No products in the cart.

- Latest

- Trending

ADVERTISEMENT

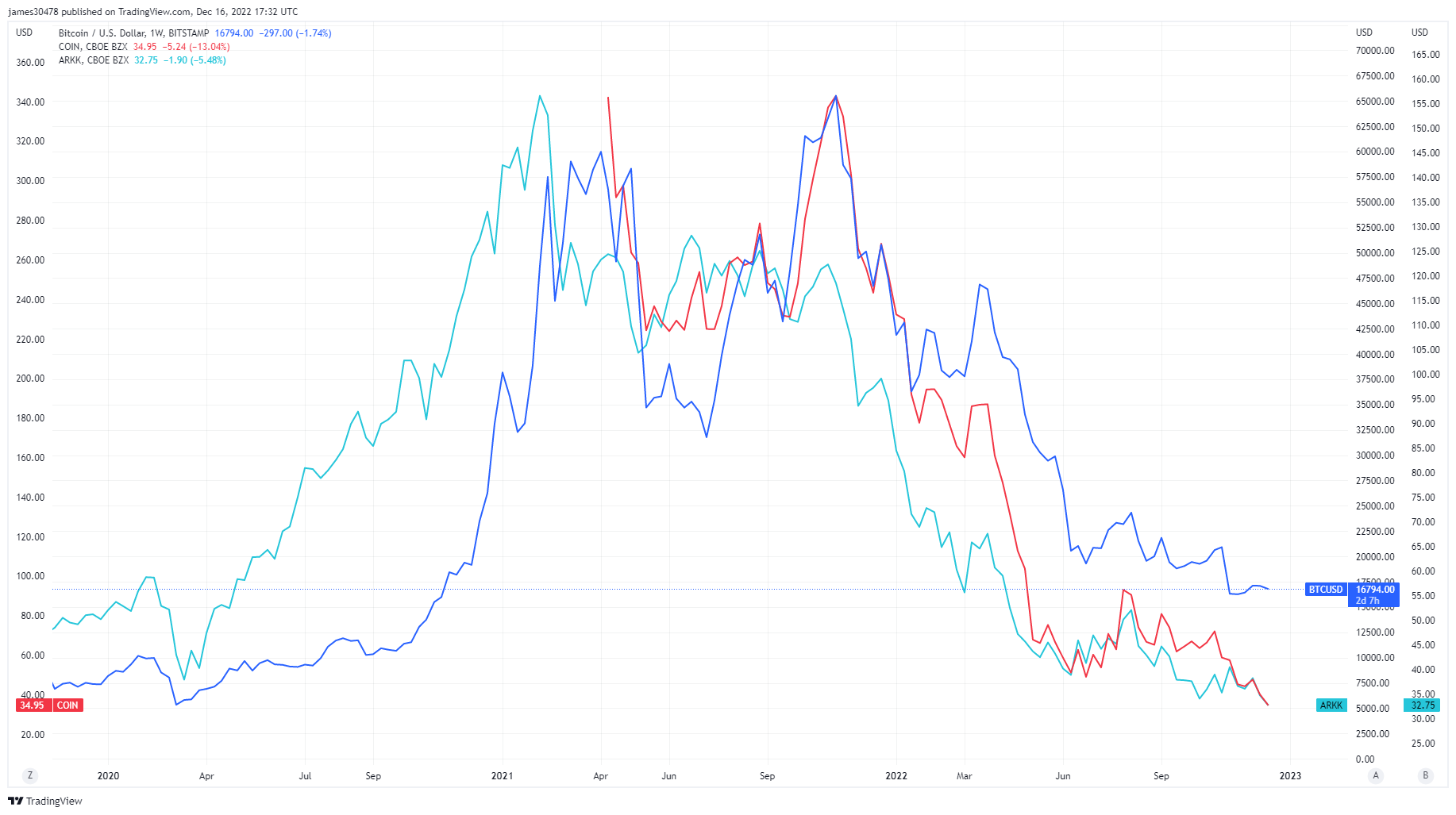

Risk, leverage and speculation can be seen as the keywords for 2021 as the coronavirus stimulus surplus funds entered the stock market and crypto ecosystem. Since then, many traditional financial assets have returned to pre-corona levels and hit record lows, including the Ark Innovation ETF, listed stocks such as Coinbase, and Bitcoin mining stocks. However, Bitcoin is still up about 5x from its covid lows.

