No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Looking at the on-chain data, we can see a clear difference in how short-term and long-term holders invest in Bitcoin. The short-term holder mostly buys at levels where he’s at $17,000 to $48,000, while the long-term holder he’s strong up to $60,000.

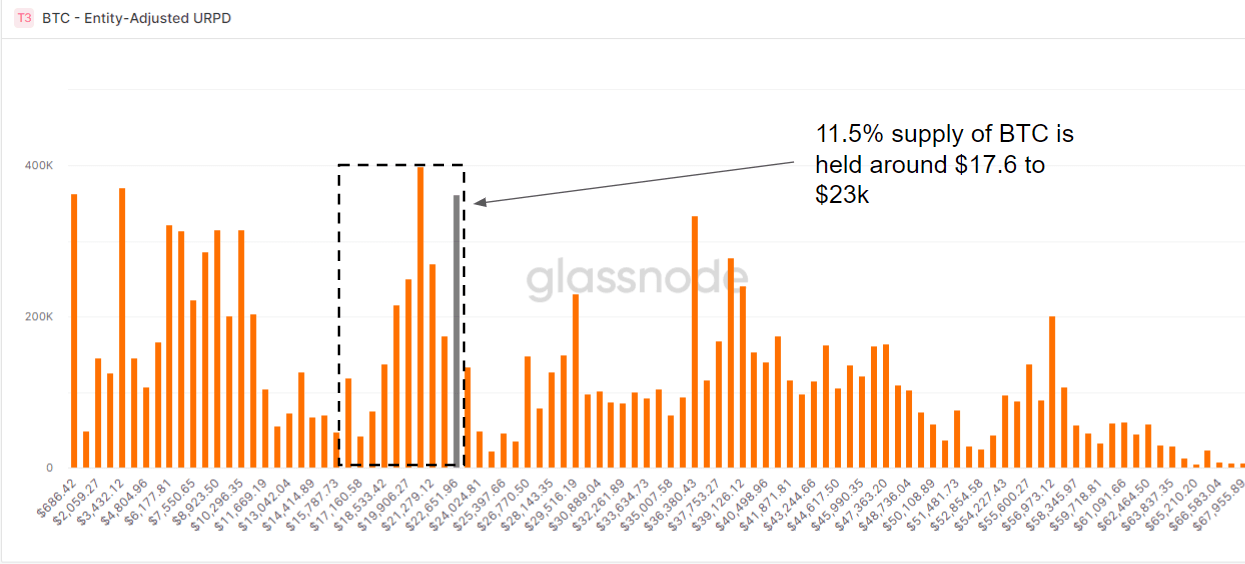

To better understand your data, you can analyze some important graphs. The UTXO Realized Price Distribution (URPD) shows the price at which the current set of Bitcoin UTXOs was created. Each bar shows the number of existing Bitcoins that have moved to the end within the specified price bucket. The price specified on the X-axis refers to the lower bound of that bucket.

After a 75% drop from this year’s all-time high, 11.5% of supply is now held at a price level around $17,000. An increase in holdings between $17,000 and $24,000 may indicate that a lot of demand has been wiped out. Since Bitcoin has not fallen below this price since 2020, all coins that are not moving should be defined as long-term holders if they are below $17.6k. However, these investors can be considered mature long-term holders. Either the coin is lost or the owner is unwilling to sell it until this point.

