No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Cointracking.info, commonly referred to as CoinTracking, is one of the leading cryptocurrency portfolio management and crypto tax software.

It started as a crypto portfolio tracking app before adding tax reporting features that are very popular in the crypto industry.

In a nutshell, CoinTracking has two roles. Crypto portfolio manager and tax reporting software.

But first things first. First you need to download the CoinTracking app and create an account to use the CoinTracking software.

As a crypto portfolio manager, CoinTracking allows users to link to all the crypto exchanges and crypto wallets they use and view the value of their crypto assets in a single interface.

CoinTracking analyzes all transactions in real-time and provides an overview of coin value including realized and unrealized gains and losses. Integrates with 70+ cryptocurrency exchanges and tracks 7000+ cryptocurrencies.

As a tax reporting software, Cointracking.info integrates with various major cryptocurrency exchanges to collect transaction history for automatic tax reporting. We support different formats of annual crypto tax reports based on different criteria (i.e. Capital Gains, FBAR, Form 8949 and German Income Tax Act). It also supports automatic import.

Trade data can be entered either manually, via manual CSV import from an exchange, or fully automatically via API.

CoinTracking offers a tiered pricing model with four packages including Free, Pro, Expert, and Unlimited.

The CoinTracking Free package allows users to manually generate tax reports using CSV files (i.e. reports are not automatically generated). Users can only generate tax reports for up to 200 crypto transactions. No automatic imports are possible, but up to two manual imports are possible.

The annual cost of the CoinTracking Pro package is $131.88. Save $60 when you pay for 2 years in advance. You can also choose to pay for a $425 lifetime subscription.

The Pro package allows users to generate tax reports for up to 3,500 crypto transactions. Each coin allows him 5 automatic imports and unlimited manual imports.

The Expert Package costs $203.88 per year. However, you can save up to $84 by paying for two years up front. You can also choose to pay for a $919 lifetime subscription.

The Expert Package allows users to generate tax reports for up to 20,000 crypto transactions. You can have 10 automatic imports and unlimited manual imports per coin.

The Unlimited package costs $659.88 annually, but you can save $240 by paying upfront for 2 years. You can also choose to pay for a lifetime subscription at a cost of $5299.

The unlimited package allows users to generate tax reports for an unlimited number of crypto transactions. Each coin allows up to 50 automatic imports and unlimited manual imports.

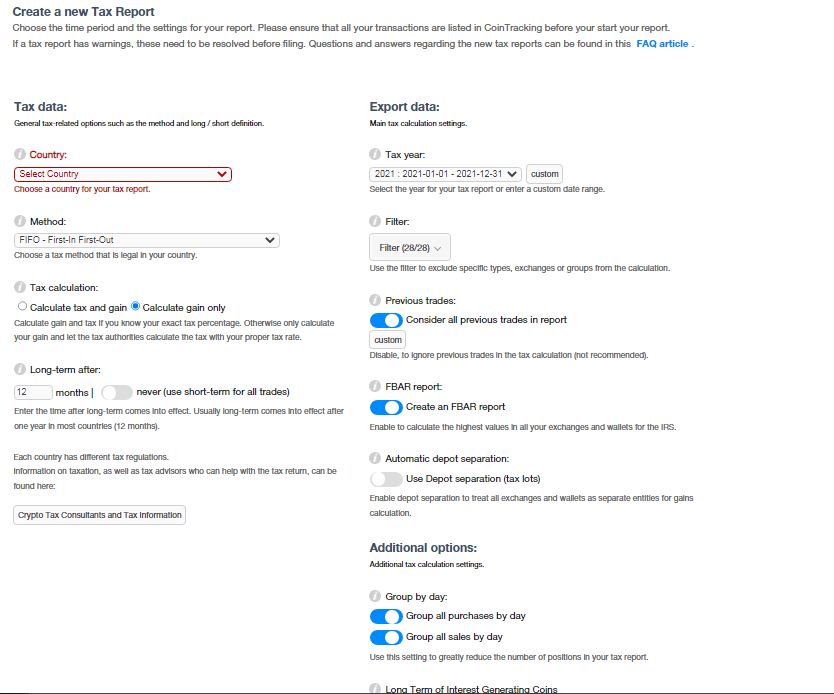

To generate a tax report using CoinTracking,[]under the tab[]Click the button. Then enter the required details such as country, year, calculation method, type of calculation (calculate tax and profit or calculate profit only).

next,[]Click.

If you are looking for a one-stop app that allows you to track your crypto portfolio and generate crypto tax reports, CoinTracking could be the right choice. Especially for low-volume crypto traders who manually enter trading data, you can also choose to use the free package.

Reports can be generated using different methods such as FIFO, LIFO, HIFO, AVCO, ACB and are also compatible with crypto tax laws of different countries around the world.

It is also relatively easy to use and integrates with various cryptocurrency exchanges and wallets, allowing you to automatically import transaction data from the exchanges and wallets you use.

In a nutshell, the CoinTracking app is a great tool for cryptocurrency investors and traders, designed for beginners, experienced individual traders/investors, and institutions.

It is a leading tax reporting platform run by a reputable company that continues to improve its product capabilities to comply with the ever-changing crypto environment, especially when it comes to crypto laws.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024