No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Leading digital asset managers say institutional investors are increasing their short positions in Bitcoin (BTC).

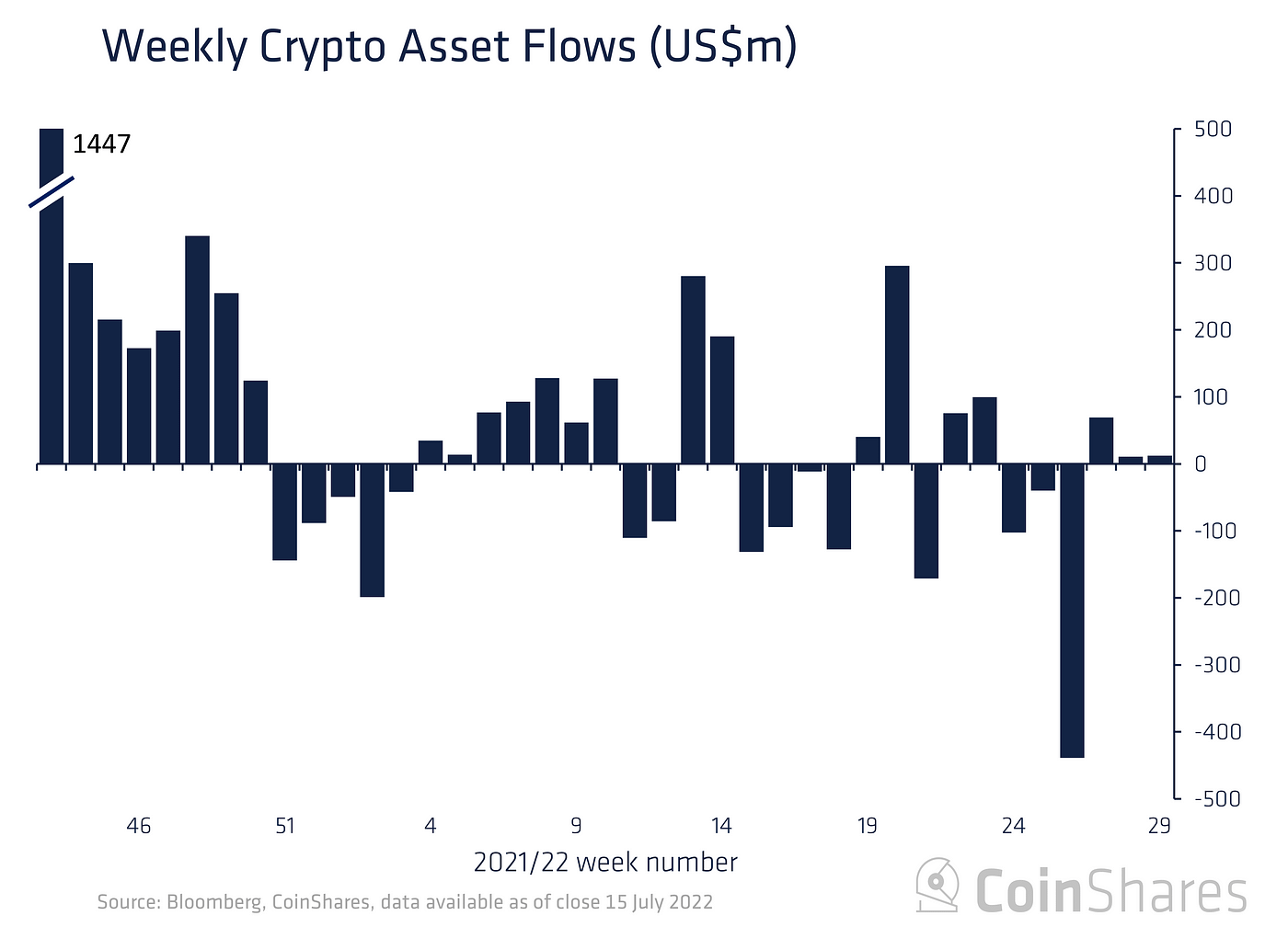

CoinShares in the latest Digital Asset Fund Flow Weekly Report find The short BTC investment product saw an inflow of $ 15 million last week, while the long investment product suffered a net outflow.