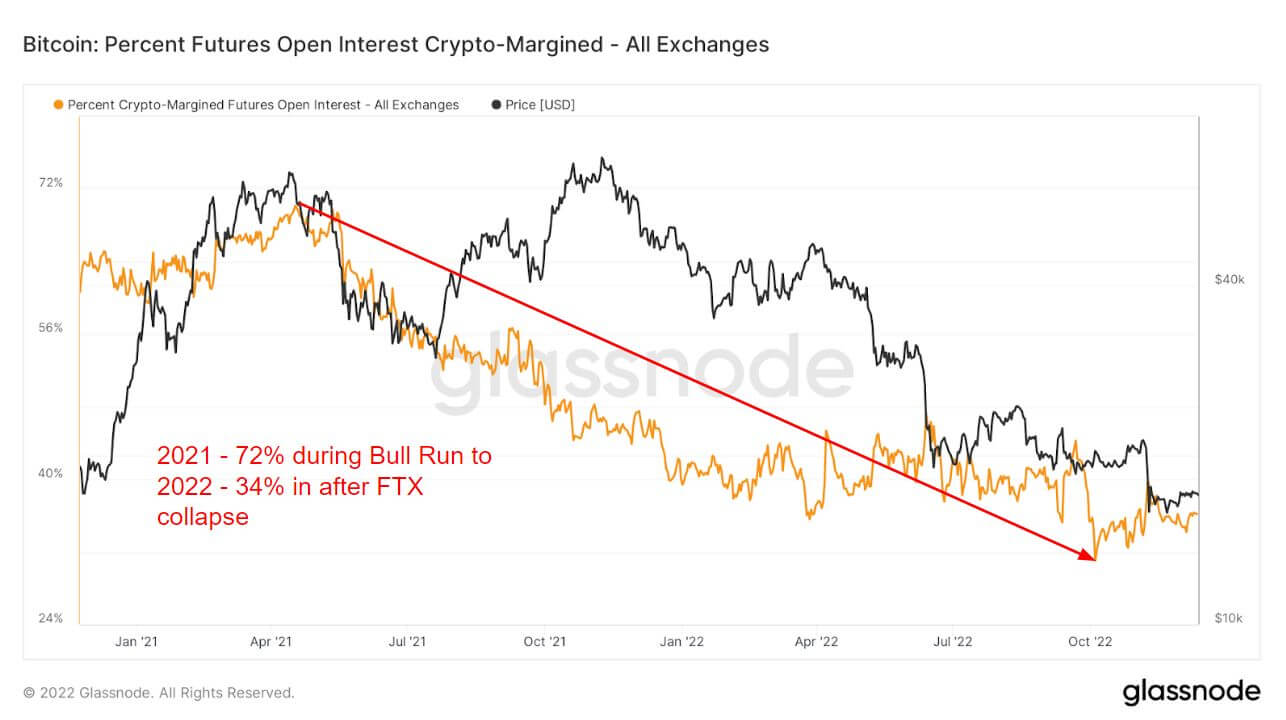

The introduction of derivatives was a big part of the 2021 bull market that allowed investors to take on additional risk and speculation. One method is the futures open interest, which is the total amount of funds (in USD value) allocated to open futures contracts.

In the 2021 bull market, 72% of all collateral used for futures open interest was crypto margin, or BTC. Due to the high volatility of the underlying assets, leveraged positions add more volatility and risk.

However, as 2022 approached and risks collapsed, investors only used 34% of their cryptocurrency margin. Instead, they have moved to either fiat currencies or stablecoins to hedge against volatility. Since the Luna collapse, cryptocurrency margins have been below 40%, indicating risk-off, and remained flat for the remainder of 2022.

