No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Coinshares, Europe’s largest digital asset investment group, believes the current crypto market has “only marginal negative sentiment” after a severe bear market in 2022.

Coinshares as Bitcoin May Hit $18,000 for First Time Since Mid-December analysis It has become clear that the outflow of funds from the world’s cryptocurrency funds is beginning to weaken. A recent blog post shows that Bitcoin has only lost $6.5 million and sentiment remains negative.

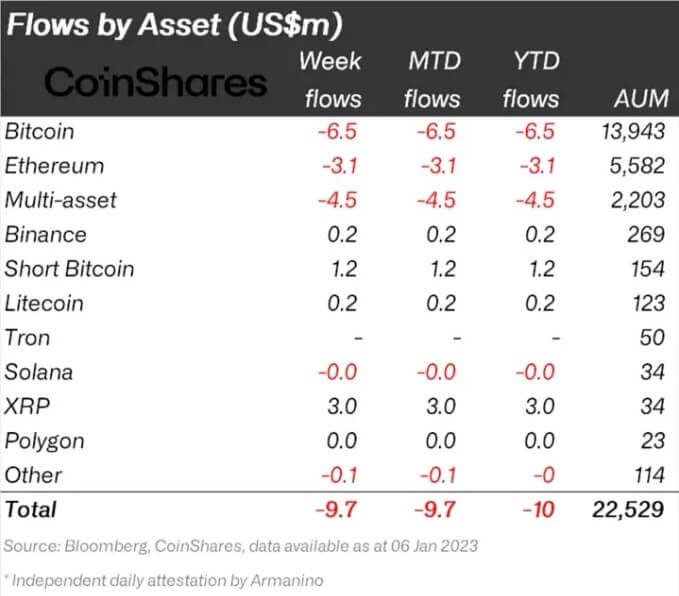

Digital asset investment products saw a total outflow of US$9.7 million, highlighting the continuation of the mild negative sentiment that has persisted for the past three weeks.

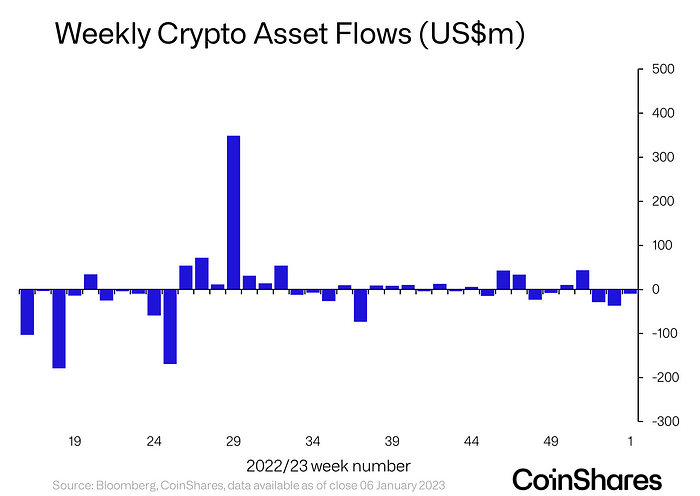

The chart below shows continuous outflows from cryptocurrency funds consistently over the past six months, with only five weeks of inflows over the entire period. However, outflows fail to accumulate substantial amounts as the numbers suggest that inflows and outflows have offset and remain reasonably flat.

The largest weekly outflow in the last 52 weeks amounted to about $175 million, while the largest inflow amounted to about $350 million.

18 weeks of outflows equals 17 weeks of inflows in a difficult bear market over the past 52 weeks.

However, Ripple’s XRP “reversed the trend” and saw an inflow of $3 million last week. Coinshares believes it has “improved the clarity of its litigation with the SEC.”

Alongside XRP, other assets that have avoided positive outflows include Binance (BNB chain), Litecoin, and Polygon. These assets either had nominal inflows or remained flat throughout the week.

The bearish trend within the crypto has yet to be broken, as highlighted by the $1.2 million inflow into the Short Bitcoin fund.

CoinShares described the trend as continuing mild negative sentiment that has persisted for the past three weeks. However, the first graph clearly shows that the increase in outflows seen during the FTX crisis has decreased in the first week of 2023.

