No products in the cart.

- Latest

- Trending

ADVERTISEMENT

According to page 32 report As published by ByBit, the Solana ecosystem saw strong growth in Q2 2022 with strong performances from GameFi and DAO.

There has been increased DAO activity, continued volatility in the NFT market, strong interaction with GameFi, and declining DeFi market share during the quarter.

While some parts of the network may have seen solid growth, it wasn’t without its problems. During this time, we experienced two major network failures. However, as the report notes, upgrading to Solana appears to have had a positive effect.

Our network upgrades in late Q2 significantly improved transaction processing and reliability.

Additionally, the report highlights problems with Solend, Slope Finance, Crema, Nirvana, and Saga as examples of network security that need to be significantly improved. Some events occurred early in the third quarter, but were included because they could impact Solana’s growth in the future.

, which fell from a Q1 high of $146 to a Q2 low of $26, showing a broader market decline. However, $SOL also fell 46% against Bitcoin, indicating that Solana’s surrender was somewhat independent of the overall market.

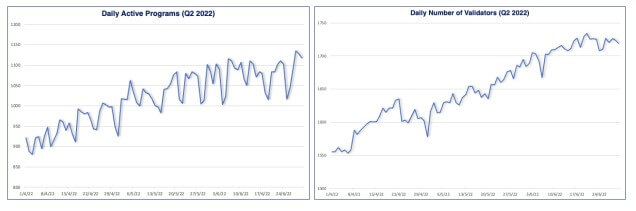

However, when it comes to on-chain activity, bullish statistics support the report’s belief that Solana is experiencing network growth despite downward price pressure. As you can see below, the number of programs and validators active every day is steadily increasing.

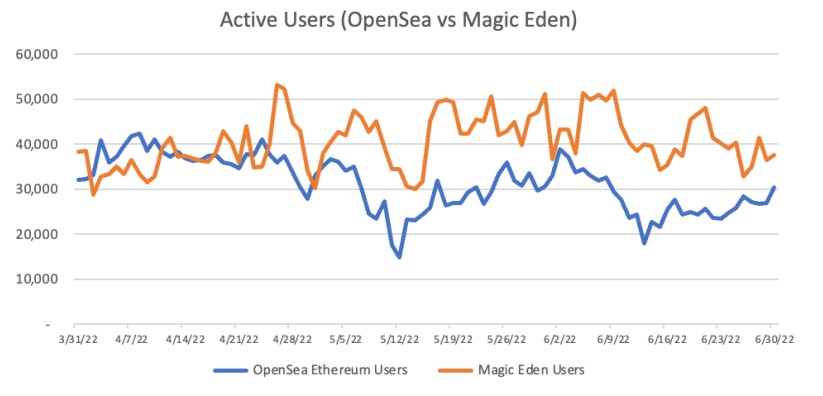

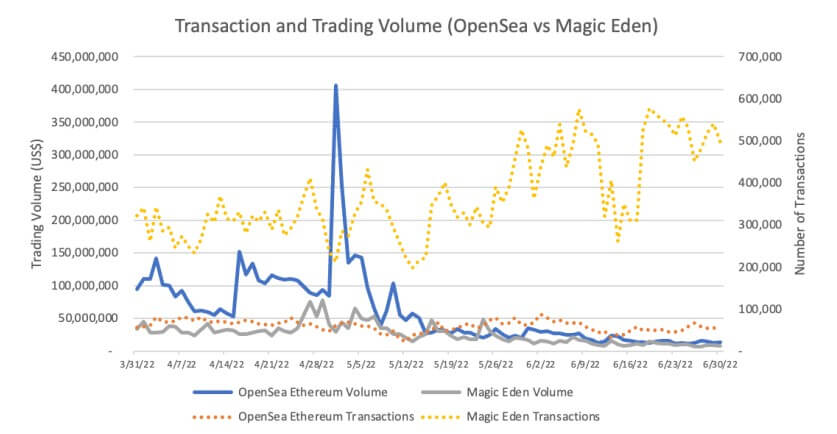

The number of active users interacting with NFTs on Solana is also healthy compared to OpenSea. He also has more than 5x more transactions on Magic Eden than he does on OpenSea, but the transaction value is similar in both ecosystems.

DAO activity is on the rise, as the report claims that Solana is catching up with Ethereum in DAO numbers.

In summary, the DAO creation tool Realms has recorded a significant increase in DAOs on Solana to over 800 DAOs at the time of writing, compared to 100+ in January 2022.

Solana’s DAO increased from 1,750 to about 2,500 from March to June 2022, “evidence that Solana’s DAO landscape is thriving.” In this report, we used data on the Solana multisig wallet to see an increase in DAO activity.

