No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Bitcoin (BTC) investors should expect prices to fall further as the bottom is not yet fully formed. Glassnode reported.

Bitcoin prices have fallen more than 72% from their all-time highs and may have recently been consolidated in the $ 20,000 range, but comparisons with previous bear markets show that the bottom has not yet formed. it was done.

Between December 2017 and March 2019, Bitcoin reached a break point of around $ 6,000 when it saw a 50% decline in a month. The break point for this bear market was $ 30,000 when the value of Bitcoin fell by more than 40% in two weeks.

In addition, the bear market in 2018 saw a redistribution of wealth due to falling prices. The same can be seen in the current bear market. With the surrender of long-term investors, new buyers will take action in the $ 20,000 range.

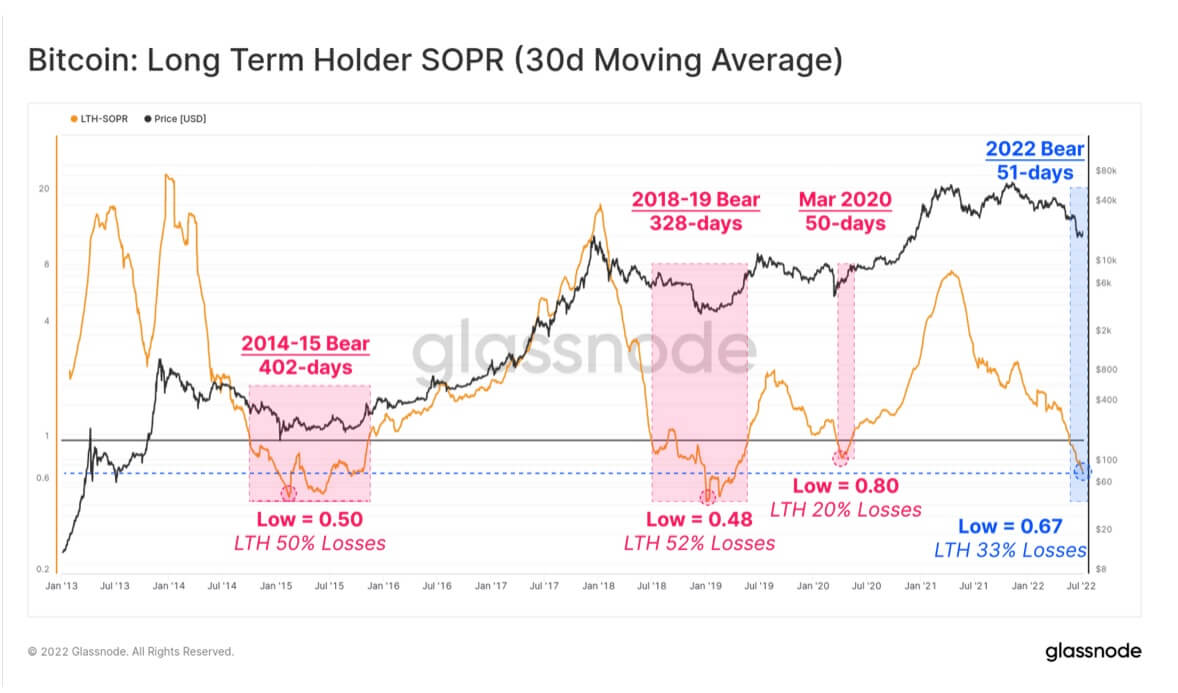

Long-term holders have been under pressure since Bitcoin’s price fell below $ 30,000, according to Glassnode. The report measured profitability using spending (actual loss) and coins below cost (unrealized loss).

The blockchain analytics company continued that the long-term holders had a spent output rate of return (SOPR) of 0.67. The average spending of long-term holders has a realized loss of 33%, and their jumble has a total unrealized loss of -14%.

On the other hand, most long-term holders of Bitcoin are those who get the coin at a higher price. Investors who bought Bitcoin between 2017 and 2020 still have assets.

According to Glassnode, in the previous resilience of the bear market, long-term holders usually held more than 34% of the Bitcoin supply and short-term holders held 3-4% of the supply.

Currently, short-term holders own about 16% of Bitcoin’s supply, suggesting that there is room for maturity to test their beliefs. This also means that the bottom of the bear market has not yet been formed.

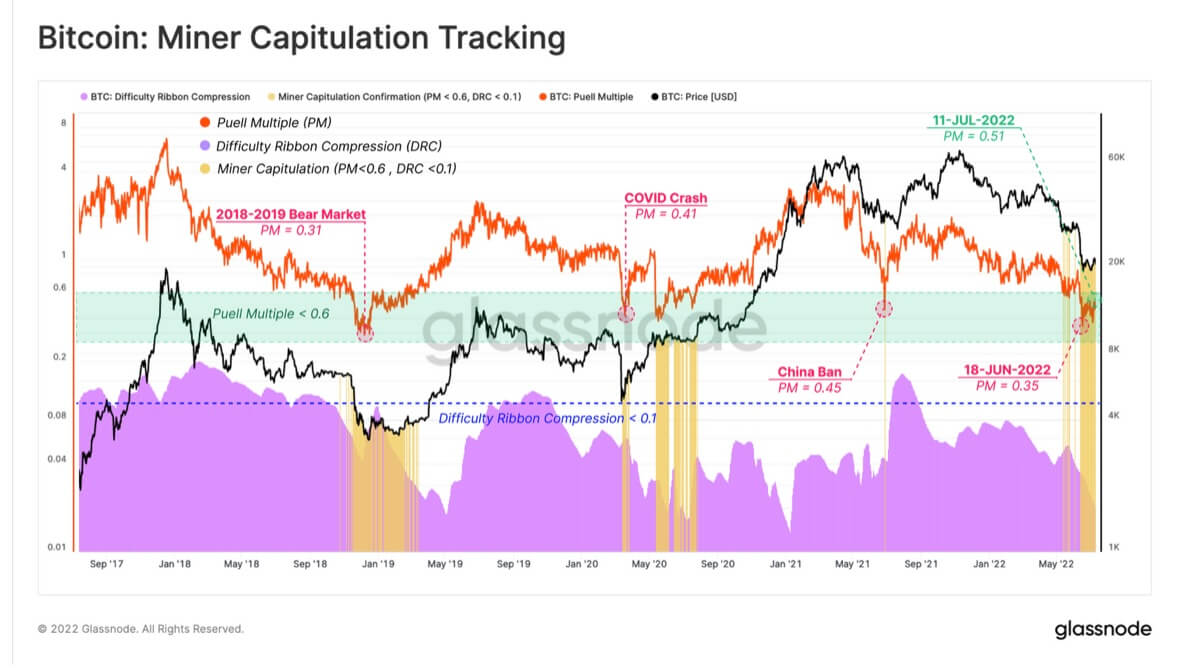

The report confirmed that the miner’s surrender is also currently taking place. As prices fall, miners may surrender more in the next quarter.

Glassnode continued that the miners’ surrender in the bear market in 2018-2019 lasted about four months, but the current surrender lasted only one month.

The blockchain analyst has concluded that the loss Bitcoin supply has reached 44.7%. This is not as serious as the previous bear market. Therefore, there is the potential for more drops before Bitcoin establishes an elastic bottom.

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

Price snapshot

Other contexts

Join now for $ 19 per month Explore all the benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024