According to Coinshares disclosure, it currently manages $1.4 billion in assets. The crypto fund aims to serve those seeking exposure to crypto through traditional exchange-traded products (ETPs).

As investors move to cold storage following the demise of BlockFi, Voyager, Celsius, and FTX, such investment vehicles may no longer fully represent sentiment across the cryptocurrency market.

Crypto exchanges differ from ETPs in many ways, but the custodial nature of the offering poses similar risks given that ownership of the underlying crypto assets does not belong to investors.

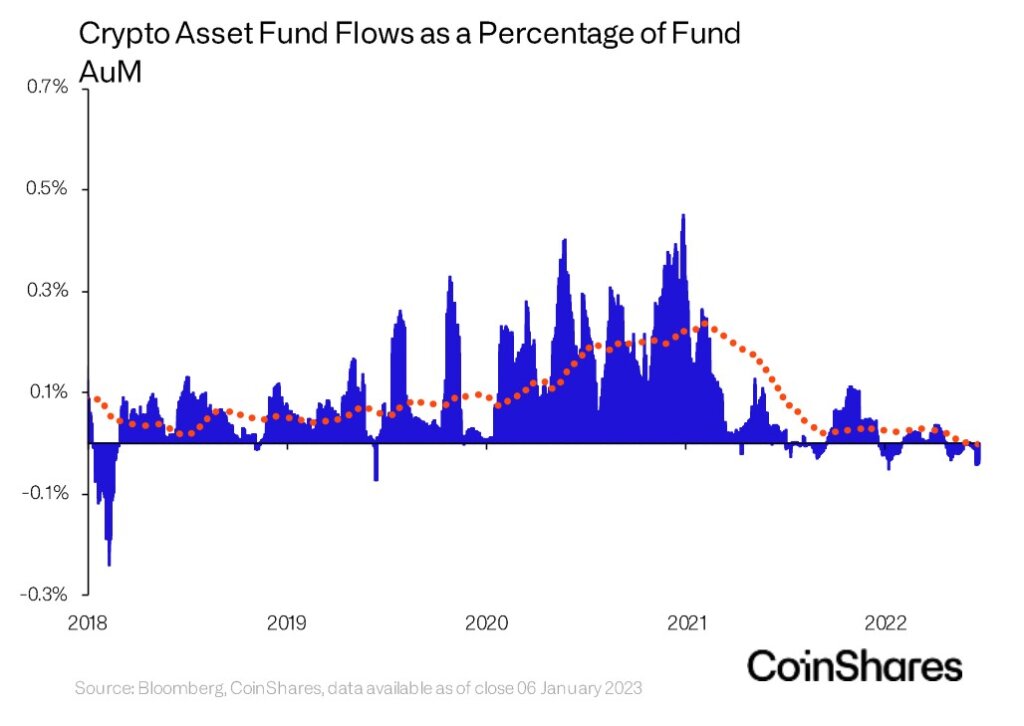

Overall crypto fund flow is negative as a percentage of global assets managed within investment funds. After peaking at around 0.25% of global capital flows at the end of 2020, crypto funds experienced a significant decline in the 2021 bull market.

Funds such as Grayscale Bitcoin Trust have been under the spotlight of crypto investors in recent weeks as they trade at extreme discounts amid turmoil within parent company Digital Currency Group. rice field.

However, on January 10, GBTC surged 12%, and in 2023 the discount rate fell by more than 20%. It remains to be seen whether the price movement of the fund, which secures its status as an important investment vehicle for those with limited access to cryptocurrencies, has shown. up in the air.

In any case, the minimal impact of crypto ETPs on the broader ETP market shows how little institutional crypto exposure is in the market compared to traditional assets.

Currently, the total amount of crypto assets under management across funds has reached $22.5 billion, of which $14.9 billion is held in Grayscale.

In contrast, US ETFs suffered losses. $596.9 billion By 2022, it will be 72 times the total value assets under management of crypto products.of total value of ETP will reach $9.3 trillion globally in 2022, despite net outflows.

Crypto markets still lag far behind traditional financial assets in terms of their impact on the global economy. However, unlike traditional financial instruments, self-custody is a core tenet of cryptocurrencies, and as the crypto industry matures, the move away from ETPs could become a familiar trend.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024