“Last week, the total inflow of digital asset investment products was $ 12 million, of which $ 15 million was inflows into short-term (reverse price) investment products, with a total net outflow of long-term investment products of $ 2.6 million. did.”

CoinShares interprets the rise in short BTC products as a sign that investors are hoping for a further decline in the crypto market, but not necessarily wanting to sell out from long positions.

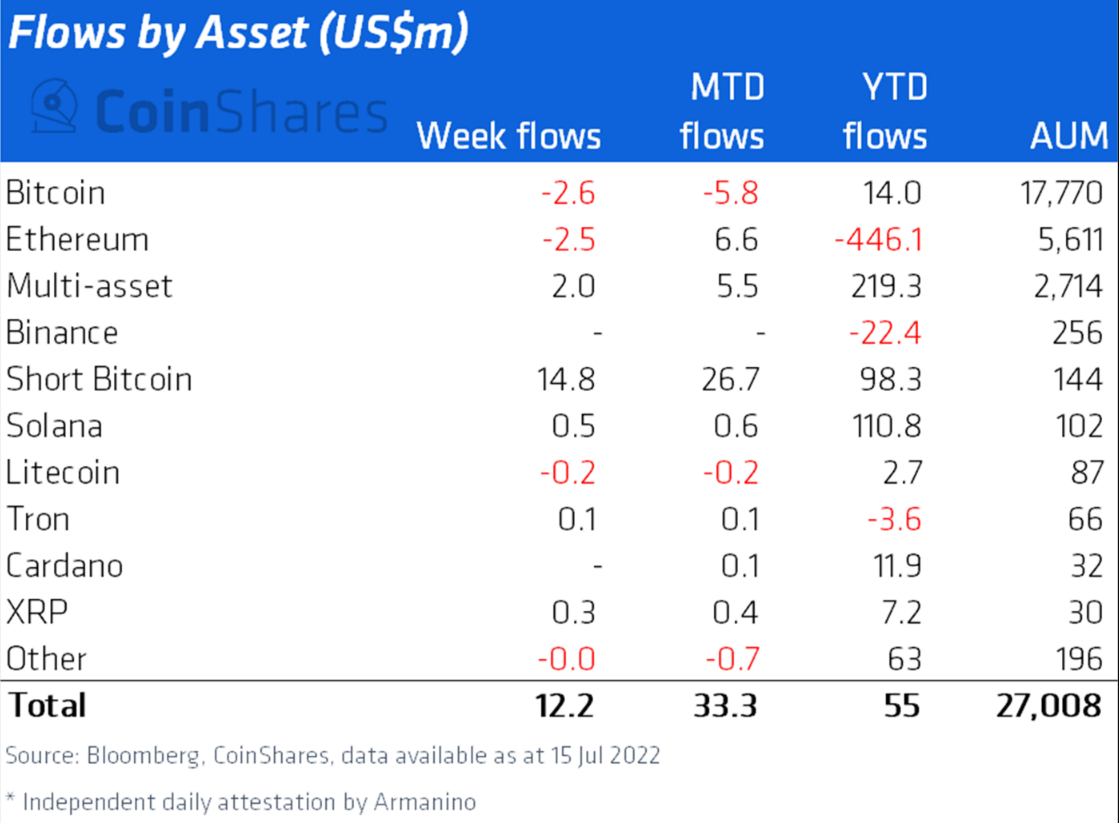

Long Bitcoin’s investment vehicle was hit by a $ 2.6 outflow last week, with an annual inflow of $ 14 million.

After three weeks of influx, Ethereum (ETH) investment products suffered a slight outflow last week.

Litecoin (LTC) also suffered a slight outflow last week, and most altcoin products saw a slight inflow that week.

Investment products from Solana (SOL), XRP, and Cardano (ADA) received $ 500,000, $ 300,000, and $ 100,000 inflows, respectively, while multi-asset products exceeded the remaining $ 5.5 million.

“The multi-asset investment product, which has a strong position in the bear market from a flow perspective, has seen a total inflow of $ 2 million, far more than any other asset, at $ 219 million. became.”

Don’t miss the beat subscribe and deliver encrypted email alerts directly to your inbox

Check price action

follow me twitter, Facebook When telegram

Surf the daily hoddle mix

& Nbsp

Featured images: Shutterstock / ImageBank4u / Nikelser Kate

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024