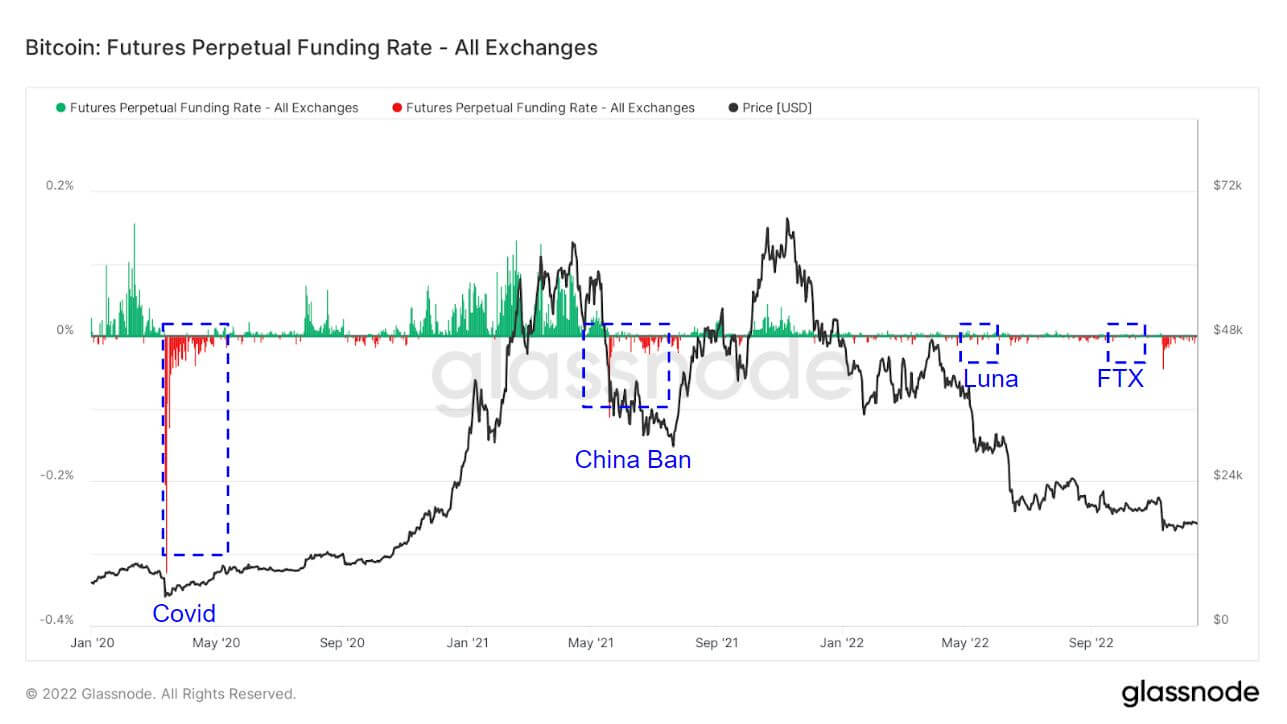

The 2021 perpetual swap funding rate shows that investors are mainly long-term investors and that they are becoming more and more bullish on BTC. However, the funding rate in 2022 is somewhat subdued compared to 2021.

The average funding rate (%) set by the exchange for perpetual futures contracts. If the rate is positive, the long position will periodically pay out the short position. Conversely, if the rate is negative, the short position will periodically pay out the long position.

Highlighted are areas where investors go in the opposite direction and short the market. It just so happened to coincide with the Black Swan event. China banning Covid, BTC, Luna and FTX collapse has seen huge short premiums. This is usually a cycle low or local bottom for BTC as investors try to send BTC as low as possible.

Liquidations in 2022 are subdued compared to 2021, when investors liquidated billions of dollars in early 2021 as a result of less leverage in the market. 2022 is now millions.

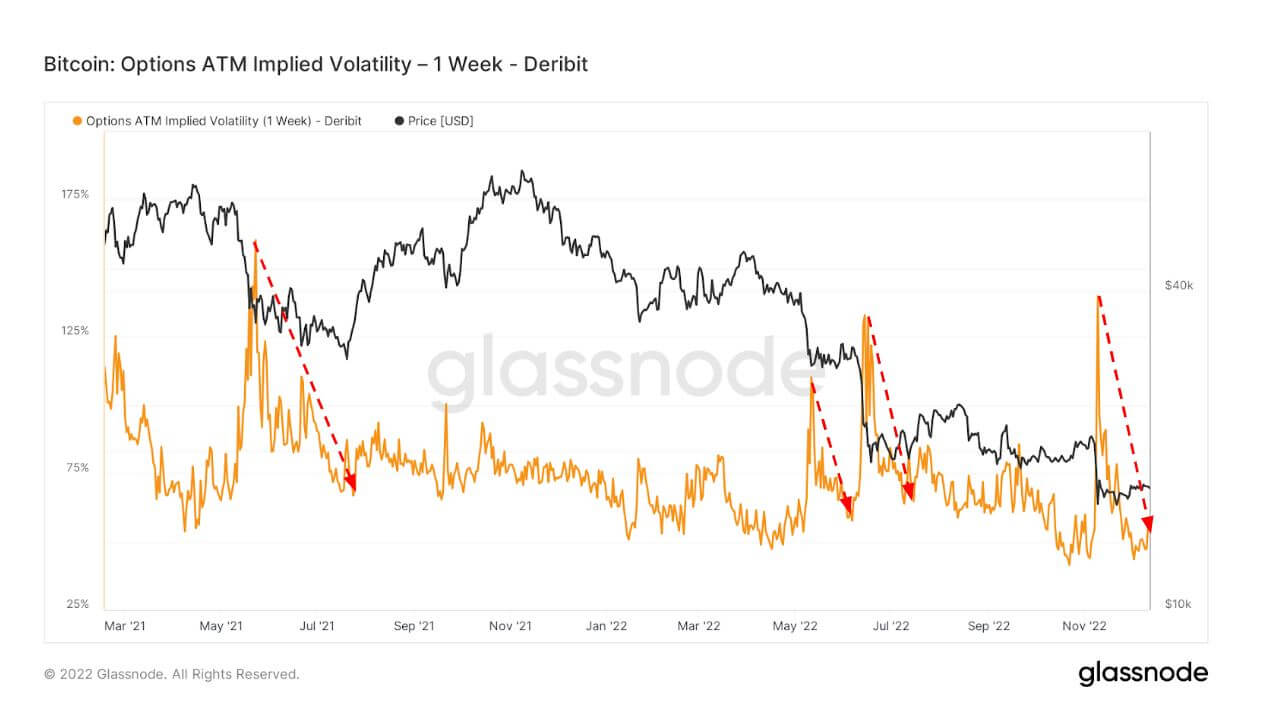

Implied volatility (IV) is the market’s expectation of volatility. Given the price of the option, we can solve for the expected volatility of the underlying asset.

