No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Cobo helps institutions and high-value individuals (HNIs) manage and expand their holdings of cryptocurrencies by providing clients with infrastructure services such as custodian wallets, DeFi gateways and crypto-based yield funds. Cryptocurrency custodian.

Institutions wishing to publish cryptocurrencies can do so in a secure and controlled industry-compliant manner that minimizes the risk of cryptocurrency volatility and loss from fraudulent projects.

Cobo was founded in Beijing by Discus Fish, an early cryptocurrency adopter who founded F2 Pool, the world’s largest mining pool, and Changhao Jiang, a former Google platform engineer with a PhD in computer science.

Its infrastructure is integrated with 60 main blockchains and currently manages over $ 1.5 billion of crypto on behalf of clients, including crypto exchanges, DeFi protocols, liquidity mining pools and wealthy individuals.

This review details Cobo’s infrastructure, the services they provide, and how institutions and HNIs can benefit from them.

Cobo acts as a gateway to the world of cryptography and serves three aspects.

Cobo provides crypto storage services to institutions that store crypto in secure vaults with high availability, access control, and global distribution.

These vaults are multi-signature access that requires a transaction to be signed before two or more people can process it, or a key that splits a private key into multiple parts and stores them in different locations or with another person. It provides unique features such as sharding.

Institutions can create role-based access to vaults so that qualified team members can access and manage funds.

From a compliance perspective, Cobo is licensed by the Financial Crimes Enforcement Network (FinCEN) in the United States and as a Trust or Company Service Provider (TCSP) in Hong Kong.

When institutions and HNIs store their ciphers in Cobo, they have immediate access to yield-generating asset management services such as liquidity mining and controlled access to specific DeFi protocols.

The vault also comes with access to a creation platform as an NFT service that allows institutions to securely create NFTs, connect to the market and trade.

The vault’s capabilities are enhanced by a blockchain-based forwarding network called loops. This network is built for free transfers and payments and can be managed from the Custody dashboard or API that allows you to connect to your custom application.

Cobo provides controlled access to the DeFi protocol for institutions wishing to expose to decentralized finance with minimal risk in an industry-compliant environment.

Most of Cobo’s DeFi operations include liquidity mining, which provides liquidity to carefully selected DeFi protocols in exchange for profits. This service provides approximately 5% to 30% of liquidity with the protocol of your choice.

