No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Gold has long been considered an ideal hedge against inflation. Precious metals have endured the ordeal of an economic meltdown and have risen against the dollar’s crashing value, or so I thought.

Global events in 2022 show that gold may no longer be the best hedge against inflation.

So far, the world has seen war between Ukraine and Russia, US inflation reaching its highest level in 40 years and fears of a looming recession.

But despite this, the price of gold fell 7.07% in the last 6 months.

A closer look at the supply and demand of precious metals makes the idea of gold as an inflation hedge even more flawed.

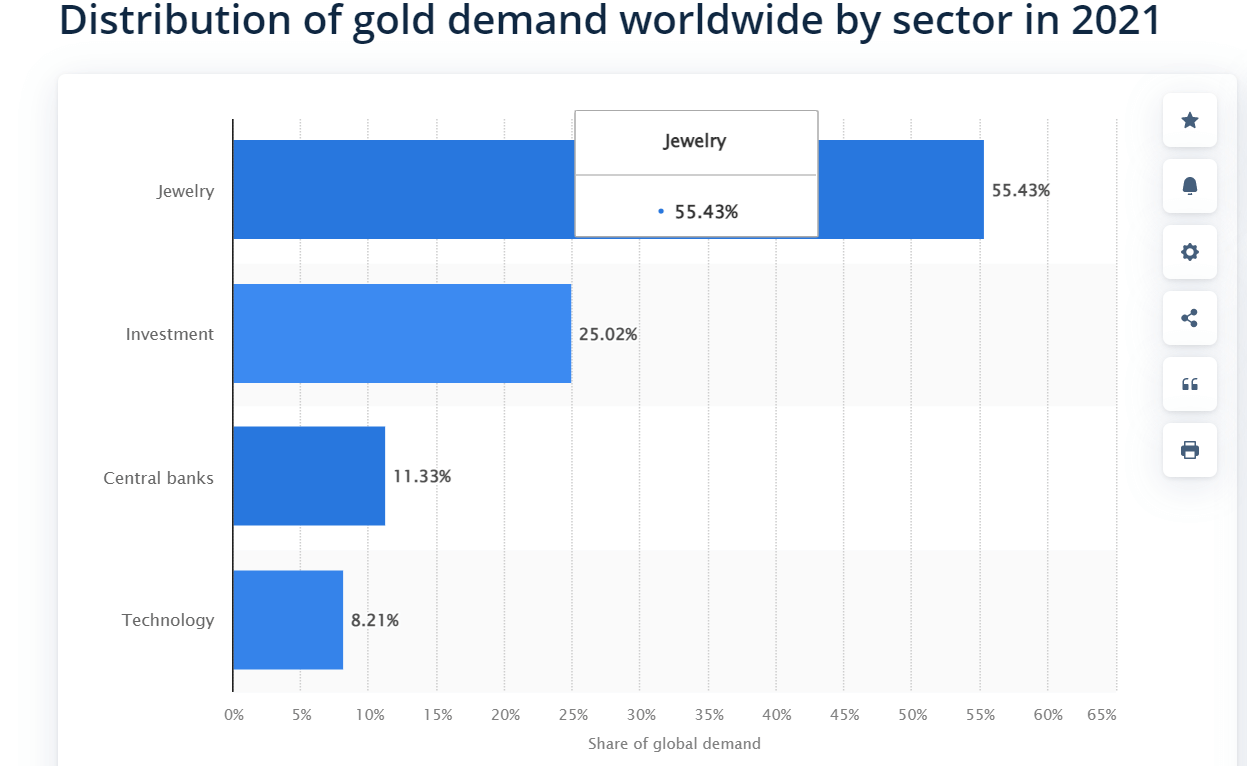

Gold currently has a market capitalization of around $11 trillion. However, more than 50% of that demand is for jewellery, 25% is for investment, and central banks hold about 11.33%.

After the US abandoned the gold standard in 1971, there was a sharp divergence between the value of gold and the value of stocks.

As of January 1980, the market capitalization of gold and equities was $2.5 trillion each.

As of 2022, the market capitalization of equities has ballooned to $115 trillion, while gold is around $12 trillion. The sharp difference in stock value is due to fiat currency.