Viewing the at-the-money (ATM) IV over time gives a normalized view of the expected volatility. This often goes up and down depending on actual volatility and market sentiment. This metric shows the ATM IV of an option contract expiring one week from today.

After a chaotic 2022, the Bitcoin ecosystem enters a quiet December. Options volatility has collapsed, crashing with each black swan event, and is now at his multi-year low of 40%.

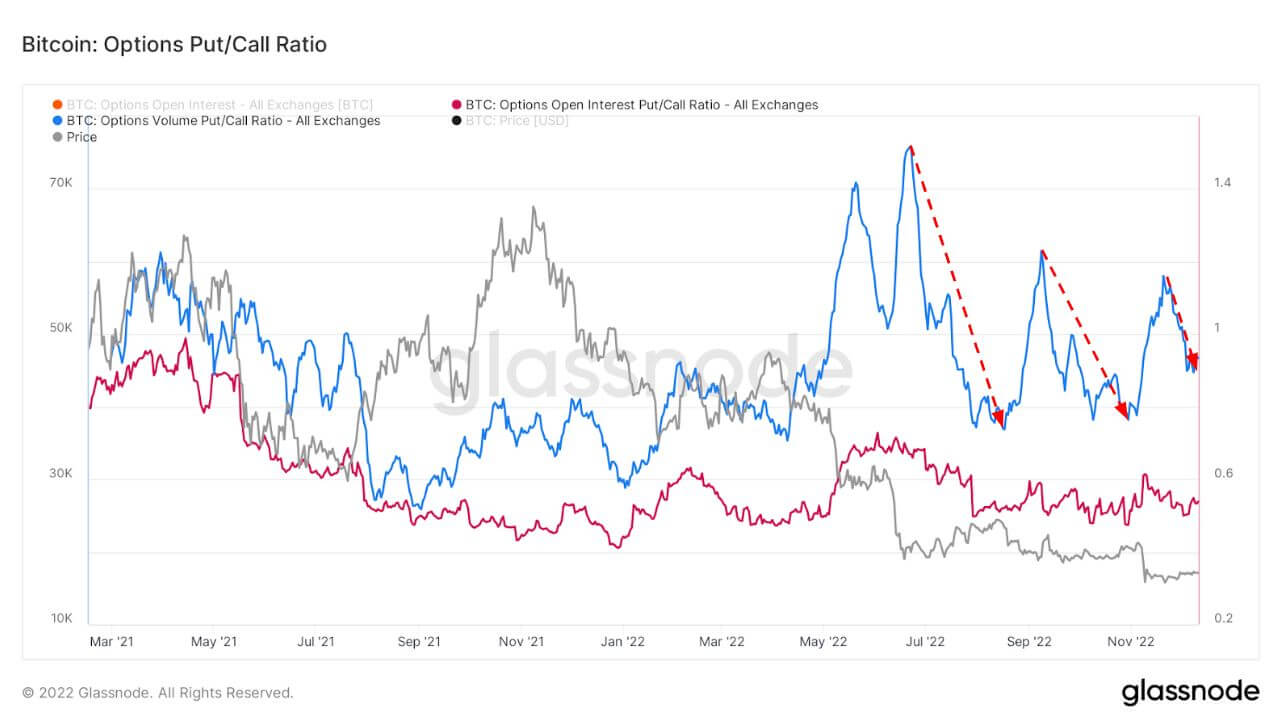

This chart shows the put/call ratio of the options market, displayed in terms of open interest (red) and traded volume (blue).

When risk and volatility occur, puts tend to be placed at higher premiums, as shown below. After Luna and FTX crashed, put option premiums dropped. This is also a good indicator of a bear market.

