No products in the cart.

- Latest

- Trending

ADVERTISEMENT

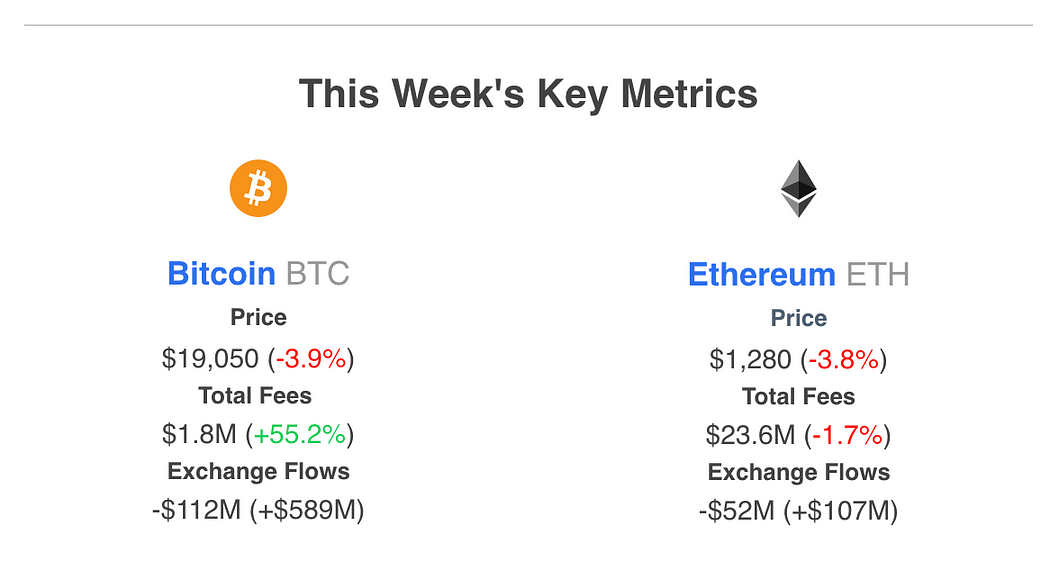

One metric suggests that market participants are putting pressure on Bitcoin (Bitcoin) and Ethereum (ethereum) in the long run, according to crypto analytics firm IntoTheBlock.

Lucas Otumuro, the company’s head of research, said: Note A new analysis shows that the top two crypto assets continue to see exchange outflows, but this week’s levels are at a slower pace compared to the previous week.

According to Outumuro, exchange withdrawals could indicate accumulation by investors who store cryptocurrencies outside of centralized exchanges.

The researchers also note that Bitcoin’s network fees, which track not only demand to use the cryptocurrency but also willingness to spend, have recovered 55% this week from annual lows printed last week. Ethereum fees also remained relatively high by bear market standards, according to Outumuro.

Additionally, researchers say Bitcoin’s 30-day volatility has dropped to a two-year low.

BTC has been hovering around the $20,000 range since mid-June and is trading at $19,187 at the time of writing. The top-ranked crypto asset by market capitalization is up 0.44% in the last 24 hours.

ETH is trading at $1,300 at the time of writing. The second largest crypto asset by market capitalization is up more than 1% in the last 24 hours.

Don’t miss the beat apply To get encrypted email alerts delivered directly to your inbox

check price action

Please follow us twitter, Facebook When telegram

surfing The Daily Hodl Mix

Featured Image: Shutterstock/Murvin DNA/Sol Invictus

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024