No products in the cart.

- Latest

- Trending

ADVERTISEMENT

This recent run of the crypto market is often compared to the bullish run of 2017. With such limited data in these price ranges, we can only compare the current situation with what was seen three years ago, but what’s different and what will happen this time in the 2021 crypto market?

As Bitcoin celebrates its 12th birthday on January 3, some analysts have warned that Bitcoin is no longer in circulation. Pantera Capital claims that since PayPal announced that it will enter the Bitcoin market, payment giants have purchased 70% of all newly created Bitcoins.

This can have a significant impact on asset liquidity, depending on how the coin is used by other large investors buying PayPal and BTC. In the case of PayPal, you can think of it as expecting that more Bitcoin will be needed to meet the demands of future users.

However, large investment companies may be considering buying as much Bitcoin as possible and holding it for the long term.

Supply limits could push demand up, thus pushing Bitcoin to higher prices, and we could see the beginning of this price action in 2021.

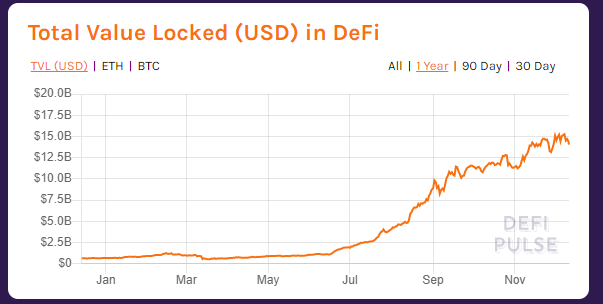

2020, like many others, could be called the Year of DeFi. This is due to a number of DeFi projects that have seen significant price increases throughout the year.

Graph showing DeFiTVL (total value lock) in 2020

Bitcoin is expected to reach the end of the year in the best territory of all time, and investors are looking at the expanded sideways action to invest in altcoin to diversify their crypto holdings. We expect to sell some.

As this liquidity plunges into the altcoin project, the price of undervalued coins can rise significantly. This is great for crypto investors who can make a profit, but even more important for project developers who can use these pumps to fund their projects, and cryptocurrencies for alternative seasons. Make it an important and healthy part of industry development.

In 2021, many altcoins may continue due to the influence of Bitcoin. But how can you make a price forecast to find out which prices are soaring, which are flat lines, and never get going?For this i recommend NikPatel’s blog Here you can find excellent resources for choosing altcoin.

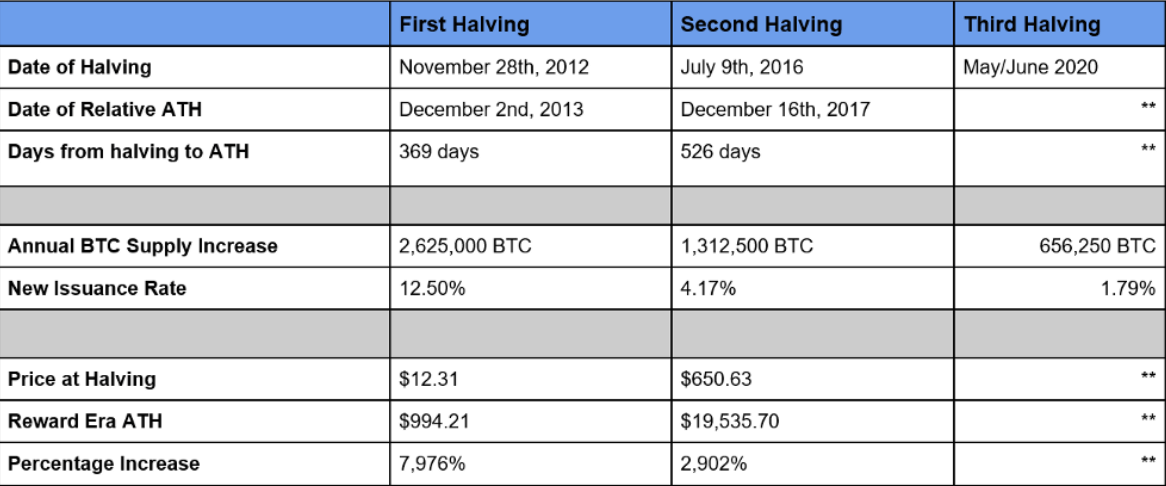

Back in May, Bitcoin was halved to the third half, which halved the miner’s block reward. There is usually a lot of speculation about how the market will react when these events occur, but much more straightforward is the relative all-time maximum (ATH) date following these events. is.

As can be seen in the table below, new highs tend to arrive in December of the year after the half has taken place. Therefore, if this trend continues, investors may consider accumulating Bitcoin from now until December 2021 at this time of next year in order to maximize profits.

Another thing to consider with this in mind is that many analysts predict at the end of the year as Bitcoin could accumulate much of 2021 and spend it building higher lows. That means it could jump to a price of $ 50,000.

Images taken from the Fitzner Blockchain blog Moderate

Over the last few months, PayPal has announced its integration into cryptocurrency payment platforms, with a flood of institutional investors investing in Bitcoin such as Square and Grayscale.

This trend is expected to continue for many until next year, the latest being Ray Dalio.Billionaire was doing Reddit AMA (Ask me anything) When the Bitcoin topic was raised.

Dario writes:Bitcoin (and some other digital currencies) has had similarities and differences with gold and other limited supply mobile (unlike real estate) wealth stores over the last decade. I think it has established itself as an interesting gold-like asset option. Therefore, it can serve as a diversification into the storage of gold and other such wealth assets.“

This is in stark contrast to Dario’s previous comments on Bitcoin when he was very critical of cryptocurrencies. In 2021, more prominent hedge fund managers such as Billionaire and Dalio may begin to soften their stance on cryptocurrencies as they begin to realize the benefits of adding digital assets to their portfolios.

The news could come in the form of these individuals announcing their accumulation of Bitcoin shares in the hope of encouraging others to enter the market to improve their position. I have.

Overall, 2021 will be an exciting year for the crypto market. We hope that there will be widespread adoption and understanding of how cryptocurrencies can benefit people’s lives.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024