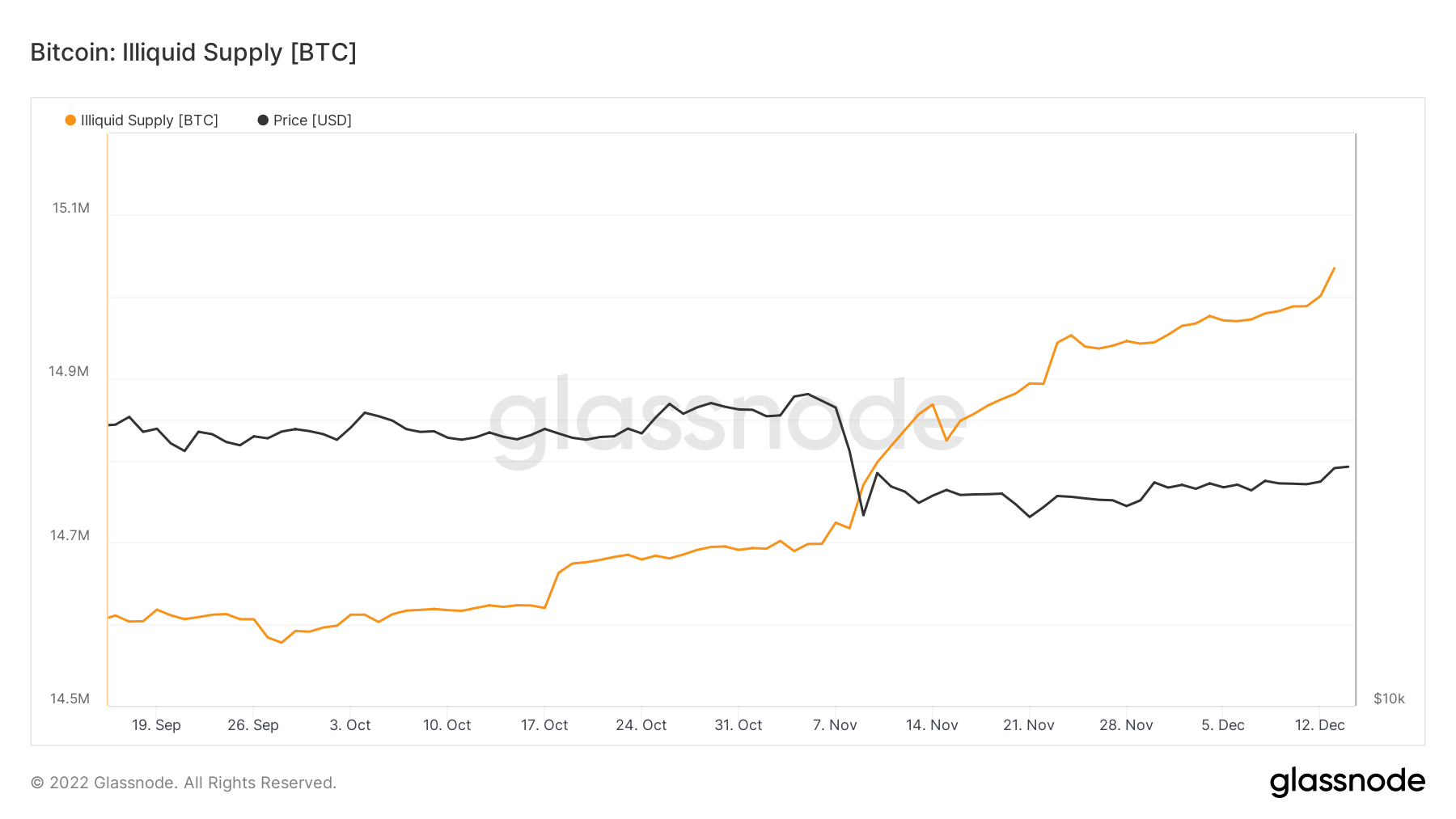

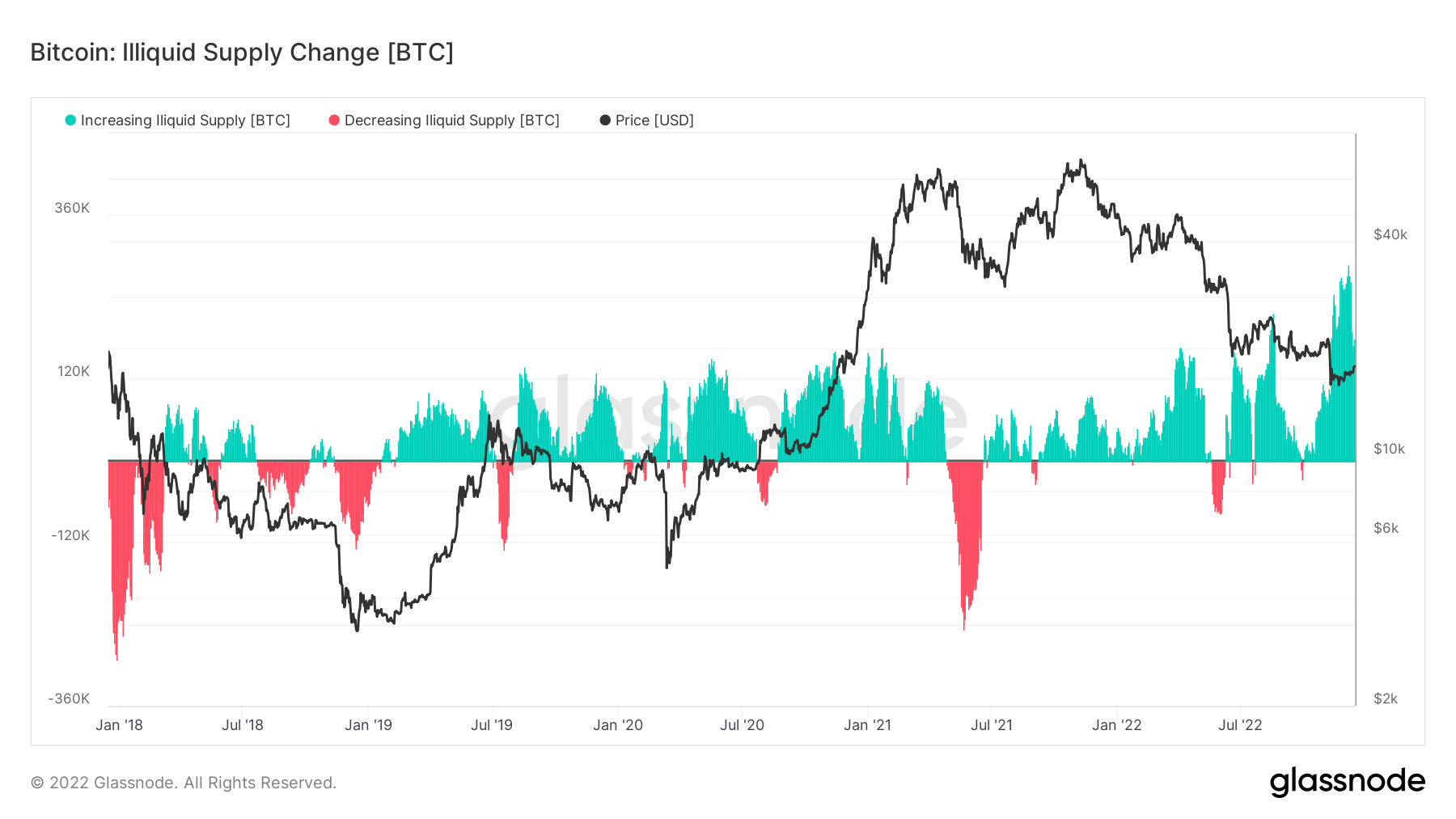

The illiquid supply passed through 15 million coins held in cold or hot storage wallets. With BTC in circulation of approximately 19.2 million, this represents 78% of the circulation held by less liquid entities.

With the collapse of FTX, self-custody has become a central focus and over the past three months the rate of change in illiquid supply has been the highest in over five years, indicating coins are leaving exchanges. I’m here.

