No products in the cart.

- Latest

- Trending

ADVERTISEMENT

One of the key historical indicators is that Bitcoin (BTC) may have finally bottomed out after an eight-month bear market, analysts closely followed is emphasized.

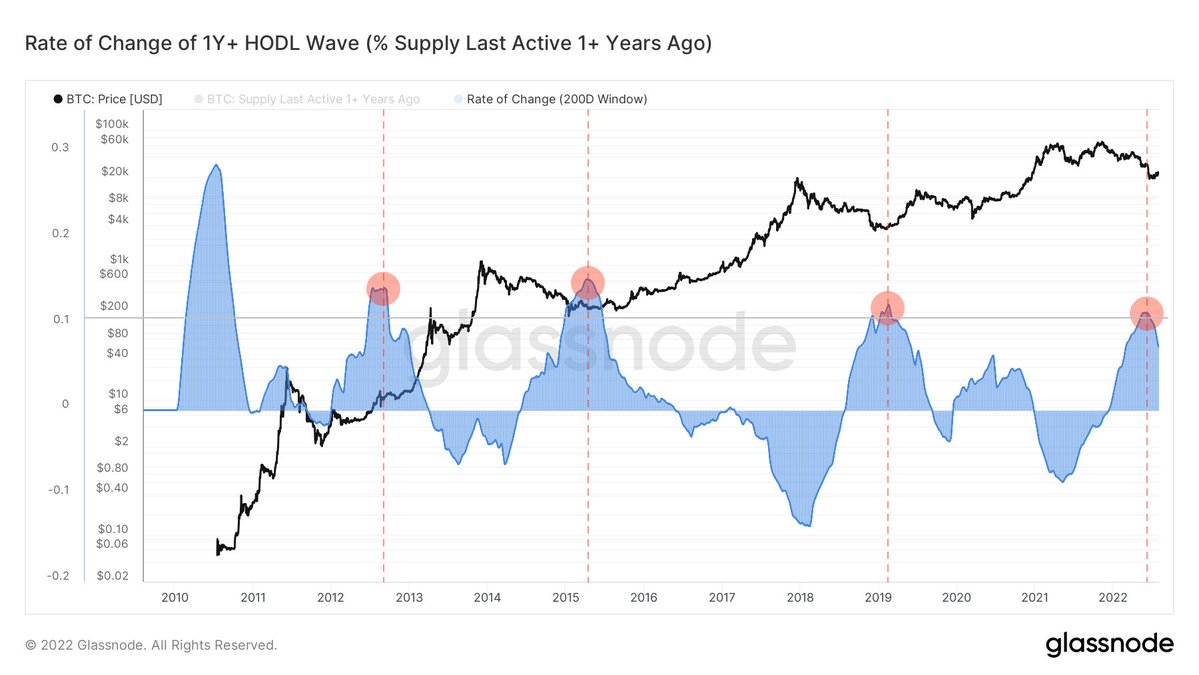

Pseudonymous Cryptocurrency Enthusiast TechDev To tell His 399,600 Twitter followers talk about the importance of the annual HODL wave, a metric that tracks Bitcoin after it has been dormant for over a year. The three previous instances of static BTC peaking in 2012, 2015 and 2019 were soon followed by rallies.

“Over a year the HODL wave 200-day rate of change peaks above 0.1.

4 signals in 11 years.

At the time of writing, Bitcoin is trading at $23,066, down less than 1% over the past 24 hours.

