No products in the cart.

- Latest

- Trending

ADVERTISEMENT

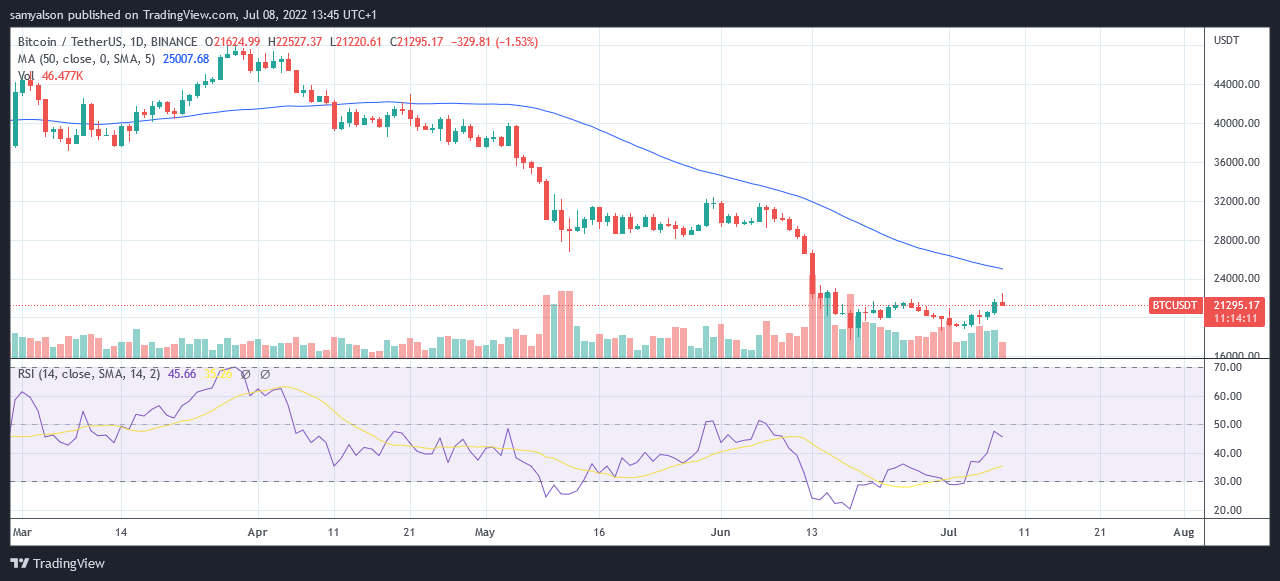

Bitcoin (BTC) prices surged to $ 22,500 early on July 8th, prompting a call for a bullish revival from some quarters.

Relief comes after weeks of extreme volatility when BTC drops to $ 17,600. However, given the recent extremes, it is premature to call the end of the bear cycle.

Since the beginning of the new month, Bitcoin has gained a value of 13% and has shown signs of bottoming out, as evidenced by the decisive rising pattern formed by the daily closing prices.

Total market capitalization has improved over the past week. Inflows have been totaled since the beginning of July $ 53.2 billionRepresents a 6% increase.

Despite the positive signs @CryptoCapo We warn investors not to get hooked or expect the imminent movement to be significantly higher. His reason “not a single bullish sign in favor of this treatise.”

In addition, despite the bailout rally, @ CryptoCapo hopes that local top retests will be categorically rejected, adding that alts can suffer up to 50% loss as a result. ..

good morning!

DXY is a parabola. Bitcoin rises a bit and people are euphoric and demand 40k. There are no signs of bullish support for this rise, and prices are still at 21k-22k (resistance).

Rejection becomes stronger. Altcoins can drop by 45-50%. There is no mercy. pic.twitter.com/5s6GMLrqGo

Il Capo Of Crypto (@CryptoCapo_) July 8, 2022

Considering the vulnerability of the macroeconomic environment, Extreme fear In the market, this latest move over $ 22,500 can be fake.

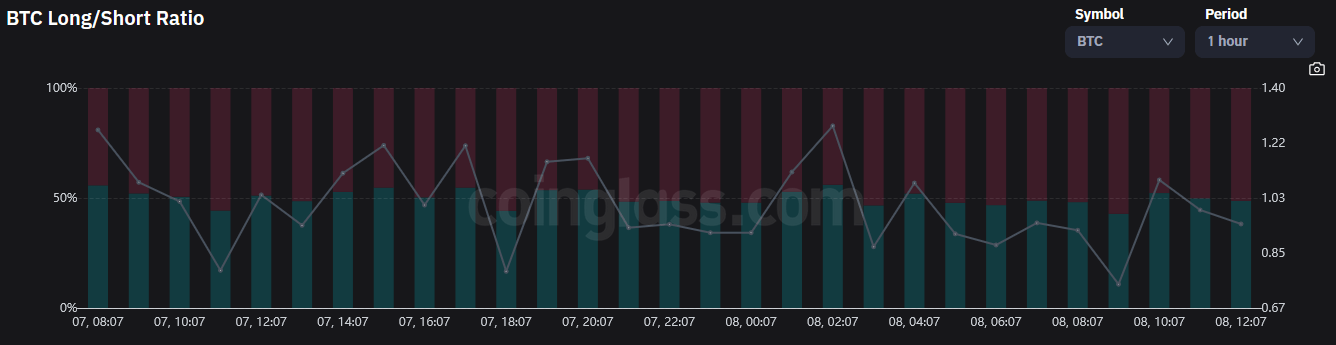

Latest long / short ratio data from coinglass.com It shows that the trader has slightly shorted within the last 2 hours with a long of 48.7% and a short ratio of 51.3%.

At the time of the press, the $ 21,600 resistance level retest has failed.

according to Bitcoin magazine The report, “The Final Stage of the Mountain. Gox Rehabilitation Process,” is underway.The funds borrowed from the exchange hack have been sent letter As of July 6, the trustee of the case confirmed that the repayment was in place.

Hacking in 2014 lost more than 700,000 BTC. Investigators have discovered 141,686 BTC for redistribution to victims. Victims can choose to receive BTC, BCH, or cash repayments.

Potentially, this situation means that an additional 142,000 BTC will be dumped into the market, which could increase seller pressure during this delicate period.

Cash payments seem to offset this, but it is estimated that sales pressure will increase as the trustee liquidates the equivalent BTC.

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

Price snapshot

Other contexts

Join now for $ 19 per month Explore all the benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024