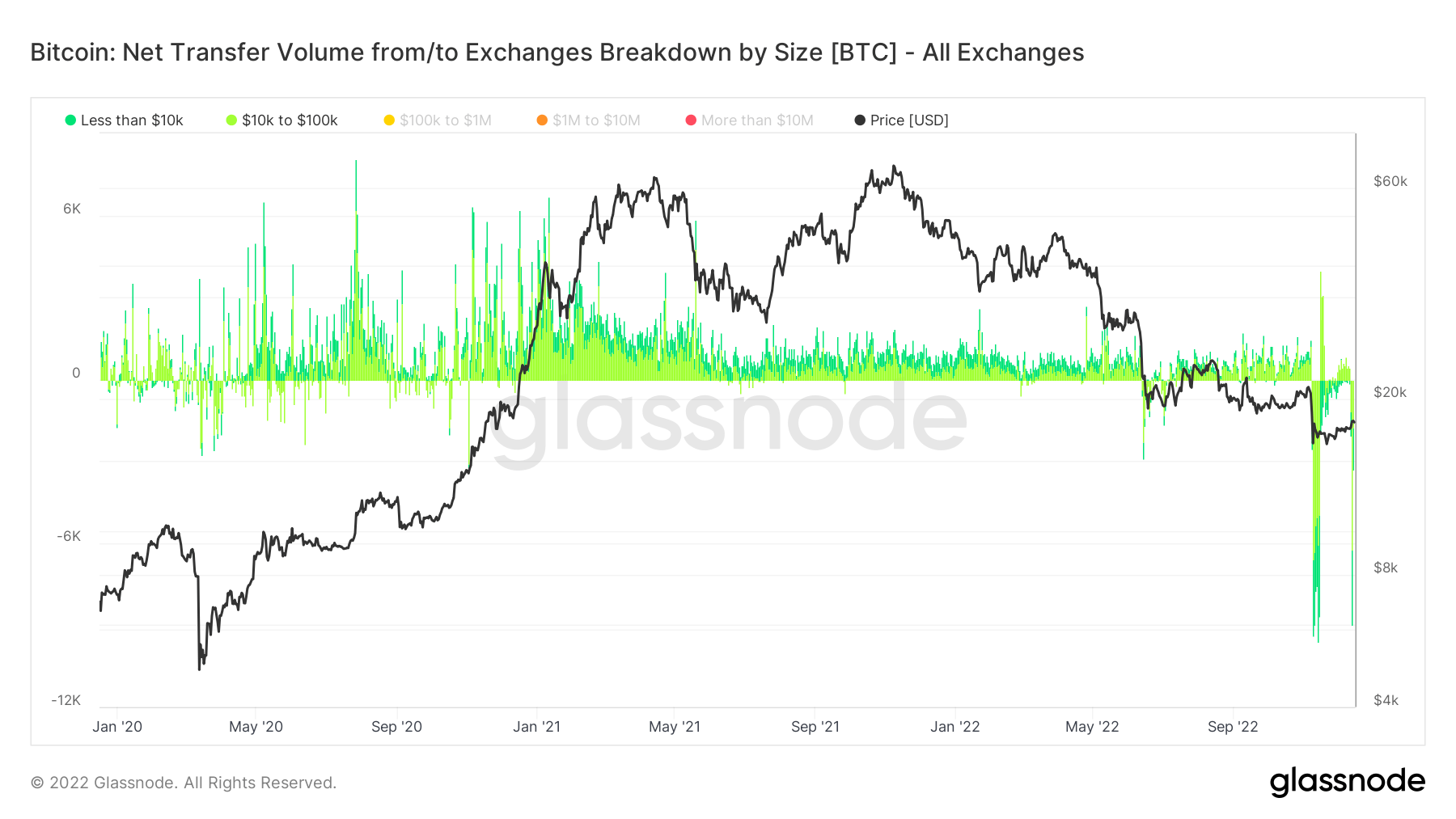

To understand when investors are taking coins off exchanges, use the metric net transfers to/from exchanges broken down by size.

Choosing below $100,000 alludes to retail trades that saw $160 million withdrawn multiple times during the FTX crash, and most recently, a large number of withdrawals from Binance in the week starting December 12th.

