No products in the cart.

- Latest

- Trending

ADVERTISEMENT

of crypto market Some market watchers have just added $50 billion to what they feared would be the beginning of the next drop with a revisit of this year’s lows.

But what is behind this massive price increase across the crypto complex?

It can be seen that several factors overlap.

First, the deleveraging event appears to have come full circle, and there may be no more falling dominoes. After Terra VoyagerCelsius and Three Arrows CapitalNo more shoes have fallen yet.

Second, sellers may be exhausted as major coins such as Bitcoin are in oversold positions.

We can add a third factor related to that. Whales are about to occupy new positions We believe we are at or near the bottom of the crypto market.

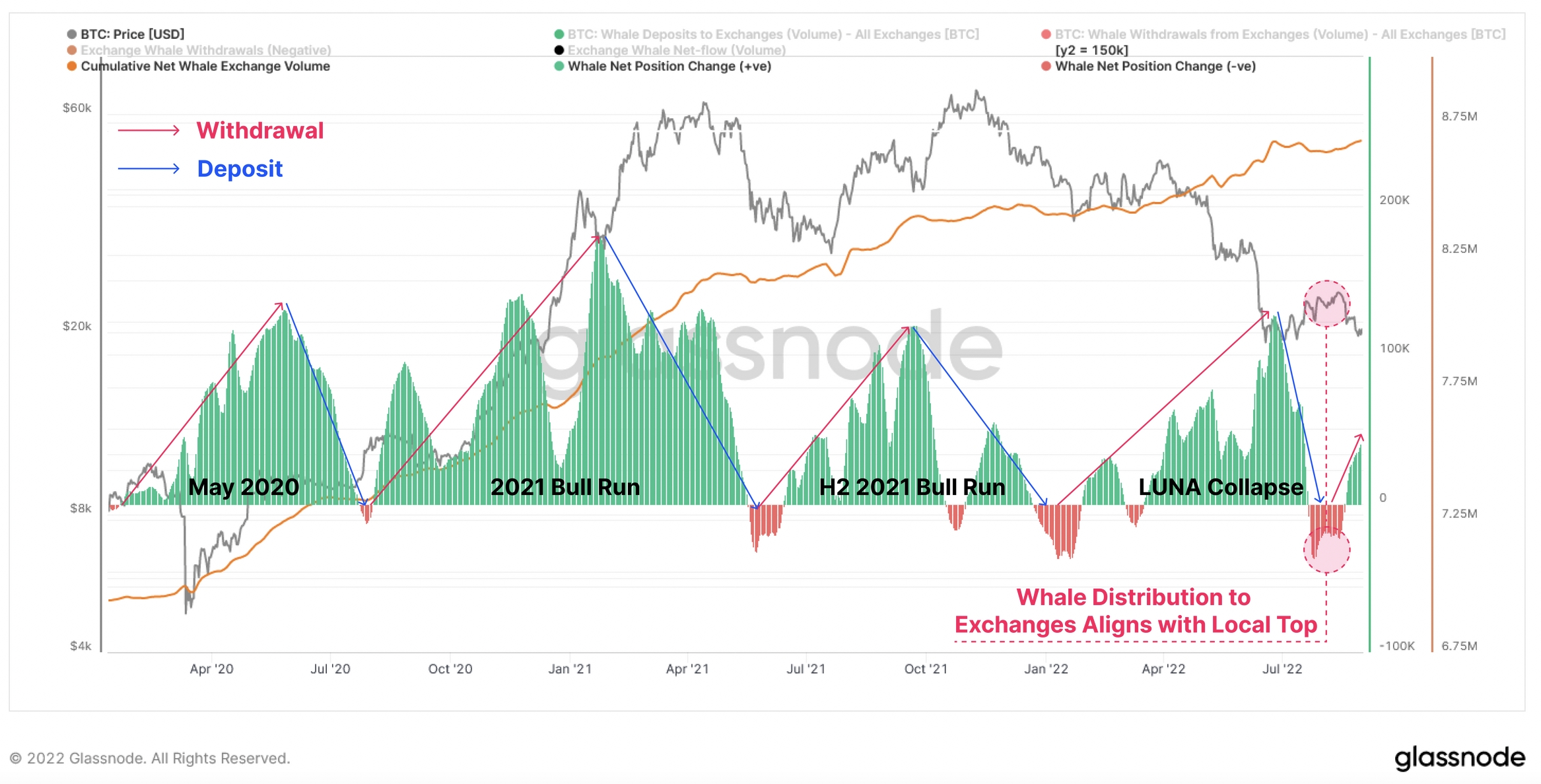

A 1,000 Bitcoin whale has been distributed to exchanges following the collapse of Luna (more on Luna below). glass node It shows how the distribution of whales is consistent with the top of the region.

Fourth, other asset classes and macro-environmental conditions must be considered, and this background music could trigger today’s impressive turnaround.

There was no statement from Fed Chairman Jay Powell that he would be slowing the pace of rate hikes, but there were signs elsewhere that the dark clouds had gone too far in the stock market.

For example, in China, producer price inflation data The performance was better than expected, raising expectations for further stimulation.

European gas prices fell on expectations of easing measures emerging from European policymakers today.

This led to bond prices falling, but oil rose and so did gold. But the general good vibes in the stock market have had an impact on other risk assets as well. Crypto is the ultimate risk asset.

