No products in the cart.

According to CoinShares’ weekly report, digital asset-based investment products recorded a $255 million outflow in the week of March 6-12, marking their fifth straight week of losses.

This amount is also included in CoinShares’ data indicates From March 6, he recorded his 10% decline in total assets under management (AuM) in the week of March 12, “wiping out the inflows seen this year,” according to the report.

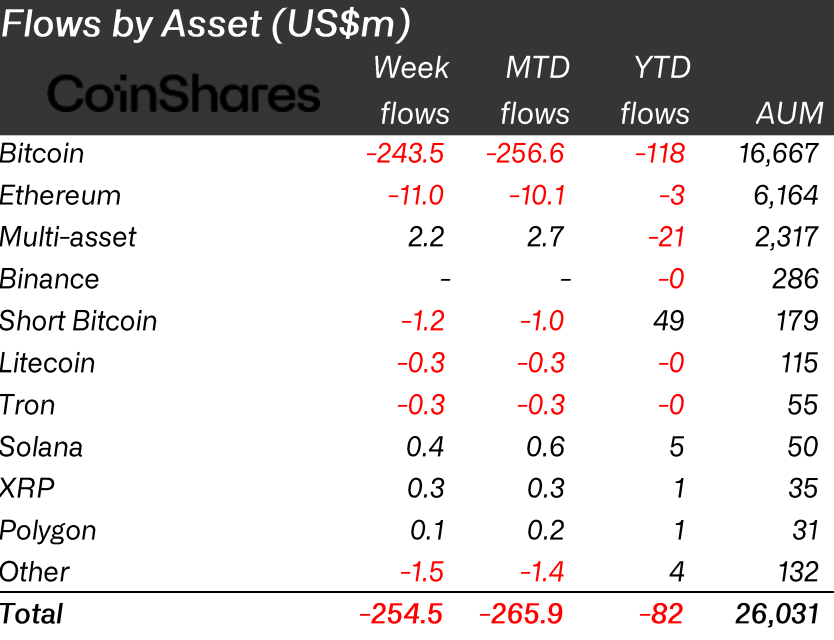

Flow by asset

Bitcoin (BTC)-based investment products saw the biggest outflow last week, with a $243.5 million outflow. This accounted for over 95% of the total spills recorded that week.

Ethereum (ETH) followed BTC with the second highest value of $11 million. Despite recording inflows in the past few weeks, the Short-BTC product recorded his $1.2 million outflow, placing him third in the rankings.

Litecoin (LTC) and Tron (TRX) also recorded 300,000 outflows each. Meanwhile, Solana (SOL), Ripple (XRP) and Polygon (MATIC) finished the week with gains of 400k, 300k and 100k respectively.

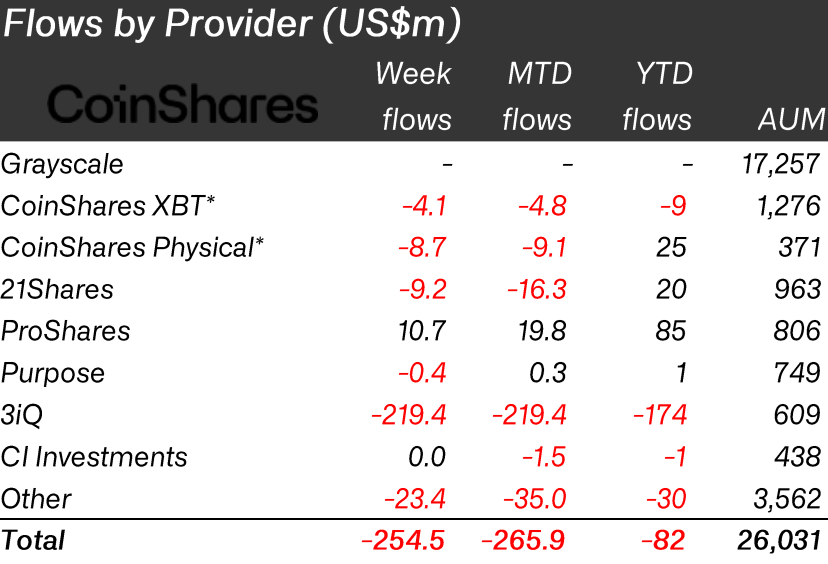

Flow by provider

Looking at fund flows based on provider, 3iQ has emerged as the institution with the highest outflow, recording $129.4 million.

Coinshares spot and Coinshares XBT collectively lost $12.8 million, while 21Shares recorded a $9.2 million outflow. Agencies such as Purpose also recorded $400,000 and $23.4 million outflows last week.

Meanwhile, ProShares emerged as the only financial institution to record inflows, growing $10.7 million in seven days.