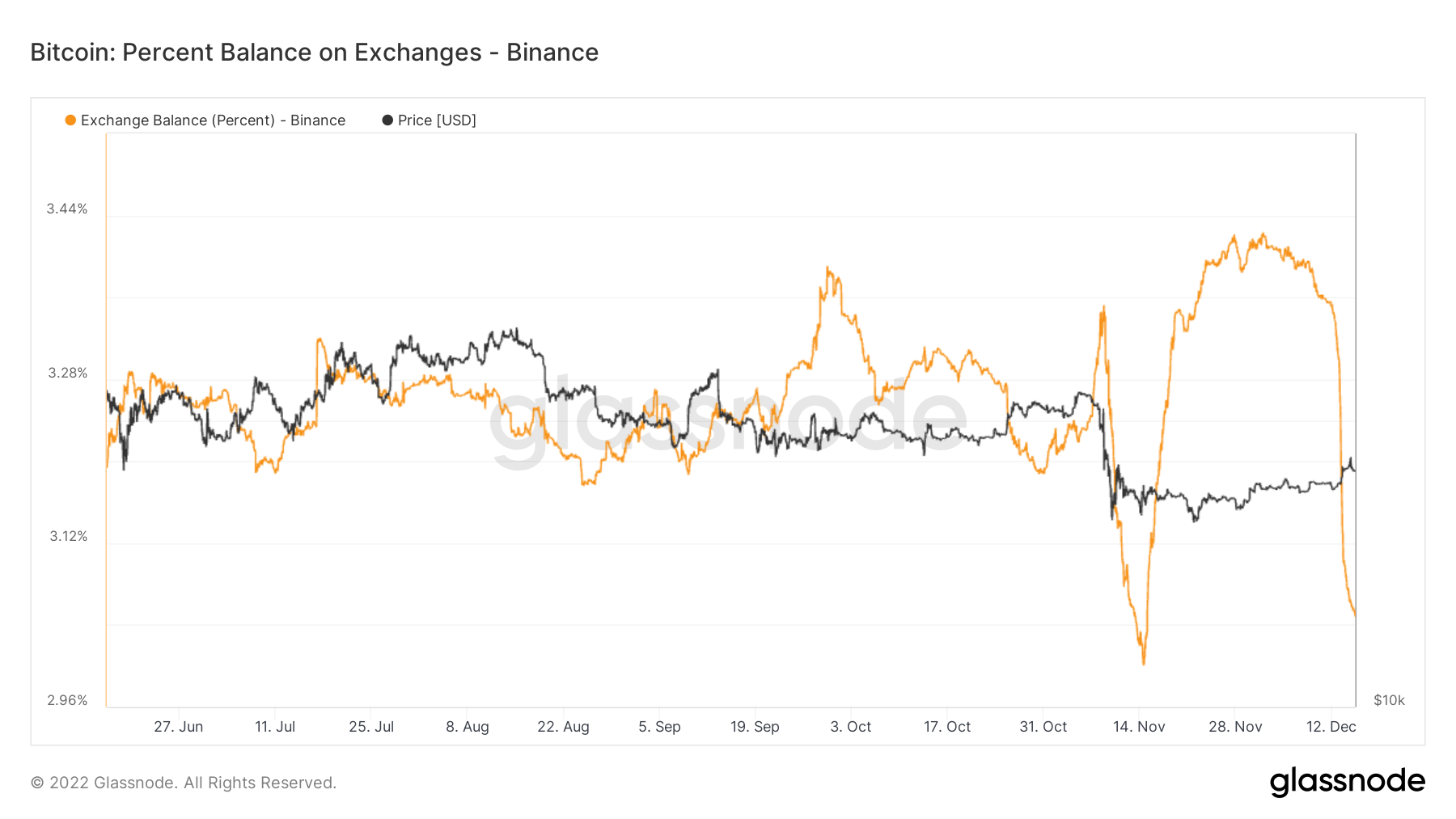

Binance left the exchange this week after seeing an unprecedented coin outflow. Withdrawals of Ethereum-based tokens surpassed $2 billion, while proof of reserves fell by $3.5 billion. However, redemptions and withdrawals were managed seamlessly.

