No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Investors quickly made about $260 million in Ethereum (ETH) rival Phantom (FTM), according to crypto analytics platform Santiment.

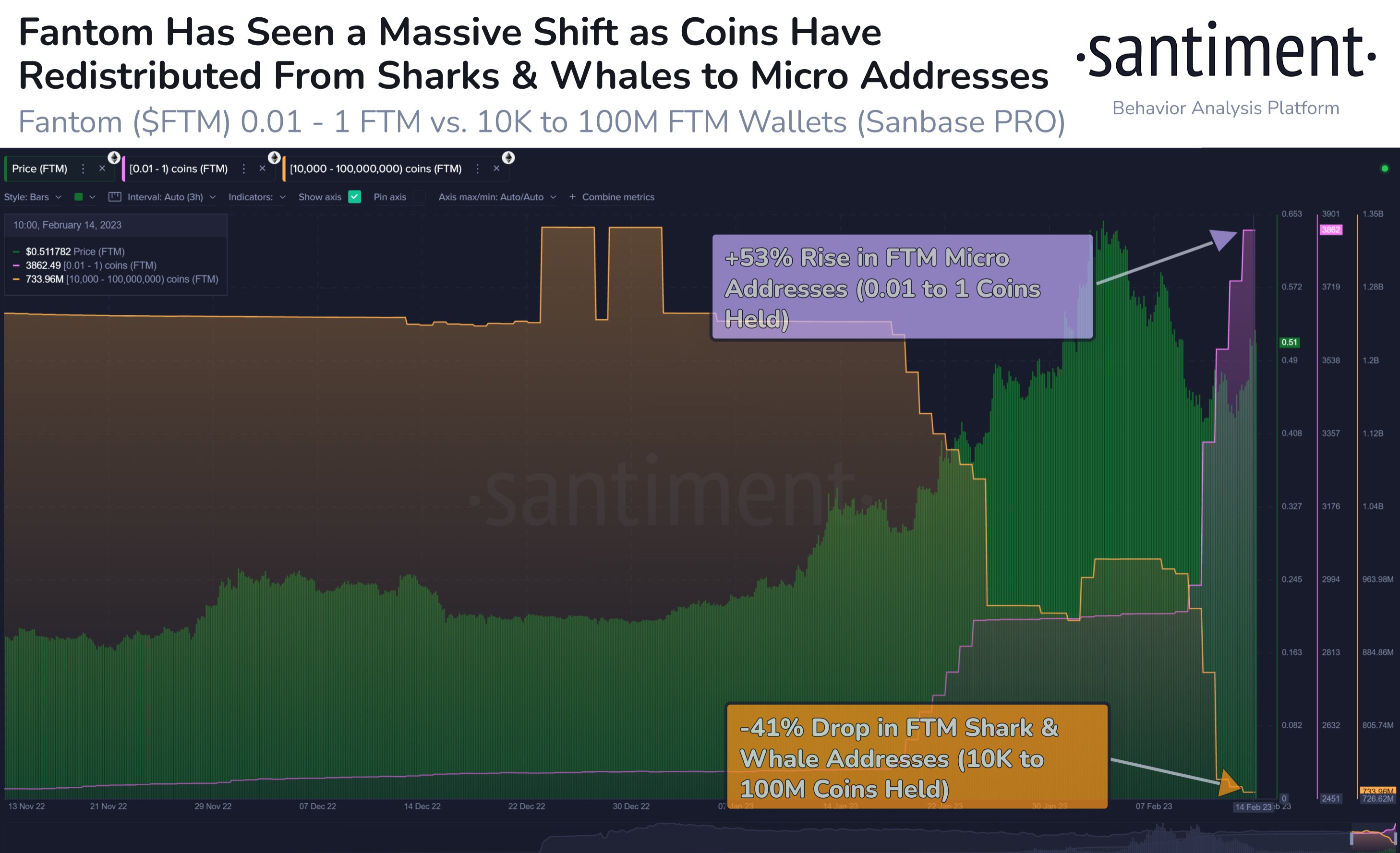

Santimento To tell Sharks and Whales unloaded $259.7 million in FTM in a matter of weeks as Phantom prices skyrocketed this year.