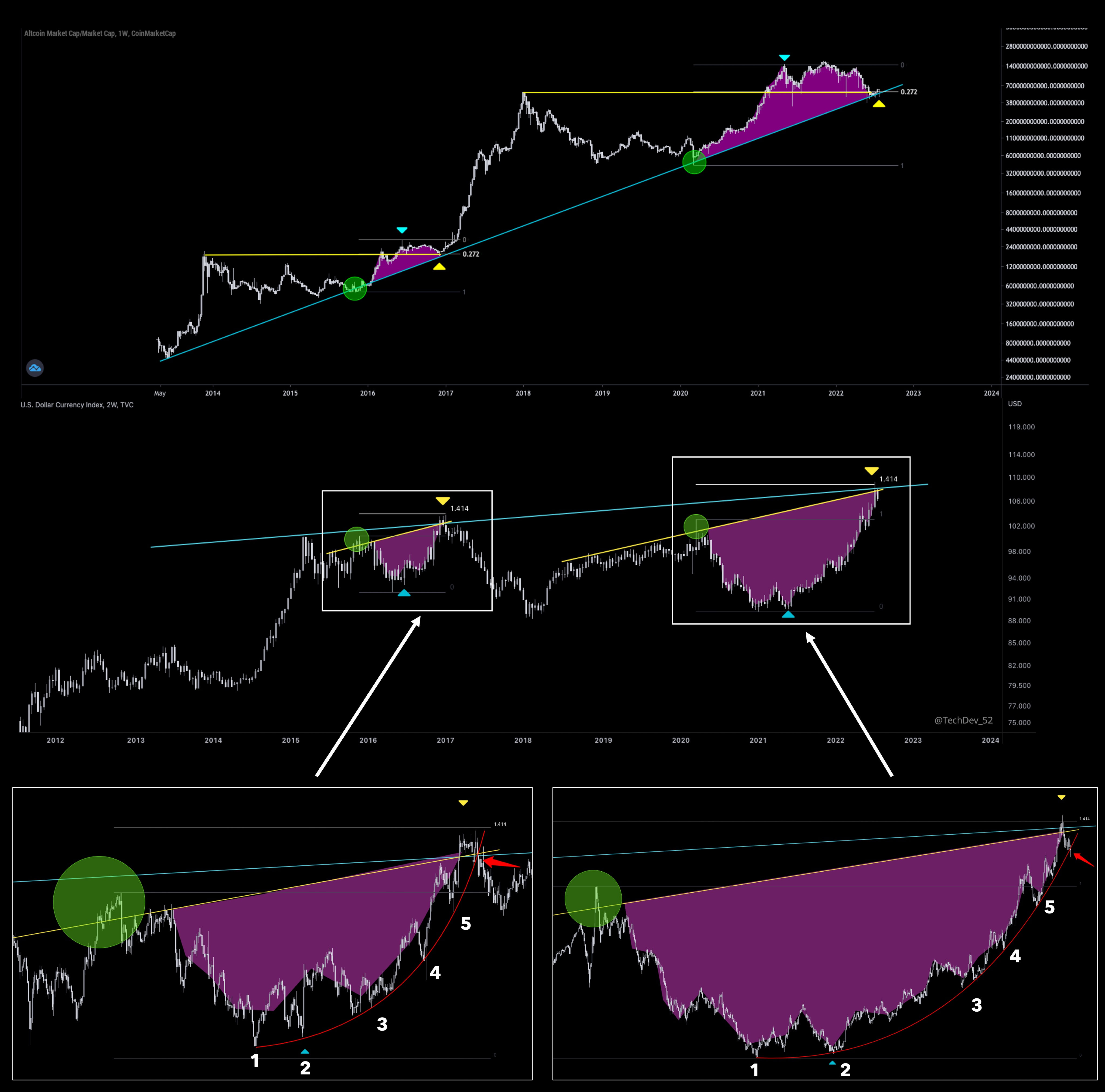

TechDev then looks at how altcoins have performed against the US Dollar Index (DXY) over about a decade. plot Fibonacci extensions suggesting altcoins may be poised to rise if DXY slumps.

Altcoins bouncing off long-term TL [timeline] + old ATH [all-time high] +0.272.

DXY at long-term TL + local TL + 1.414 after parabolic move.

Possible parabolic breakdown after 1.414 extension to 5 touchpoints and 2 TLs.

We are eyeing further confirmation of the DXY collapse and the altcoin impulse.

The analyst concludes with compare Bitcoin’s relative strength against the top 50 Dow Jones stocks dating back to 2012. The Relative Strength Index (RSI) is an indicator that traders use to measure the momentum of an asset’s trend, with a decline in the RSI suggesting strong bearish momentum and vice versa.

TechDev provides charts showing similar price ups and downs momentum, highlighting key moments from 2012, 2016, 2020 and this year.

“Bitcoin and Dow Jones 50 Monthly RSI Interactions.”

Don’t Miss a Beat Subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/BT Side

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024