No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Ethereum, the largest value smart contract platform, continues to gain strength against the US dollar, especially in its recent move above $1,600. The recovery is expected to continue after the Federal Open Market Committee (FOMC) meeting two days later and the rate hike decision.

Experts say the cryptocurrency could generally retreat before then, so it can shake off a weak hang before continuing its bullish move to a high above $2,000. Ethereum price is trading at $1,594 at the time of writing, with support around $1,500 expected to absorb mounting selling pressure.

Investors are eagerly awaiting the Federal Reserve’s decision to raise rates and expect regulators to continue with tough measures to curb economic growth. However, market watchers have noted a 25 basis point rise, which is relatively lower than December’s 50 basis point rise.

This positive sentiment comes as general inflation eased to 6.5% in December from a record 7.1% in November. It’s not enough to take the Fed off the accelerator completely, but it shows the economy is headed in the right direction.

The CPI is a measure of the Fed tightening or loosening its grip on monetary measures used to combat inflation, allowing for a recovery in markets where volatility indices are considered high, especially digital assets. .

Ethereum, on the other hand, could still break significantly despite the $1,680 resistance. With the $1,600 temporary support already penetrating, ETH price may be forced to drop to $1,500 before the uptrend resumes. Based on the daily chart, the 200-day exponential moving average (EMA) (in purple) is consolidating support in that area.

Adding credence to the short-term bearish outlook for Ethereum price is the buy signal from the Moving Average Convergence Divergence (MACD) indicator. His MACD line in blue confirmed the call for traders to offload the bag and secure profits (shake off weak hands) by flipping under the blue signal line.

Dr. Profit, an analyst and Twitter trader shared with his legions of followers on Twitter. Analysts have dubbed the pullback a “fake fool,” meaning a “weak hand shake” ahead of the next breakout in a few days.

The same daily chart shows the formation of a descending wedge, the breakout of which allowed Ethereum price to sustain its uptrend to $1,680 in January. Note that the price of ETH is currently trading almost half of its breakout target of 46.55%.

In the event of such a massive rally to $1,947, we would expect a retracement before another sharp move. That said, support at the 200-day EMA is still important for the resumption of the uptrend. However, the bulls can hasten the recovery process by regaining lost ground above $1,600.

This level of support could increase investor confidence in the uptrend, closing the gap to $1,947 and then pushing the odds in favor of a quick move to open the door to gains above $2,000. can be inverted.

Renowned trader and cryptocurrency analyst Rekt Capital has told its 334,000 followers on Twitter that Ethereum is still positioned to break through monthly downtrend resistance. According to his chart, such a move would push the price of Ethereum to $2,275. On the other hand, if this move fails, Ethereum could retest the support at $1,068.

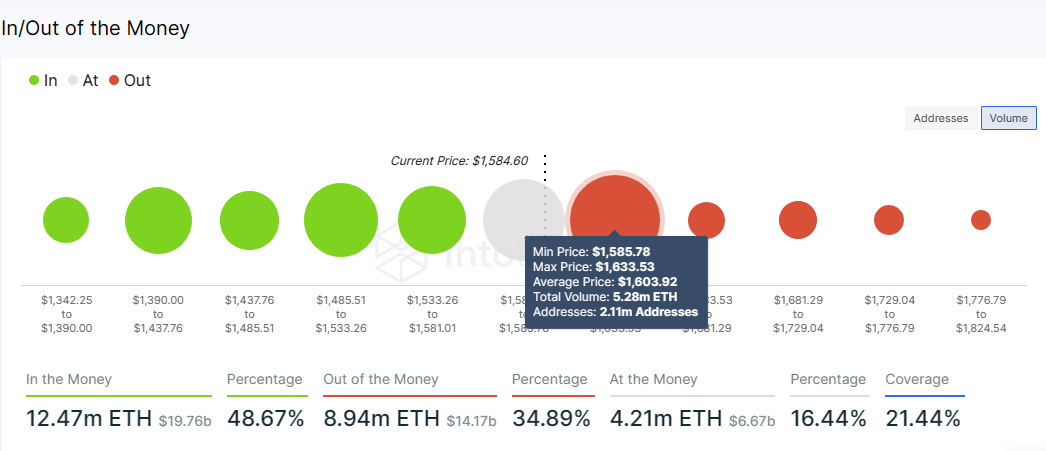

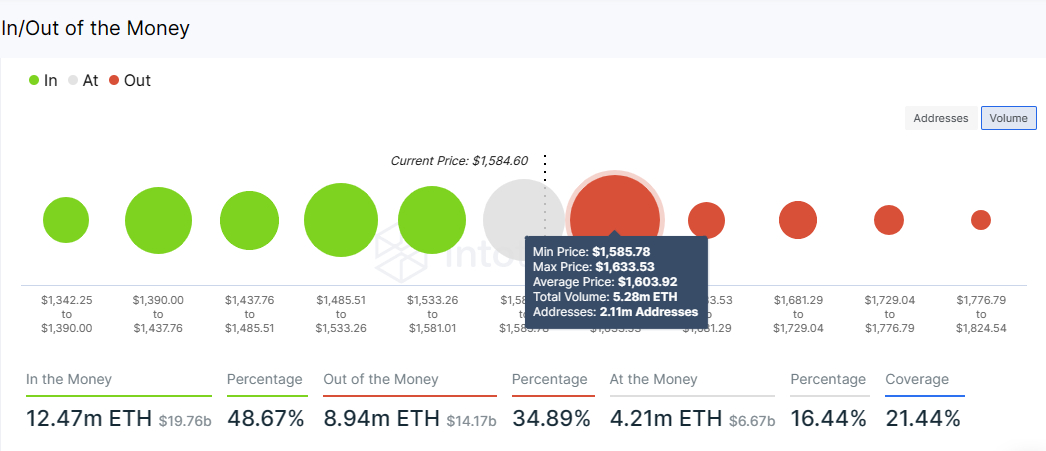

The $1,585 to $1,633 region has at least 2.11 million addresses that have purchased 5.28 million ETH in the past. According to the on-chain data presented by IntoTheBlock (ITB), these addresses are currently out of the money (facing unrealized losses).

The presence of so many sellers in this zone means that overhead pressure could spike as some investors sell at various breakeven points as Ethereum prices recover. . Bulls should prepare for any eventuality that could push the price of ETH to higher levels.

Clearly breaking through this broad seller crowd may be the only boost needed to propel Ethereum to the wedge breakout target of $1,947 and ETH above $2,000.

Conversely, Ethereum support is above a cluster of moderate to strong support areas indicated by the green circles. In addition, we validate the price analysis above.

A bullish outlook for the Ethereum price is highly dependent on the Federal Reserve’s interest rate decision. A breakout of $2,000 is needed to confirm a long-term bullish trend for ETH, but a drop to $1,500 and the $1,400 100-day EMA (blue) cannot be ruled out, at least for now.

That said, breaking $10,000 in 2023 could be a tall order for Ethereum’s price. However, the token could approach an all-time high of $4,878, especially if the bulls support a second recovery phase above $2,000 over the next few days and possibly weeks.

before you invest in ethereumwe recommend considering other likely crypto projects alongside ETH.

We have reviewed the top 15 cryptocurrencies for 2023. crypto news Industry talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talks section features insights from crypto industry insiders and is not part of the editorial content of Cryptonews.com.

Related article:

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024