However, most of the unloaded tokens were obtained by smaller destinations holding 0.01 to 1 FTM token.

Fantom Shark and Whale addresses dropped significantly during this 2023 rally. Addresses holding between 10,000 and 100 million FTM dropped $259.7 million worth of coins in the last four weeks. These coins are mostly scooped by microaddresses holding 0.01 to 1 FTM.

Fantom started the year at $0.200 and hit a high of $0.656 on February 3rd, up 228%. Fantom is trading at $0.55 at the time of writing.

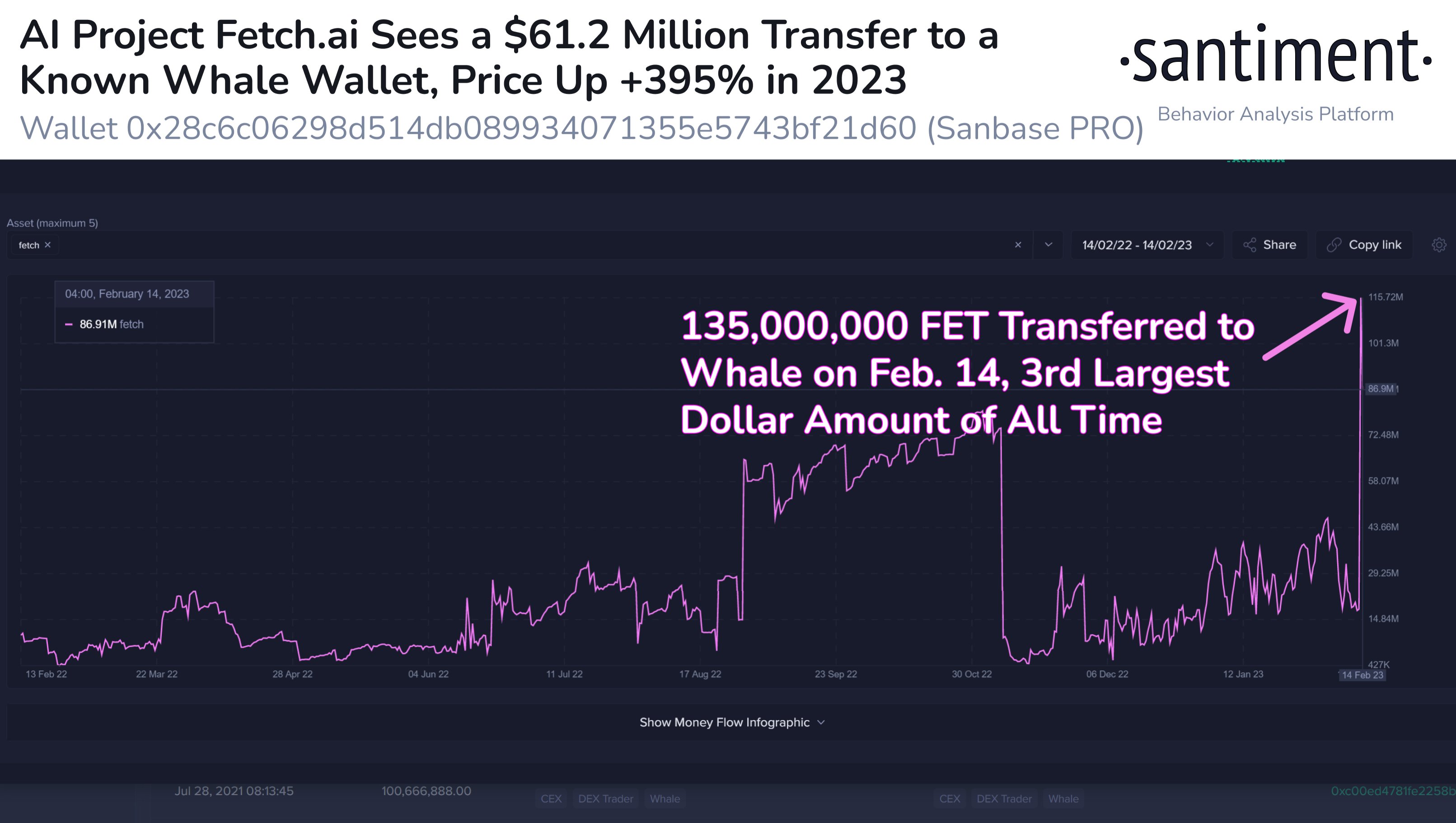

Santimento too appear The rapid rise of artificial intelligence (AI) blockchain project Fetch.ai (FET) drew attention to the massive 135 million FET whale deal on February 14th.