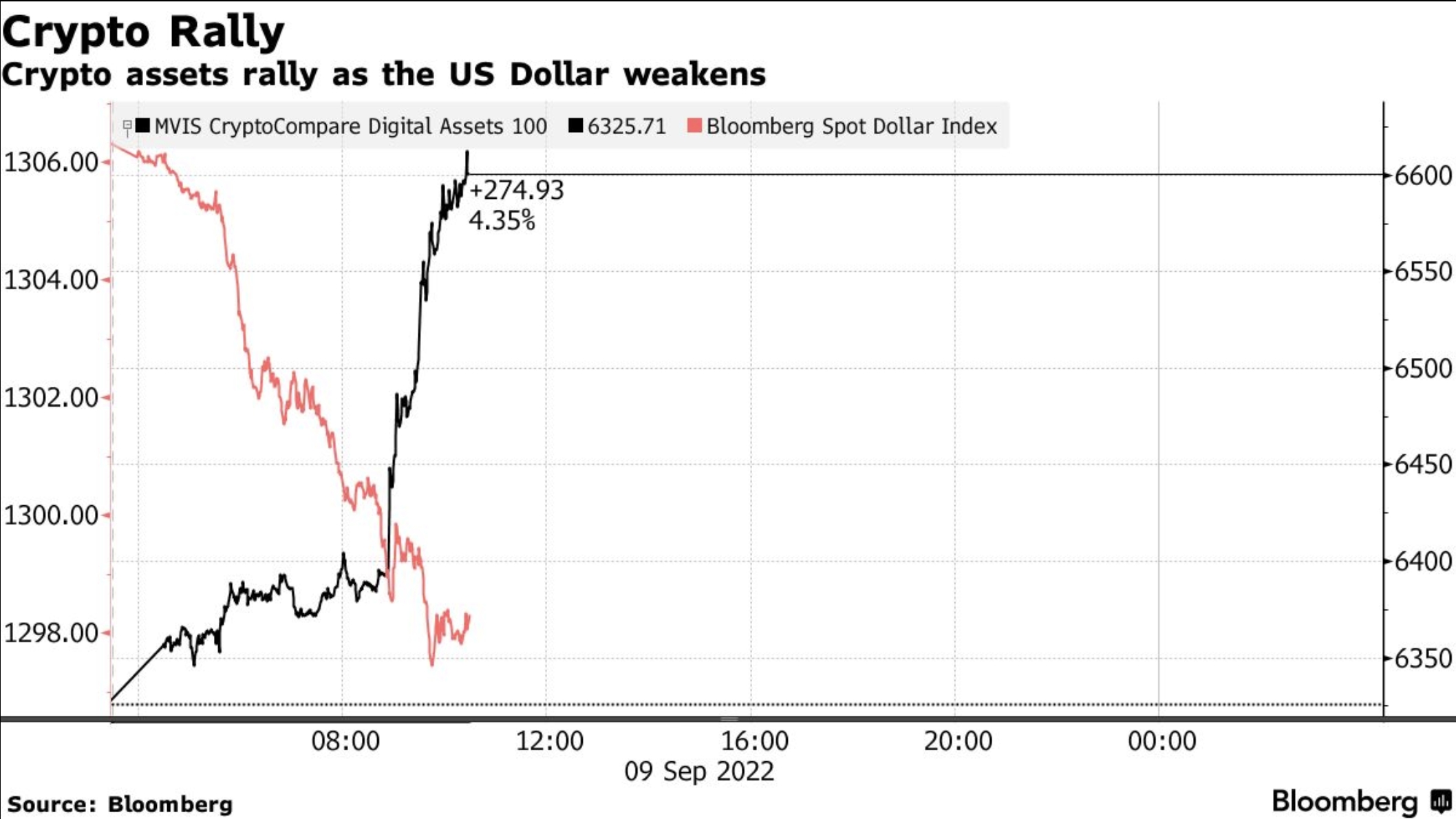

But it was the dollar’s depreciation that could be the most important catalyst for today’s bullish event. The negative correlation between cryptocurrencies and the dollar is huge, as the Bloomberg chart reproduced below shows:

A fifth factor should be considered. That is the view and action of financial institutions.The news came overnight that franklin templeton We offer crypto accounts to institutional investors.

Earlier this week, DBS, Singapore’s largest bank, announced it would offer digital asset services to trade with its wealthiest 300,000 customers. Whompoa Group followed suit a few days later.

And all this because the world’s largest asset manager, black rockwas moving to encryption on behalf of the client.

The sixth and final positive to bring into the mix is the Ethereum merge.

Ethereum can be considered the best commercial network in the crypto asset class. In fact, we are on the path to endpoints that make it truly scalable and cost-effective for enterprises to process and run industrial-scale applications.

To this we can add a fifth reason enhancement. Institutional interest as Ethereum merger could lead to staking takeoff Interest from investment banks, etc.

All of the above may have influenced the reasoning of billionaire Sam Bankman-Fried, the founder of the hugely successful FTX cryptocurrency exchange, and others.

He told CNBC today that the worst is probably over. “I think the real pain happened to him three or four months ago. I don’t necessarily expect more pain from here. The situation in this area is very stable,” he said Bankman-Fried says.

All major coins are getting higher. Bitcoin surged 9% to just over $21,000, up from the week’s low of $18,660.