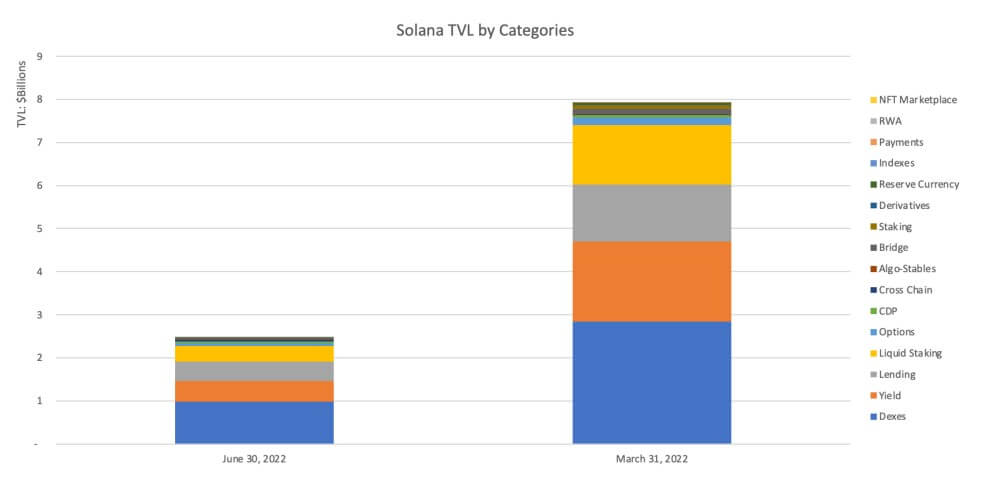

Alongside the drop in $SOL’s token price, the total amount locked in Solana DeFi dropped significantly from $8 billion in Q1 to just $2.5 billion in Q2.

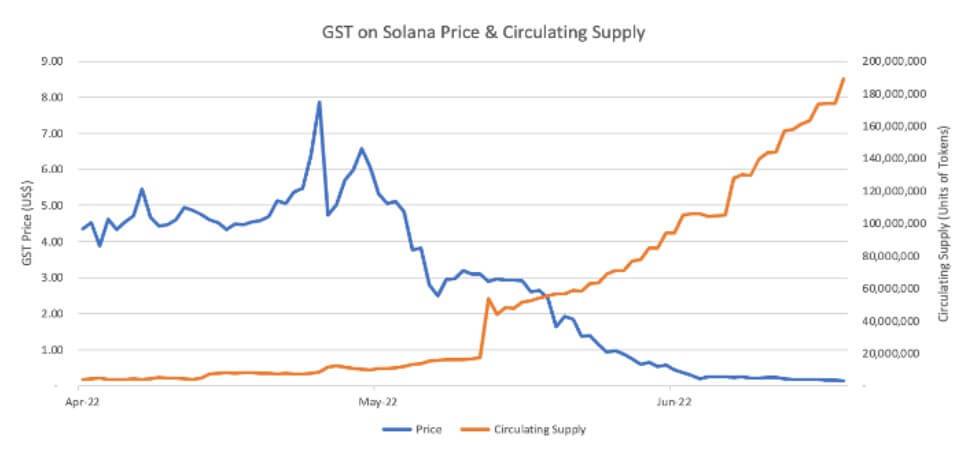

Additionally, while NFT marketplace usage may be stable, some popular NFT projects, such as STEPN, are seeing an exodus of users. The value of his GST token in STEPN fell by 99.5% during 2022 due to a surge in players and restrictions on in-game token usage.

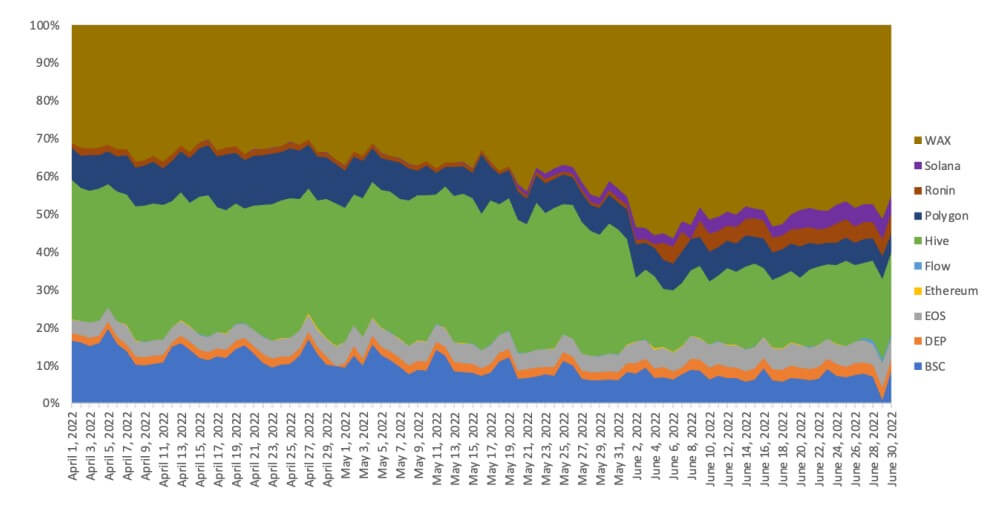

Note that among GameFi overall, Solana has increased market share compared to other chains. The report attributed this to “strong user statistics from Gameta, with Solana ranking as the top game chain since Q2.”

While the report concludes by establishing that concerns over Solana’s network instability still exist, Bybit said, “We are optimistic about the new upgrades announced during the quarter.

Increase network stability and reduce the likelihood of future outages.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024