Fetch.ai became the 102nd largest asset by cryptocurrency market capitalization after surging +395% in 2023, recording the largest transaction in 567 days. It also holds $224.46 million of Ethereum (ETH) transferred to the address.

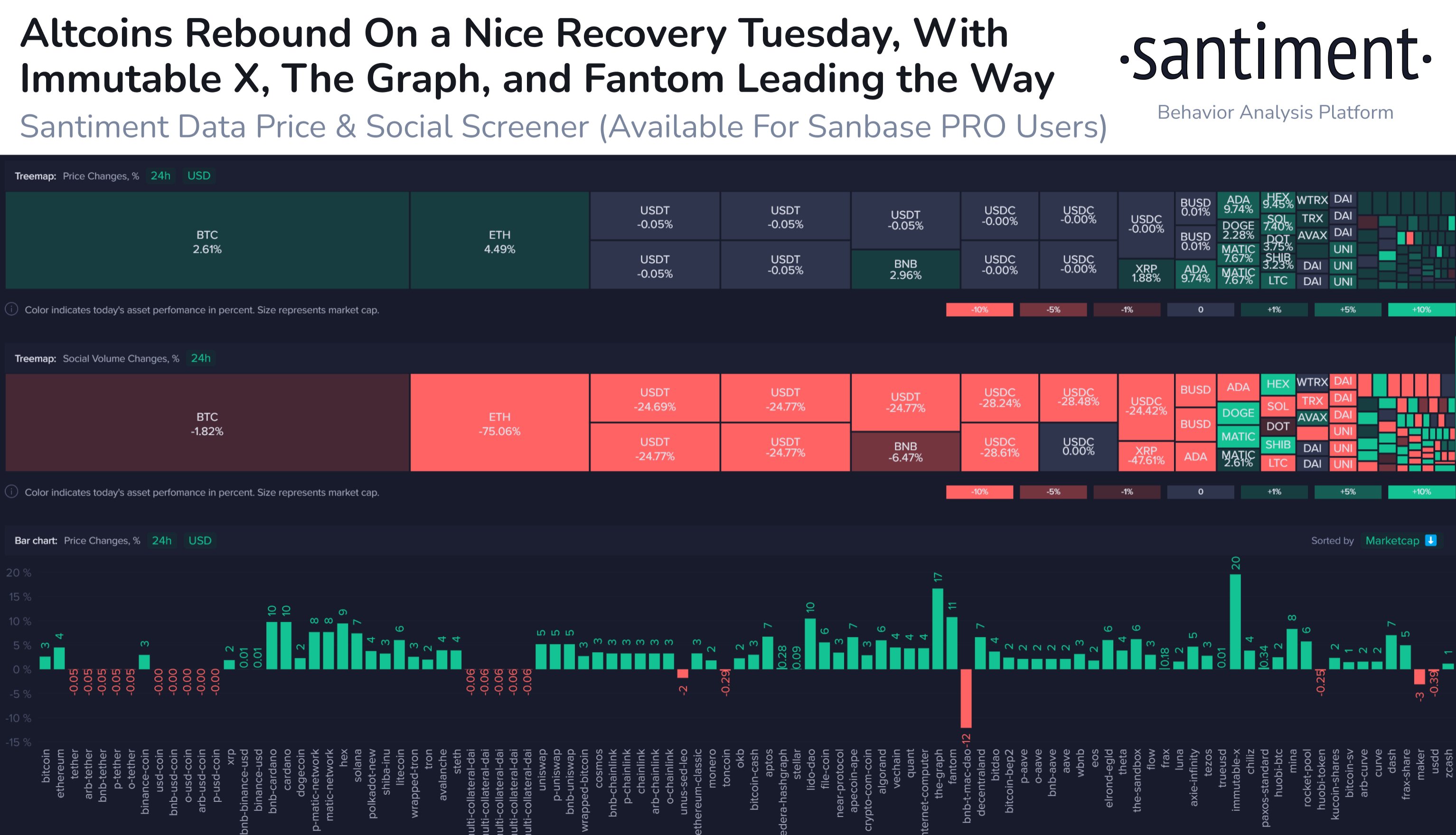

Hygiene To tell Overall altcoins show a lot of strength again as NASDAQ and tech stocks rose on Feb 14. Strongest performers are FTM along with Immutable X (IMX) and The Graph (GRT) they say.

