No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Following the recent collapse of FTX, the fallout of Three Arrows Capital has spread to Genesis, which was already bailed out by parent company Digital Currency Group (DCG) earlier this year.

There are growing concerns about the possible spread of the Greyscale Bitcoin Trust and Digital Currency Group, but are these concerns valid?

According to Nathaniel Whitmore on the Coindesk podcast, breakdownDCG is a $1.2 billion creditor of Three Arrows Capital. For transparency, CoinDesk is owned by DCG.

Genesis recently announced that it will stop withdrawing the Genesis Earn program. Additionally, news began to circulate that the company may be owing him as much as $1 billion.According to The Wall Street Journal paperthe company sought a $1 billion loan following the collapse of FTX, but no deal was made.

Adam Cochran, partner at VC firm Cinneamhain Ventures, said: broke down We have analyzed DCG’s assets to assess whether a potential $1 billion hole in its balance sheet could further hurt the cryptocurrency market.

Specifically, DCG-owned companies include crypto custodians, BitGo, web3 browser, Brave, USDC issuer, Circle, crypto news organization, CoinDesk, and many other major companies that form its heart. Portfolios containing cryptocurrency projects may be at risk of further contagion. industry.

If DCG continues to struggle, it could be devastating for the entire industry. ArchPublic co-founder Andrew Parish said on Nov. 20 that he responded to Genesis’ funding request, including a rejection from his critical crypto-focused VC firm, as a “zero taker.” ‘ claimed to have been.

B2C2 No

Fortress No

Jump No

Galaxy “No”

Apollo “No”**And there is no crypto-focused fund with meaningful appetite, let alone liquidity of scale.

Andrew (@AP_ArchPublic) November 20, 2022

posted by parish update A few hours later, B2C2 claimed it could accept a very small investment to cover part of Genesis lending book.

The collapse of Genesis could have a much bigger impact on the entire cryptocurrency industry than FTX. Genesis is a key part of the institutional infrastructure currently in place within the crypto industry.company was the first OTC Bitcoin A trading desk founded in 2013. 2020CEO at the time, Michael Moro, claimed Genesis was on track to “stand shoulder-to-shoulder with the world’s top financial institutions.”

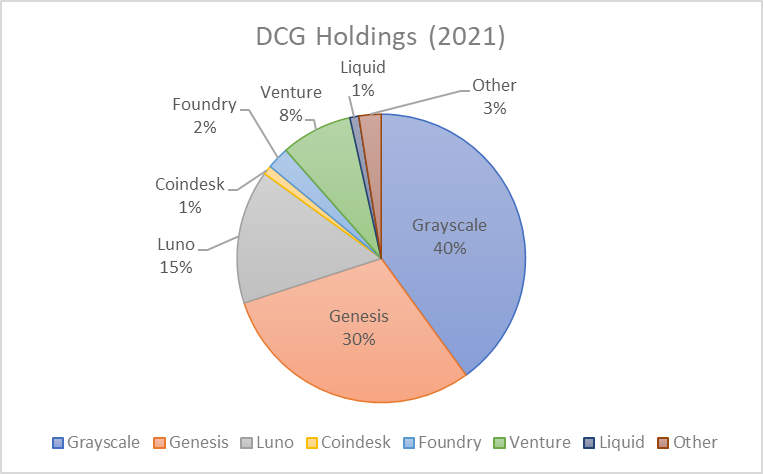

Cochran outlines DCG’s “empire” baseline, which as of 2021 will reach approximately $38 billion in assets under management.

2/18

We know they were valued at $10 billion if sold to Softbank in 2021, with GBTC around $500-750 million in fees that year and $38 billion in AUM. .

This will give you a rough idea of the value of each component in your empire. pic.twitter.com/G5V1fIe5WD

Adam Cochran (adamscochran.eth) (@adamscochran) November 19, 2022

In addition, Cochran estimated the following rough breakdown of DCG holdings across portfolios based on certain assumptions of previous investments.

As of October 2022, Genesis is no longer participant It is included in Grayscale Bitcoin Trust but will continue to act as a liquidity provider for Grayscale.

But on November 16th, Greyscale Distant Its assets are now held at Coinbase, which itself is far removed from Genesis as it has announced that it is “not a trading partner or service provider for Grayscale products.”

However, this statement is contradicted by: previous statement On Oct. 3, Grayscale CEO Michael Sonnenschein told CoinDesk that Genesis is the “sole liquidity provider” and there is no need to diversify.

Today, Genesis continues to be our sole liquidity provider, and we have had only positive relationships with them dating back to 2013, so we see no need to expand.

Sonnenshein expanded by commenting, “Genesis will continue to process the cryptocurrency purchases underlying Grayscale’s trust.” There is no further announcement on Greyscale’s official news channel regarding the dismissal of Genesis from this position.

Greyscale defines the need for a “liquidity provider” as a way to ensure that “investments are executed.”

By working with a liquidity provider like Genesis, we can tap into a variety of digital asset or protocol markets to ensure that our investments are executed in a timely manner.

Small print on Grayscale’s website includes a note stating that the product was distributed by Grayscale Securities and that “prior to October 3, 2022, the product was distributed by Genesis Global Trading, Inc.” is included.

Yet confusingly, a statement released by Greyscale on November 18 confirmed that Greyscale had not contacted Genesis after about 56 days.

No other entity, including DCG, Genesis, and other Grayscale affiliates, controls the digital assets underlying Grayscale products.