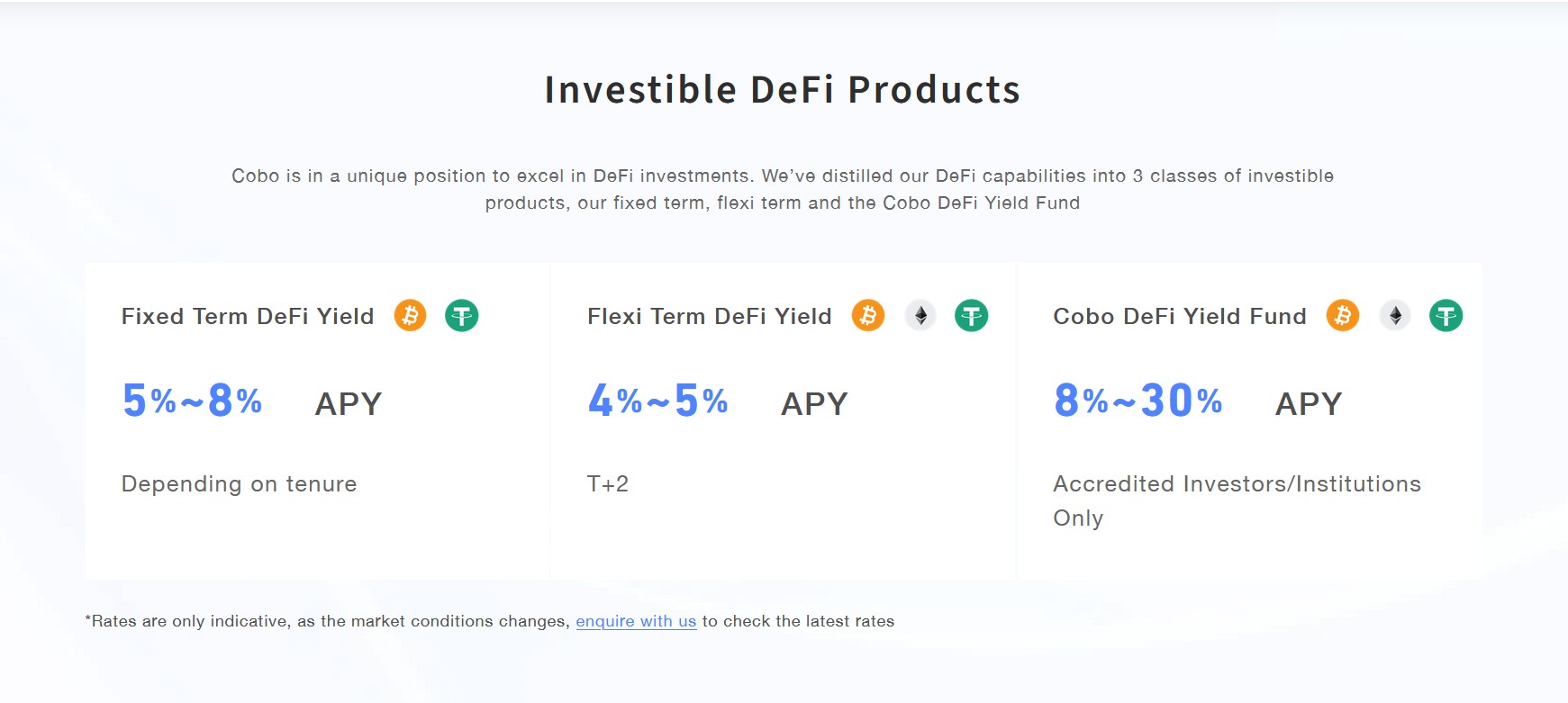

Investors can plug in the profits generated from this activity through three DeFi products:

Regular DefI yields provide an annual income between 5% and 8%. Investors fix their funds in the protocol for a period of time. This product only accepts Bitcoin (BTC) and USDT.

Flexi term DeFi yields provide an annual return of 4% to 5%. Investors do not need to lock their funds with this product. Yields are low because they always have access to their funds. This product is BTC, Ethereum (ETH), and USDT compatible.

The Cobo Yield Fund generates 8% to 30% annual revenue on BTC, ETH, and USDT. Investors can choose between a delegation pool that Cobo manages to maximize yield, or a dedicated pool created for a particular client that exposes to a combination of DeFi protocols. The minimum funding requirement for a private pool is $ 100 million.

Before investing in the DeFi protocol, Cobo performs due diligence by first performing an address analysis on the chain of various projects to find strong candidates. After the initial analysis, Cobo breaks down the tokenomics design to ensure it is sound, performs internal and external audit checks, and performs background checks to assess the founder’s background.

If all checks are successful, Cobo will develop and execute an investment strategy and use on-chain tools to perform ongoing monitoring and risk management.

