at $1,117.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024