No products in the cart.

- Latest

- Trending

ADVERTISEMENT

It’s been four weeks since the Celsius Network suspended withdrawals, swaps, and remittances between accounts because of “extreme market conditions.”

During this time, senior staff have been criticizing the company’s management mistakes. In particular, it takes a looser approach than risk management.

Nevertheless, since the beginning of July, the company has taken proactive steps to prevent bankruptcy. This includes a 150 staff reduction and a series of large loan repayments to mitigate liquidity risk.

Commenting on the spread of repayments, crypto investor Mile Deutscher called the order of the events “notable.”

Celsius’ #bitcoin The loan has been paid off completely.

Remarkable.

Miles Deutscher (@milesdeutscher) July 7, 2022

A common sentiment among Celsius users is the hope and expectation that normal operation will resume soon.

Celsius hasn’t given any updates since June 30 The team confirmed its efforts to “stabilize liquidity and operations,” such as considering debt restructuring.

Twitter account @BTCKYLEWho Disclosure He saved Bitcoin’s life in Celsius and posted the latest information on the numerous payments the company made. He posted:

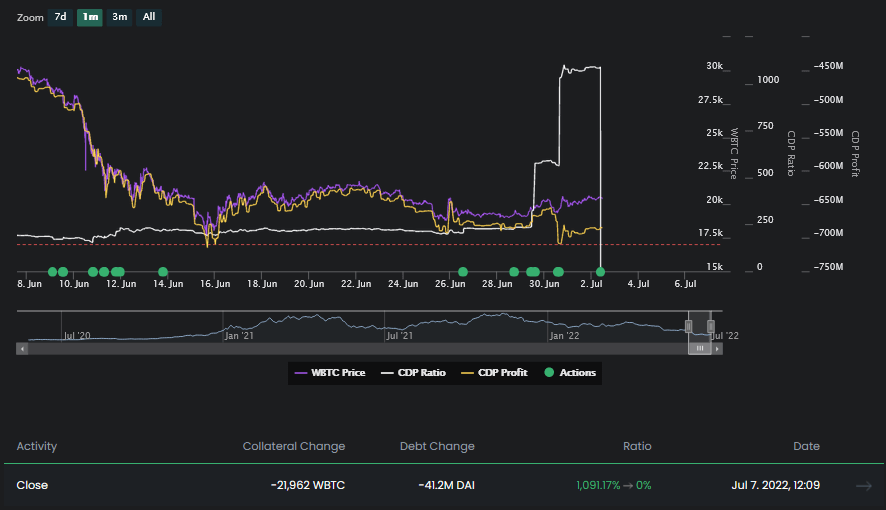

When paying back the Maker loan on July 4, Celsius used the protocol to clear the entire loan. On-chain analysis Shows that the company suffered a $ 1 billion loss in contract.

However, the company returned 21,962 wBTC ($ 440 million) as collateral. There is speculation about whether to speculate on this and strengthen the balance sheet.

Other events in Celsius saw the board shake up on July 6, according to the British filing. Companies House service.

Gilbert Nathan, John Stephen Dubel and Laurence Anthony Tosi are gone. At the new board, David Barse and Alan Jeffrey Carr have been appointed to sit with CEOs Alex Mashinsky and CSO Thromi Daniel Leon.

Bath Founder and Chief Executive Officer of XOUT CapitalFounder of, providing quantitative research on technology disruption DMB HoldingsPrivate Equity Family Office.

car I’m the CEO of Drivetrain, a company that specializes in. Restructuring services for “poor” companies.

Nevertheless, @blockchainchick He commented that positive progress meant nothing until the withdrawal resumed.

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

Price snapshot

Other contexts

Join now for $ 19 per month Explore all the benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024