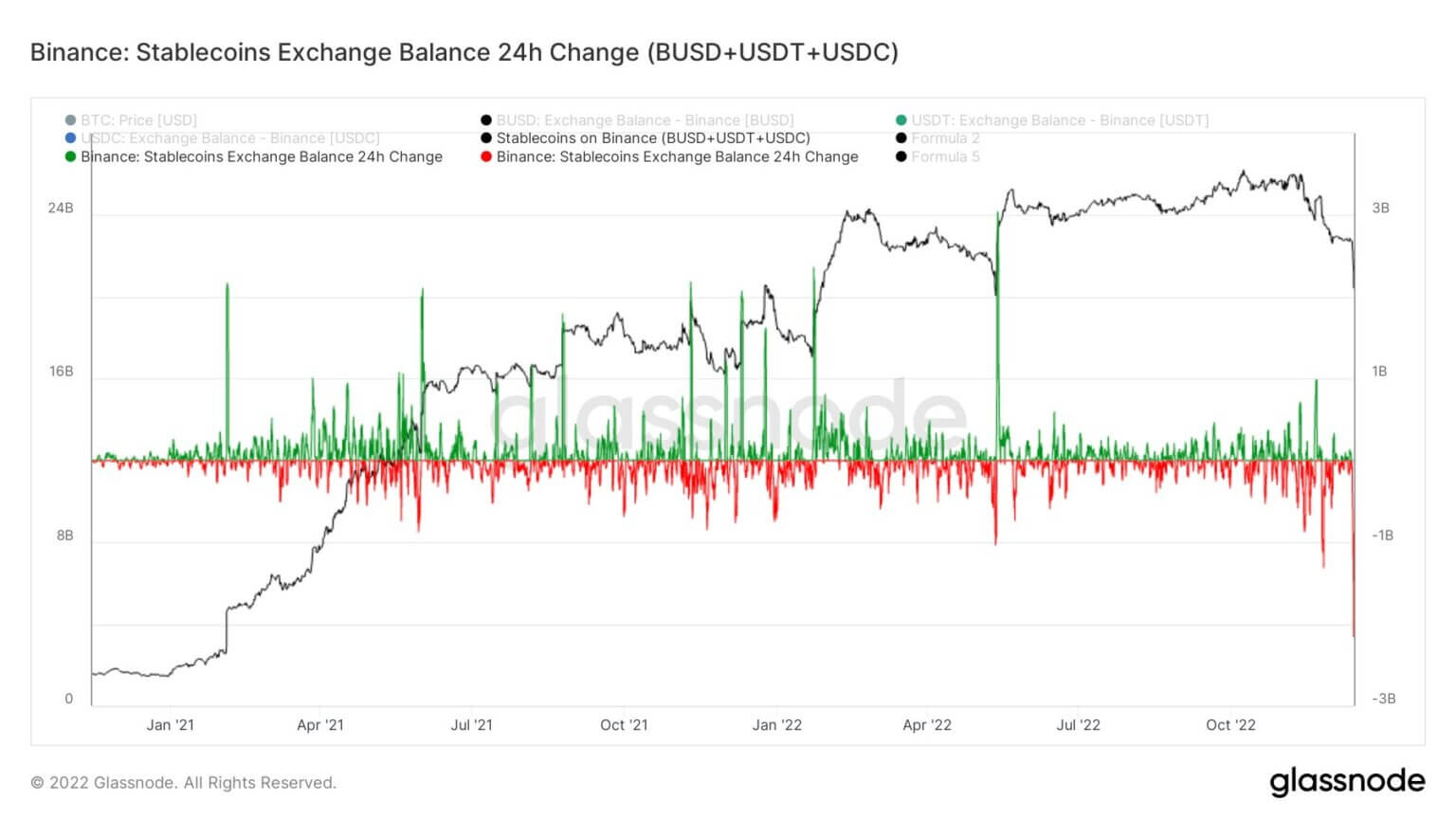

Binance faced the largest stablecoin (BUSD+USDT+USDC) outflow in 24 hours, reaching $2.159 billion.

Binance has confirmed that over 65,000 BTC have left the exchange in the last seven days. For the first time since January 2018, the exchange’s bitcoin supply has fallen below 12% of his, but holding about 3% of the exchange’s bitcoin supply, although the exchange’s balance is drying up. doing.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024