Given that less than two months later, Genesis was confirmed as the liquidity provider tasked with purchasing the underlying cryptocurrency of the Grayscale Trust, the accuracy to Genesis and DCG at this point is astounding. It is difficult to ascertain proper exposure.

Genesis appears to have been bullish on the future of Bitcoin price discovery recently, as the company’s strategists weren’t able to call it Bitcoin’s top. In November 2021, a Genesis strategist claimed that Bitcoin’s price drop from $69,000 to $55,000 was simply a “natural breather.” Since the statement, Bitcoin has fallen another 70%, below $17,000.

Currently, Grayscale Bitcoin Trust is transaction At a 43% discount on net asset value (NAV), that means Bitcoin held under the trust is currently valued at around $9,300.

Cochrane then assessed the potential real-world value of each portion of DCG’s portfolio and examined the liquidity available for each investment. Cochrane made some assumptions in establishing the ratings for each element, so the numbers should be considered hypothetical, using publicly available information and his own professional insight.

However, Cochrane concluded that DCG would need to sell an equity, venture, liquid crypto asset, or one of its flagship brands to raise $1 billion.

14/18

So, to hit $1 billion, it seems like you’ll need to:

– sell shares

– sell all ventures

– sell all liquids

– Sell Luno/Coindesk/Foundry (if worth)And I hope they get good value for it all.

Adam Cochran (adamscochran.eth) (@adamscochran) November 19, 2022

Former Goldman Sachs trader Patrick Feeney backed up the claim that Grayscale and later DCG were in trouble.feeney Claim Avoided FTX collapse by assessing Sam Bankman-Fried’s body language and avoiding “MtGox, BTC-e, Cryptsy, Cryptopia”.

Feeney argued that DCG and Grayscale are in a “tough situation” with a lack of liquidity and “massive lending problems.”

This is the tricky part. This means that there is not enough liquidity. Therefore, the problem of lending, non-hedging mechanisms, and inadequate assumptions of risk are too great. Amaranth was the same. But unlike here, Amaranth said that by the fall of 2007, at $4 billion he had 10x leverage and it took him three weeks to blow up 4/n of Nat Gas. It was mkt.

Feeney Factor (@TheFeeneyFactor) November 19, 2022

Cochran concluded that DCG may need to rely on someone “overpaying” for some of its GBTC or Genesis holdings to avoid further problems.

16/18

Maybe someone overpays for something and gets lucky, or they can sell part of Grayscale or Genesis to a big company like Fidelity.

But you may have to scuttle everything else to save the Golden Goose here.

Adam Cochran (adamscochran.eth) (@adamscochran) November 19, 2022

Arthur Hayes contributed to the discussion share medium paper By data innovation. The article summary states

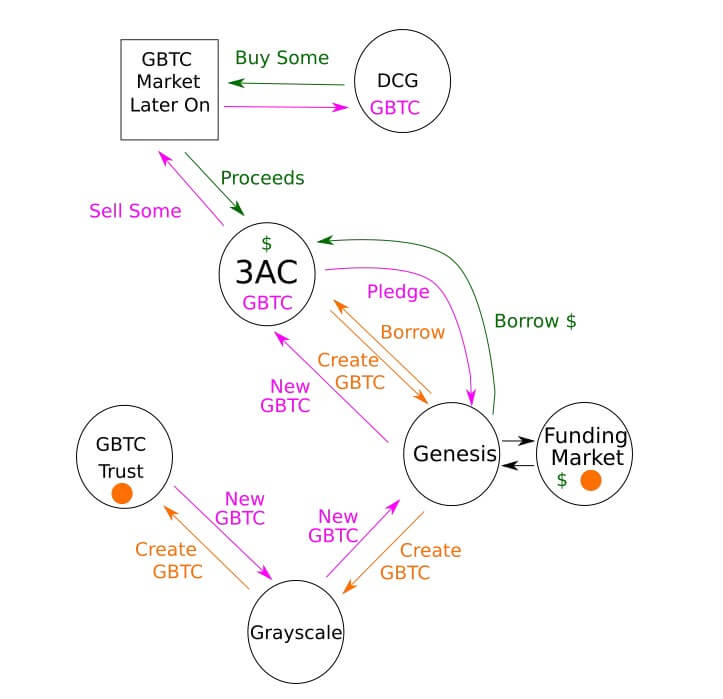

DCG and 3AC appear to have engaged in some scheme to extract value from the GBTC premium.

The article claims that Genesis, DCG, Grayscale, and 3AC created a circular infrastructure for borrowing and lending BTC to create GBTC shares to squeeze money out of the GBTC premium. To this end, we analyzed publicly available data.

Given that both Grayscale and Genesis are SEC-registered, DataFinnovation argued that “regulators wouldn’t have a hard time understanding this.” While some of what is discussed in the above analysis may be considered speculation, DataFinnovation makes an important point. The truth may come out as the investee is clearly under regulatory scrutiny. The question is, what impact will it have on the global crypto market?

Crypto bear markets are notoriously tough. For example, in 2018, the global market capitalization of this industry fell from $828 billion in January 2018 to just $100 billion in September 2018.

On November 9, 2021, the crypto industry’s market capitalization reached $2.8 trillion. However, his market cap is down 70% to $831 billion at the time of writing. Thus, the 2018 bear market bottom was 17% lower than today. A surrender equivalent to the 2018 collapse would leave the current global market cap at just $350 billion.

If DCG, Greyscale, or Genesis face insurmountable financial hardships, a new catalyst could enter the arena as the market tests its 2018 bottom.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024