ethereum Expected to continue in good shape thanks to Merge’s upgrade, it no longer boils, but its mojo has also been rediscovered. The leading smart contract platform is trading at $1,724, up 5%.

Besides top coins, there have been amazing advances in other areas as well.

Crypto traders are rooting for Terra Classic’s uptrend, which has improved by 64% this week alone and nearly 400% over the past 30 days.

A slight reversal today as LUNC fell 12% to $0.000445. Surprisingly, it is Terra 2.0 (LUNA) that is currently carrying the torch, a modified version of the collapsed Terra Luna.

Terra made a difference of over 200%in a move that astonished seasoned market observers and novices alike, as we reported earlier today.

As usual with such violent price movements, there is suspicion of aerial manipulation.

Twitter crypto influencer Fat Man believes a dump is taking place, and buyers who are currently in may be left behind.

There is also a strong bullish move in the BTC perpetual futures market, which Kaikoh analyst Riyadh Carey has taken a keen eye on.

All things considered, there are plenty of reasons to be cheery about the cryptocurrency sector at the moment. This is something that may not have been said earlier in the week.

Nonetheless, volatile times are of course essential for cryptocurrencies, so investors may want to accumulate consistent and regular amounts rather than dumping them in bulk.

In other words, the market may have bottomed out, but it may not have bottomed out yet.

However, if you’re looking to hold for months instead of days, fishing around or below the current price level may prove profitable. dollar cost averaging is your friend

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024