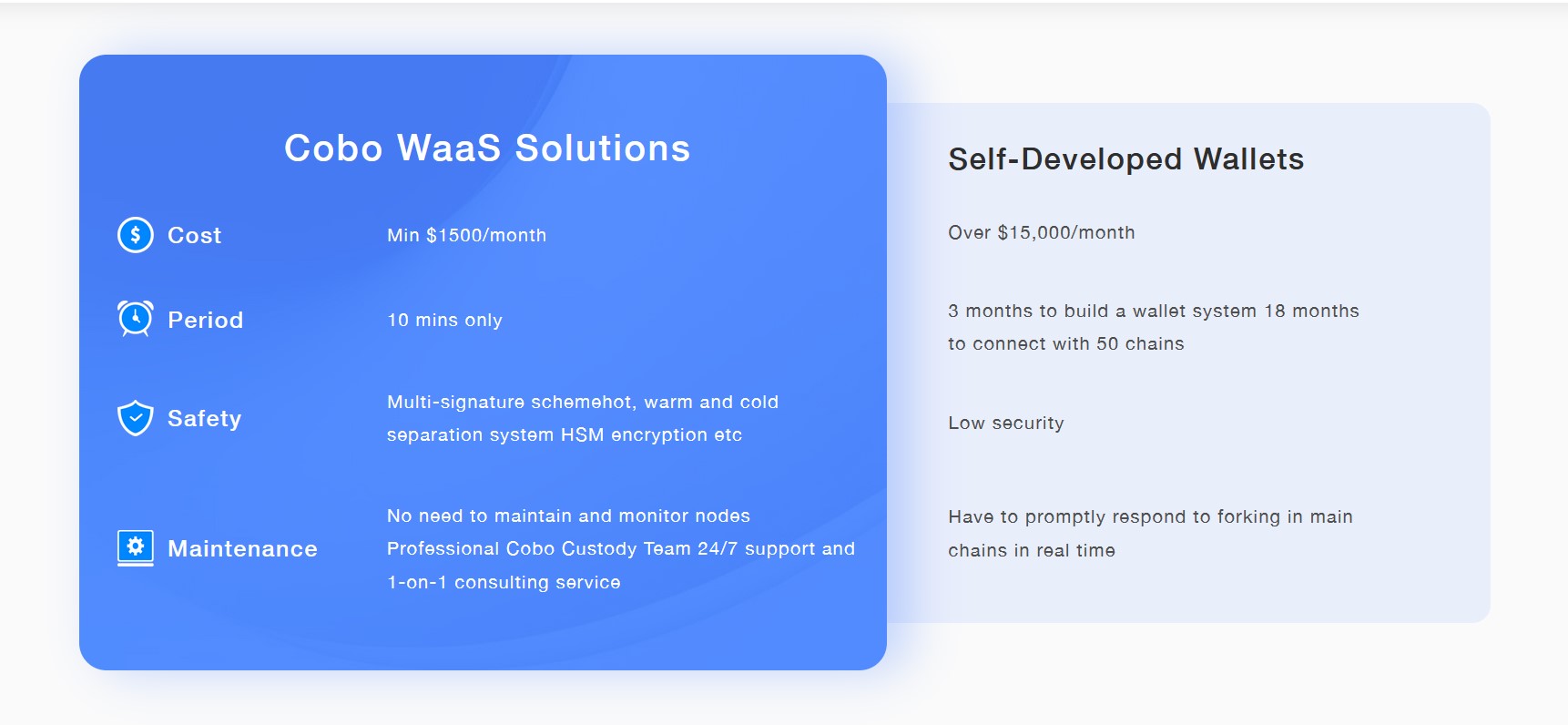

Wallet-as-a-Service (WaaS) is a framework that enables institutions to build custom crypto wallets with high security and high availability while managing all Cobo-based blockchain technologies and features. is.

The framework is integrated with 60 blockchains and supports 1,600 ciphers. All the institution needs to do is set up a wallet for the developer to include custom features. The wallet SDK supports Python, Javascript, Golang, Java, and PHP.

According to their website, wallets cost about $ 1,500 a month compared to self-developed ones, which can cost about $ 15,000 a month. Financial institutions can also set up a wallet in just 10 minutes, compared to the hours, days, or even weeks it takes to develop a wallet from scratch.

Finally, Cobo maintains and updates the underlying infrastructure to enable real-time integration of events such as hard forks.

DeFi-as-a-service (DaaS) is a secure gateway to the world of decentralized finance for financial institutions who want fine-grained control over their DeFi activities. The main difference between Cobo’s DeFi offering and Defi-as-a-service is that the former does not allow direct access to the DeFi protocol, while the latter does.

DeFi services are a group of managed yield products, and Defi-as-a-service is a gateway that allows institutions to interact directly with the DeFi protocol.

The service provides tools that not only securely connect to the protocol, but also allow institutions to configure role-based access, custom workflows, on-chain monitoring, and multisig access to the DeFi protocol on the public blockchain. To do.

DaaS is offered in three formats: centralized, smart contracts, and dedicated blockchain.

The centralized form allows access to the DeFi protocol and NFT marketplace while abstracting the concerns of the underlying infrastructure. It comes with fiat on / off ramps, workflow, compliance and auditing capabilities.

The smart contract form comes with a module that connects to the safe of the Gnosis network, the predictive market for the Ethereum blockchain. This form comes with continuous on-chain risk management, custom workflows, and alerting capabilities.

A dedicated blockchain solution supports cross-chain asset management and comes with role-based access and a completely custom workflow.

Cobo’s security architecture is an industry standard, with three layers of private keys and ISO27002 certification, the global standard for information security, under development. Their DeFi gateway is also protected by the same technology and has multi-signature access to eliminate a single point of failure.

Education can integrate an existing set of processes with Cobo’s software to maintain productivity and industry standards. These workflows can be customized at the smart contract level to enable features such as monitoring and on-chain risk management.

The complex institutional structure relies on a strictly restricted role to maintain order. Cobo’s role-based access capabilities create different layers or degrees of access to infrastructure and products. In this way, only those authorized by the institution can access it.

Cryptography is volatile, so financial institutions need to keep track of their investments. With continuous monitoring and risk management, you can respond to price fluctuations in real time.

Strict security as the infrastructure is military grade and private keys are distributed globally

Licensed in the US, Hong Kong, Singapore, Europe, United Arab Emirates, Cayman Islands

Affordable to manage all the underlying infrastructure

Industry-compliant systems and processes

Compliant with AML / KYC / KYB / CFT regulations

Cobo is a one-stop shop that addresses the needs of your organization’s cryptocurrencies by offering innovative products that set you apart from the competition. While many other storage services simply store the client’s encryption, Cobo allows access to some products to increase funding.

Another way Cobo stands out is how to generate yield. Similar institutional investor services create ETF-like derivatives that track cryptocurrency baskets, and Cobo provides liquidity for terrestrial projects.

This method is superior to ETFs, as a downturn in the market can erode a significant portion of the value of ETFs. As long as liquidity-providing protocols are used, Cobo will make a profit, so this same recession is unlikely to affect Cobo.

Cobo also saves clients potentially millions of blockchain transaction fees over a loop network.

Finally, Cobo’s on-chain monitoring, custom workflows, role-based access, multisig wallets, compliance and auditing capabilities provide educational institutions with the tools they need to execute transparent transactions in line with regulatory requirements. increase.

Cobo provides effective tools and infrastructure to bring traditional financial transparency and compliance to decentralized finance. The service is powerful for both traditional and crypto-native institutions, such as hedge funds that require DeFi exposure and crypto exchanges that require cold storage services.

Other services provide educational institutions with a secure way to participate in the new Web3.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024