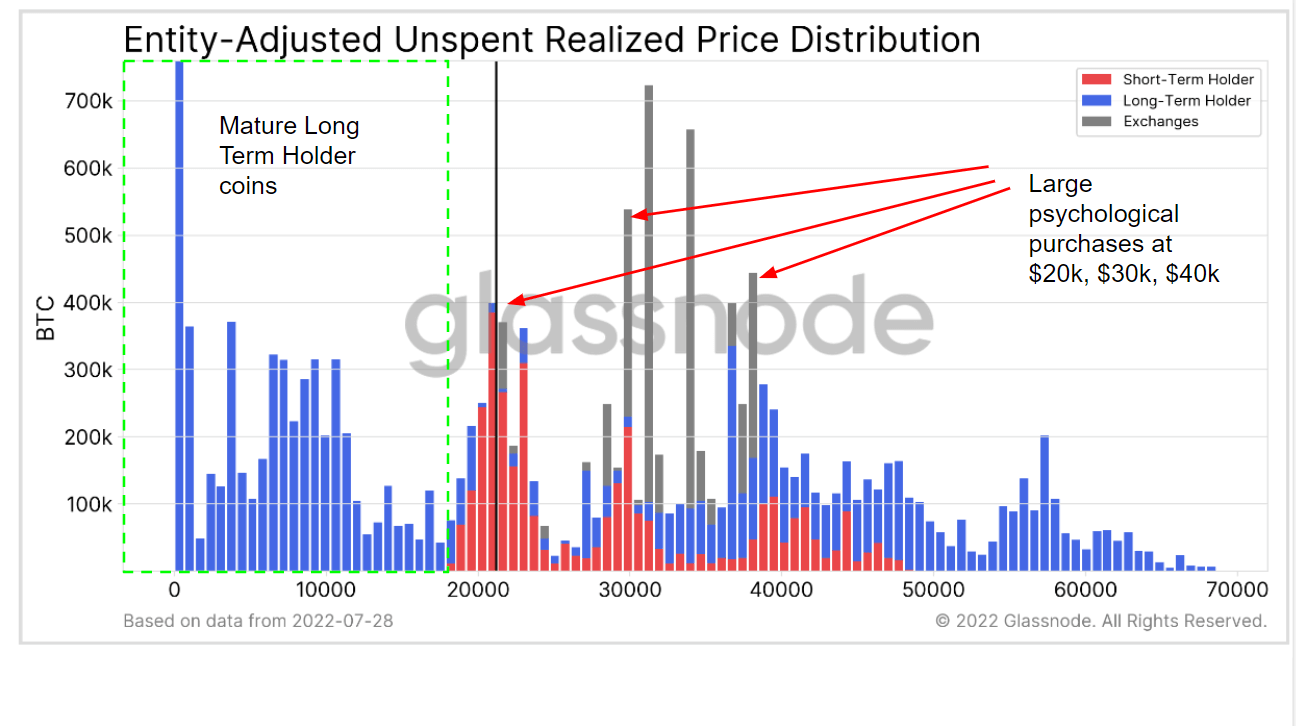

The following chart shows the types of cohorts to buy at these price levels.entity-adjusted version of URPD metric provides supply segmented by long-term holders (blue), short-term holders (red), and exchange balances (grey). All supply is shown in price buckets where each entity got (on average) coins.

For short-term holders (BTC holding less than 155 days), we see a transfer of ownership from long-term holders surrendering sellers to HODLers or investors around $20,000 from long-term holders to short-term holders . They see value in these price ranges.

There is strong buying on a psychological level from both short and long term holders of 20,30,40,000. There is currently a large supply of long-term holders in the water. It will be interesting to observe if short-term holders turn into long-term holders in her 40-50k range.

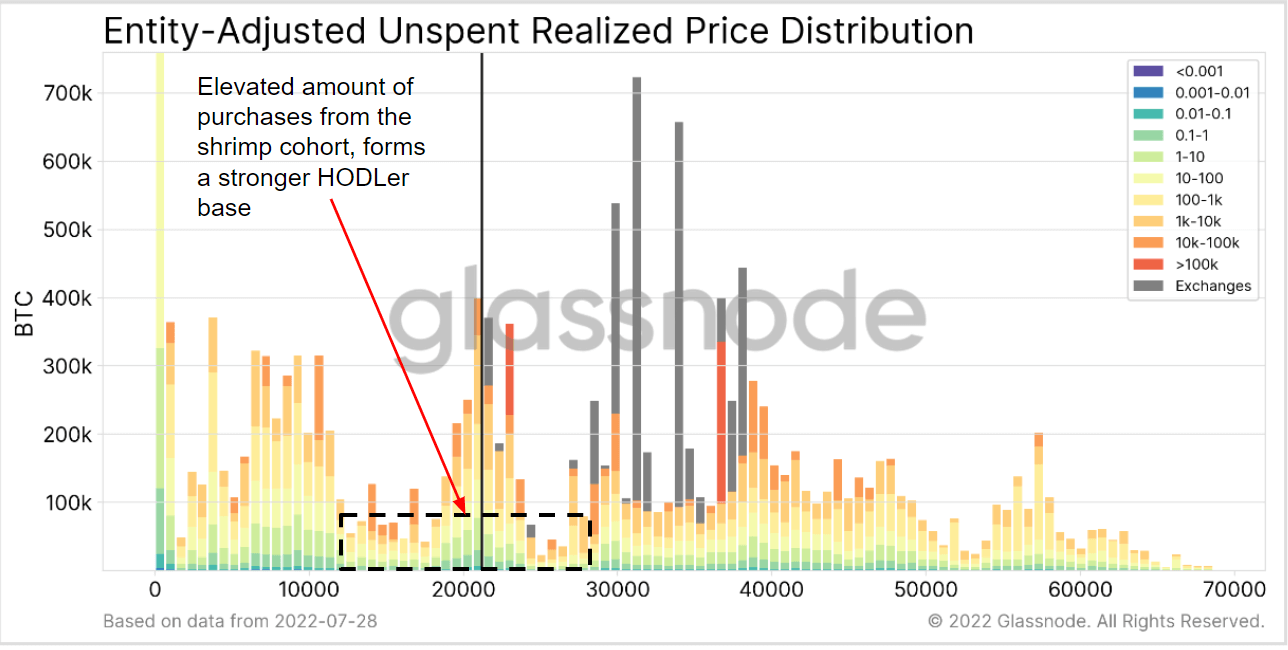

Shrimp cohorts with less than 1 Bitcoin are piling up sats relentlessly across the price range. Shrimp appears unfazed by price action, buying a significant amount of bitcoin at the current lower price level compared to similar historical price ranges. The black vertical bar shows the market price at the charting timestamp.

Interestingly, most exchange coins were purchased between $30,000 and $49,000, with few above $40,000. This information is important when assessing the liquidity of exchanges that hold Bitcoin on their balance sheets. At the current $23,800 level, the exchange is down about 65% of the coins it does not sell.

Buying by exchanges below $30,000 is down. However, about 350,000 BTC was bought at his psychological level of $20,000 for a total of about $7 billion at the time of sale. Addresses below 10,000 Bitcoin mostly defended the level.

The following tweet by Professor Chaine shows an animated version of the UDRP chart over time.

About peut aisment voir cette dynamique prendre forme et l’offre changer de proprit ds que le prix a invalid le niveau des 20k $

Depuis, pres de 2,6 million de BTC, soit 13,9% de l’offre en circuit ont t changes entre 17,8k $ et 22,5k $ pic.twitter.com/zIDsJWhCpz

Professor Chane (@profchaine) July 28, 2022

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024