Altcoins have rebounded heavily as the Nasdaq and tech stocks performed well on Valentines Day. There is still a clear correlation between stocks and cryptocurrencies that traders hope will dissipate.Historical A broken correlation portends a bull market.

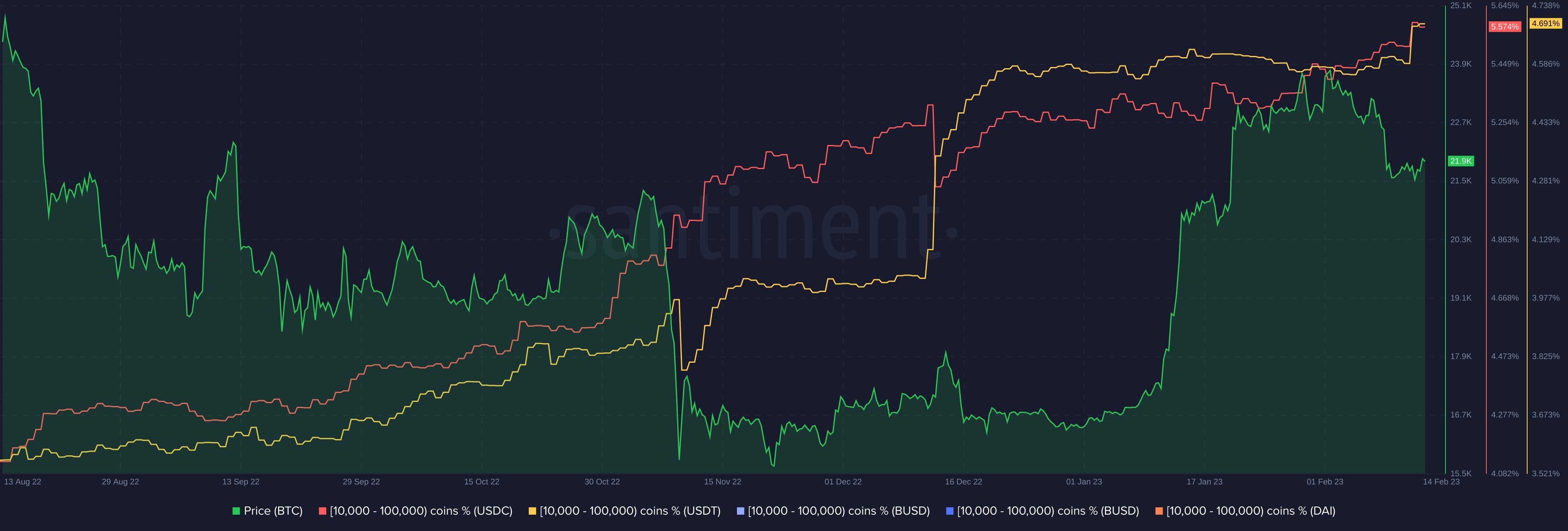

Finally, an analytics company To tell Small shark investors are fleeing stablecoin Binance USD (BUSD) after the Wall Street Journal. report The US Securities and Exchange Commission (SEC) plans to sue its foundry company Paxos for violating investor protection laws. Paxos has already agreed to stop issuing stablecoins, but will continue to redeem them. The BUSD shark invests in Tether (USDT) and USD Coin (USDC) instead.

Amidst the BUSD frenzy, there is a rapid decline in the number of Binance stablecoin small shark addresses being sued by the SEC. Instead, these sharks are increasing their positions in USDT and USDC instead. .”

Don’t Miss a Beat Subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook and telegram

Surf The Daily Hodl Mix

Generated image: In the middle of the journey

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024