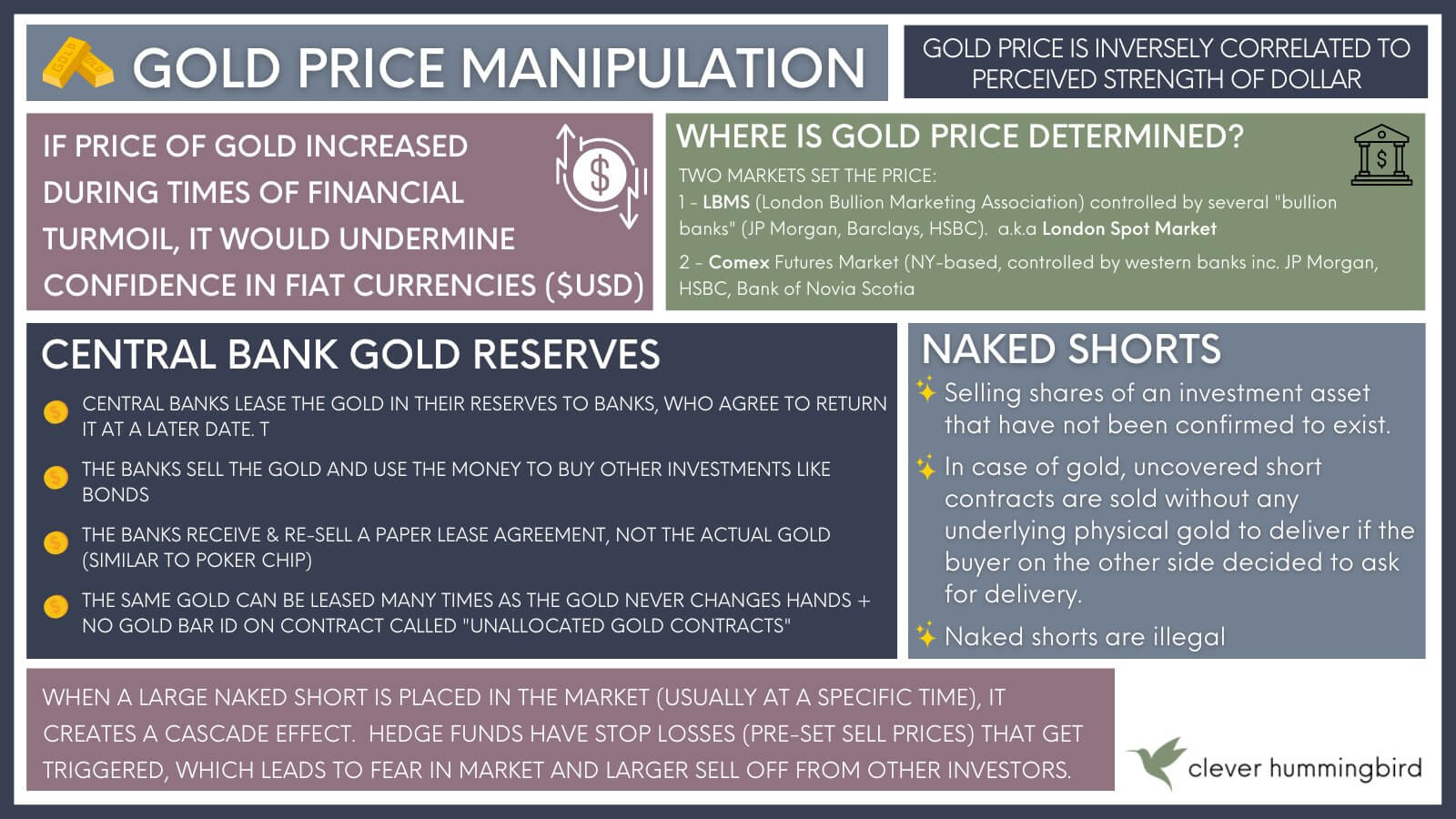

Since central banks hold most of the precious metal, its declining value suggests price manipulation.

Central banks typically lend gold-backed notes to commercial banks.

These banks use certificates to buy bonds and other assets and then sell them for a profit to buy back the certificates.

This and other practices are common ways central banks keep the price of gold low. A significant increase in the value of gold will lead people to sell dollars for gold.

Given that gold and fiat currencies are stores of value that are less likely to be manipulated, Bitcoin (BTC) remains the asset most likely to intervene as a hedge against inflation.

Despite its volatility, Bitcoin has all the qualities that make it the best long-term hedge against inflation. It is anonymous and decentralized, making it difficult to manipulate.

Additionally, its limited supply, durability, transparency, and impossibility of counterfeiting mean it can stand the test of time and continue to increase in value.

Over the past five years, BTC has increased in value by 407% compared to gold’s 35%. Meanwhile, the US dollar has gained 15% in value compared to other currencies, but inflation has reduced purchasing power.

Its volatility is still an issue, but it’s important to understand that Bitcoin’s value as an inflation hedge holds long term.

For context, MicroStrategy’s adoption of Bitcoin helped its stock price outperform stocks of Nasdaq, Gold, Silver, and FAANG.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024