No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Leading digital asset managers are finding that institutional investors are pouring more capital into short-lived cryptocurrency investment products than ever before.

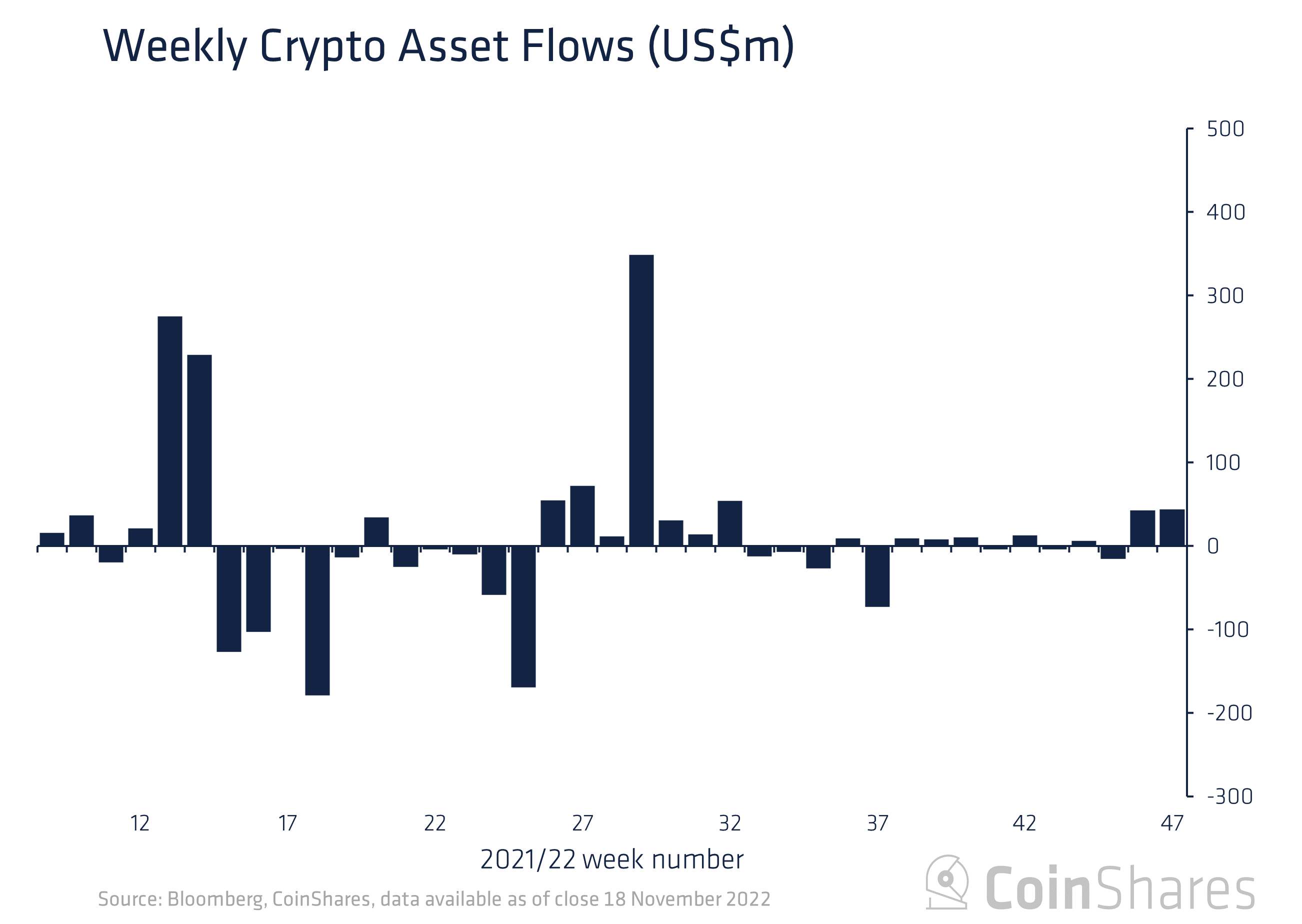

In the latest Digital Asset Fund Flows Weekly reportCoinShares says crypto investment products saw most inflows towards short investment products last week.

Short investment inflows accounted for 75% of total inflows, suggesting very negative sentiment across the asset class, but total AuM is now at $22 billion over two years. It’s at its lowest point.”

CoinShares found that Bitcoin (BTC) short investment products have flowed in across all regions, but that doesn’t necessarily mean investor sentiment is united.

Geographically, both the U.S. and Europe saw inflows into short investment products, but some outflows were seen in some short products, with investors wondering if the market had hit a low. It suggests that opinions are divided.

According to the report, BTC investment vehicles accounted for the majority of capital inflows in long products, taking in $14.3 million last week.

Bitcoin saw a total inflow of $14 million, but when offset by inflows into short investment products, the net inflow was -$4.3 million. Short Bitcoin AuM is currently at 173 million. $186 million, close to the all-time high of $186 million.”

Long Ethereum (ETH) investment products saw small outflows. Conversely, the short ETH product saw similar inflows to his BTC.

Ethereum saw a small outflow totaling $800,000, while the largest recorded inflow into short Ethereum investment products totaled $14 million. It could be the result of the Shanghai update enabling and new uncertainties over hacked FTX ETH assets totaling around $280 million.

All altcoin long products were leaked last week. Solana (SOL) lost $3.3M, Binance Coin (BNB) $0.6M, XRP $1.4M and Polygon (MATIC) $0.2M. Multi-asset investment vehicles, which invest in multiple digital assets, saw inflows of $2.8 million.

Don’t miss a beat subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Susanitah/Vladimir Kazakov

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024